In our first report in this series, we provided a detailed overview of carbon neutrality in real estate investment. In the second report, we examined how companies are seeking to achieve carbon neutrality and the challenges of achieving carbon neutrality in the real estate industry. This report will review the current regulatory landscape regarding carbon neutrality and the likelihood of future legislation and regulations as the topic continues to gain traction globally and in the real estate industry.

While we are not lawyers and this paper does not constitute legal advice, we intend to share what we’ve learned from our own experience, research, and perspective regarding legislative risks and opportunities in carbon neutrality. There is rapid growth in policies, legislation, ordinances, and laws related to carbon emissions, carbon neutrality claims, and net-zero carbon commitments, that can significantly affect real estate investors. There is also confusion in definitions and terms, both within the U.S. and internationally, and regulations may refer to net zero and carbon neutrality interchangeably without defining either term. Within real estate investments, we think of net zero as a property that produces as much energy as it uses. We think of carbon neutrality as a focus on reducing net emissions and then purchasing renewable energy certificates (RECs) and carbon offsets to reach “zero.” In this report, we will provide an overview of laws affecting the real estate industry and attempt to clarify their meaning and impact.

Setting the Scene

In 1856, a scientist named Eunice Newton Foote proved that CO2 in the atmosphere would trap heat and cause warming.1 But it wasn’t until the 1970s that scientists documented the increasing CO2 in our atmosphere and warned of global warning,2 and not until 2011 that the U.S. Environmental Protection Agency (EPA) began regulating greenhouse gases (GHGs) for stationary sources (such as factories, power plants, or landfills) under the Clean Air Act.3 Now, as we continue to