The combination of investment characteristics associated with institutional investment in timberland and agriculture offers a compelling rationale for their inclusion in larger multi-asset portfolios, and ultimately allows for the expansion of the efficient frontier, as determined by traditional mean-variance portfolio optimization.

Interest in natural capital is rising, and natural resource asset classes such as timberland and farmland are attracting increasing investor attention given their potential to positively impact the environment while augmenting the returns generated from traditional management. Their historical investment performance and interaction with other traditional financial asset classes indicate that their inclusion within multi-asset investment strategies can achieve the financial objectives of long-term institutional investors by offering competitive risk-adjusted and long-term stable returns, enhancing portfolio diversification, and preserving capital. These investment characteristics are supported by sound market fundamentals driven by increasing human need for shelter, food, feed, fuel, and fiber.

Our experience of sustainably managing timberland and farmland assets has taught us that protecting and promoting healthier and more diverse ecosystems can enhance their long-term capability to generate competitive returns. Good stewardship is good business—we focus on positively affecting communities through compelling employment opportunities, efficient water resource management, third-party-certified land management practices, and technological innovation to effectively protect healthy ecosystems while meeting clients’ financial goals. And the inherent characteristics of sustainably managed timberland and farmland that can help address the global challenges of climate change, nature loss, and rising inequality are increasingly assigned tangible value that adds optionality to land management, increases the investable universe, and is accretive to returns.

Timberland and farmland: real assets with complementary investment attributes

Timberland and farmland are attractive long-term investments that have historically delivered capital preservation and competitive risk-adjusted performance alongside stable cash yield and long-term appreciation. Additionally, they have provided potential to diversify investors’ broader investment portfolios and hedge against inflation.

Competitive risk-adjusted and stable long-term returns

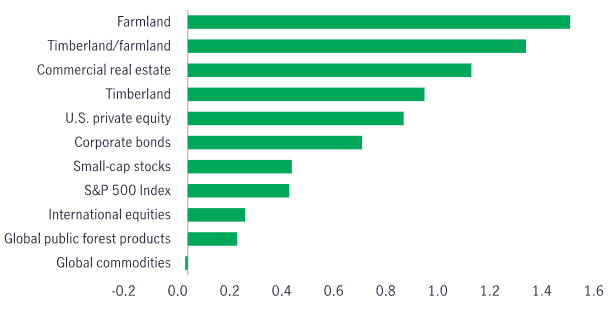

Timberland investments provided average total annualized real USD returns (net of inflation) of nearly 7% and nominal returns of 9% between 1991 and 2022. Over the same period, total real returns for investments in farmland averaged 8%, or nearly 11% on a nominal basis.1 In addition, timberland and farmland have performed well on a risk-adjusted basis over the last 25 years, as measured by Sharpe ratios. At 1.47 and 0.91, respectively, farmland and timberland compare favorably against most traditional financial assets. When timberland and farmland are combined in a hypothetical 50–50 allocation, the resultant pro forma natural capital portfolio would have produced a favorable Sharpe Ratio of 1.30 over this timeframe.2

Sharpe ratios for select U.S. asset classes and international equities (1998-2022)

Source: Manulife Investment Management, NCREIF, S&P, MSCI, Cambridge Associates, Ibbostson Associates, and Macrobond, as of December 31, 2022. The Sharpe ratio calculation uses 0.692% as the risk-free return, which is the 10-year average yield of U.S. Treasury bills over 2003–2022. Non-specified asset classes are U.S. asset classes. International equities include non-U.S. stocks.

Diversification benefits

Timberland and farmland can play a role in improving the overall performance of a mixed-asset portfolio through diversification due to their low, and in some cases, negative correlation with other traditional financial assets. Meanwhile, timberland and farmland returns have maintained an average correlation of approximately 0.77 with each other over the past 20 years, a positive, but not perfect, correlation due in part to variations in market dynamics specific to each asset class. This allows for the inclusion of both assets in a larger portfolio to provide diversification and an expanded natural capital investable universe.

Our timberland and agriculture investment strategies also include diversification within each asset class across regions, timber species and age class, crop types, end products, and markets to help mitigate risk from weather, pest, disease, natural disaster, and macroeconomic and market-specific factors.

Compelling market fundamentals

Population growth, demographics, and economic development continue to drive demand for shelter, food, feed, fiber, and fuel, which are the foundation of key end-use markets for timberland and farmland products. This growing demand is juxtaposed by a decreasing supply of available arable land and limited availability of commercially operable timberland. These factors will place increased pressure on managers to farm crops and manage timber plantations in the most efficient and environmentally sustainable manner and use technological and scientific advancements to increase productivity.

- Timberlands are biological wood factories that grow in volume and value over time regardless of the macroeconomic environment, and their carbon sequestration capabilities are now more explicitly valued. During periods with weak market conditions, timberland owners can defer their harvest operations and allow their trees to grow in both volume and value, including their carbon value potential, providing additional optionality in certain timber production regions. Meanwhile, scientific and technological advancements in genetics and silviculture can increase yield while mitigating risks from extreme weather, natural disasters, and disease.

- Farmland productivity gains are crucial to meet growing demand from an increasingly limited area of available arable land, and new advances in genetics and agronomy are sustainably improving farmland yields while tempering input costs and promoting long-term soil health. Farmland values may benefit from the additional volume and higher quality crops produced, as well as soil’s potential to store carbon.

The enduring theme of finite natural resources, managed sustainably to meet the increasing needs of a growing population with rising income, will continue to be a fundamental demand driver for natural capital investments.

Constructing an efficient frontier with U.S. timberland and farmland

To illustrate the benefits of adding both timberland and agriculture to an institutional portfolio, we constructed a pro forma 50–50 timberland and farmland portfolio to be placed within a hypothetical mixed-asset portfolio similar to one held by a typical institutional investor.3 An efficient frontier was generated for this portfolio without an allocation to U.S. timberland and farmland investments. A second efficient frontier was then generated allowing for an allocation of up to 7% for a 50–50 timberland and farmland investment, using data from the National Council of Real Estate Investment Fiduciaries (NCREIF).

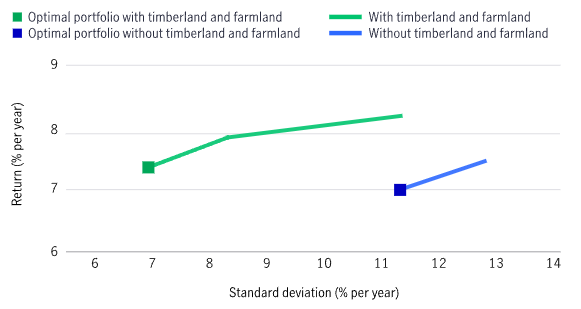

Inclusion of timberland and farmland demonstrates lower volatility and higher risk-adjusted returns

Comparison of efficient frontiers and optimal portfolios with and without U.S. timberland–farmland

Source: Manulife Investment Management, NCREIF, S&P, Macrobond, MSCI, as of December 31, 2022. Average return and standard deviation of asset classes and their correlations are calculated using historical annual USD-based return data from 2001 to 2022.

This chart shows the results of this analysis. The lines represent the efficient frontiers—the theoretical collection of all possible optimized combinations of asset class allocations within a given portfolio—with and without timberland and agriculture. The inclusion of timberland and farmland can potentially improve the risk/return profile by shifting the efficient frontier upward and to the left. The optimal portfolio with timberland and farmland, defined as the portfolio with the highest Sharpe ratio, generated a slightly higher nominal annual USD-based return of 7.4%, compared with 7.3% for the optimal portfolio without them, while having a significantly lower volatility than the portfolio without an allocation to timberland and farmland. The Sharpe ratio of the optimal portfolio improves from 0.57 to 0.96 after the inclusion of timberland and farmland, a 68% enhancement in risk-adjusted return performance.

The mean-variance analysis demonstrates how including natural capital asset classes, such as timberland and farmland, in a multi-asset institutional portfolio may offer the potential to enhance the portfolio’s overall risk-adjusted returns.

A rising focus on natural capital

In addition to the benefits of improved financial performance, the rise in interest and importance of natural capital is illuminating the social and environmental benefits inherent within our long-held belief that good stewardship is good business as well as the ongoing practice of sustainable timberland and farmland management. As these characteristics gain recognition and are assigned value by the investment community, we expect them to become increasingly accretive to returns. These attributes also add optionality in terms of land management practices and end-use markets, potentially expanding the investable universe and bolstering returns.

- Timber is a natural, sustainable, and renewable resource with an expanding set of demand drivers, including textiles, mass timber, paper packaging as a substitute for plastic, and the ability to generate high-quality carbon credits. These developments enhance natural capital’s ability to positively contribute to global ecosystems and provide additional opportunities to generate value from practices that support biodiversity, conserve water, and mitigate risks.

- Regenerative farming practices, precision agriculture, integrated pest management, water resource management, and continued innovation and technological gains can enhance sustainable farming practices and limit inputs and costs, while restoring soil biodiversity and providing potential to offer carbon sequestration benefits.

The trend toward natural capital represents an evolution in investment objectives that combines an existing financial investment case with action to combat climate change, nature loss, and support the health of global ecosystems while providing for the basic needs of a growing world population. As the world’s largest manager of natural capital assets,4 we’re able to leverage our scope and scale to tailor sustainable solutions for investors with objectives across the spectrum of impact; for example, by prioritizing carbon sequestration over timber production from traditional commercial timberland operations.

In all cases, we manage natural capital assets sustainably to meet investor objectives.

The new frontiers of a traditional asset class

The inclusion of timberland and farmland in a mixed-asset investment portfolio has been proven to provide traditional financial benefits, including enhanced risk-adjusted returns through portfolio diversification, inflation protection, stable long-term cash flows, and capital appreciation. Investor interest in natural capital is growing due both to increasing regulatory requirements to disclose and report on the climate and nature-related impact of their investment portfolios and the growing recognition of natural capital’s capability to help address the global challenges of climate change, nature loss, and inequality. We continue to engage with evolving technology, guidelines, policies, and markets that allow investors to fully realize their positive environmental and social impact alongside the financial benefits of an allocation to natural capital.

1 NCREIF, as of November 30, 2023. 2 Sharpe ratios are calculated using 0.69% as the risk-free rate, which is the average trailing 10-year U.S. Treasury bills yield. 3 The investment portfolios of multiple public pension funds were analyzed to create a model portfolio with an asset allocation reflective of the current market environment, setting minimum lower and maximum upper bounds for portfolio weights to major asset classes, with the expected return and standard deviation of each asset class informed by third-party research. 4 IPE research, as of January 29, 2024. Ranking is based on total natural capital assets under management (AUM), which includes forestry/timberland and agriculture/farmland AUM. Firms were asked to provide AUM and the as of dates vary from December 31, 2022, to December 31, 2023.

A version of this article previously appeared in the Agri Investor 2024 Impact Investing report.

Important Disclosures

Investing involves risks, including the potential loss of principal. Financial markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. These risks are magnified for investments made in emerging markets. Currency risk is the risk that fluctuations in exchange rates may adversely affect the value of a portfolio’s investments.

The information provided does not take into account the suitability, investment objectives, financial situation, or particular needs of any specific person. You should consider the suitability of any type of investment for your circumstances and, if necessary, seek professional advice.

This material is intended for the exclusive use of recipients in jurisdictions who are allowed to receive the material under their applicable law. The opinions expressed are those of the author(s) and are subject to change without notice. Our investment teams may hold different views and make different investment decisions. These opinions may not necessarily reflect the views of Manulife Investment Management or its affiliates. The information and/or analysis contained in this material has been compiled or arrived at from sources believed to be reliable, but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness, or completeness and does not accept liability for any loss arising from the use of the information and/or analysis contained. The information in this material may contain projections or other forward-looking statements regarding future events, targets, management discipline, or other expectations, and is only current as of the date indicated. The information in this document, including statements concerning financial market trends, are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Manulife Investment Management disclaims any responsibility to update such information.

Neither Manulife Investment Management or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained here. All overviews and commentary are intended to be general in nature and for current interest. While helpful, these overviews are no substitute for professional tax, investment or legal advice. Clients should seek professional advice for their particular situation. Neither Manulife, Manulife Investment Management, nor any of their affiliates or representatives is providing tax, investment or legal advice. This material was prepared solely for informational purposes, does not constitute a recommendation, professional advice, an offer or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security or adopt any investment strategy, and is no indication of trading intent in any fund or account managed by Manulife Investment Management. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification or asset allocation does not guarantee a profit or protect against the risk of loss in any market. Unless otherwise specified, all data is sourced from Manulife Investment Management. Past performance does not guarantee future results.

Manulife Investment Management

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. We draw on more than a century of financial stewardship to partner with clients across our institutional, retail, and retirement businesses globally. Our specialist approach to money management includes the highly differentiated strategies of our fixed-income, specialized equity, multi-asset solutions, and private markets teams—along with access to specialized, unaffiliated asset managers from around the world through our multimanager model.

This material has not been reviewed by, is not registered with any securities or other regulatory authority, and may, where appropriate, be distributed by the following Manulife entities in their respective jurisdictions. Additional information about Manulife Investment Management may be found at manulifeim.com/institutional

Australia: Manulife Investment Management Timberland and Agriculture (Australasia) Pty Ltd, Manulife Investment Management (Hong Kong) Limited. Brazil: Hancock Asset Management Brasil Ltda. Canada: Manulife Investment Management Limited, Manulife Investment Management Distributors Inc., Manulife Investment Management (North America) Limited, Manulife Investment Management Private Markets (Canada) Corp. Mainland China: Manulife Overseas Investment Fund Management (Shanghai) Limited Company. European Economic Area Manulife Investment Management (Ireland) Ltd. which is authorised and regulated by the Central Bank of Ireland Hong Kong: Manulife Investment Management (Hong Kong) Limited. Indonesia: PT Manulife Aset Manajemen Indonesia. Japan: Manulife Investment Management (Japan) Limited. Malaysia: Manulife Investment Management (M) Berhad 200801033087 (834424-U) Philippines: Manulife Investment Management and Trust Corporation. Singapore: Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration No. 200709952G) South Korea: Manulife Investment Management (Hong Kong) Limited. Switzerland: Manulife IM (Switzerland) LLC. Taiwan: Manulife Investment Management (Taiwan) Co. Ltd. United Kingdom: Manulife Investment Management (Europe) Ltd. which is authorised and regulated by the Financial Conduct Authority United States: John Hancock Investment Management LLC, Manulife Investment Management (US) LLC, Manulife Investment Management Private Markets (US) LLC and Manulife Investment Management Timberland and Agriculture Inc. Vietnam: Manulife Investment Fund Management (Vietnam) Company Limited.

Manulife, Manulife Investment Management, Stylized M Design, and Manulife Investment Management & Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.

3407736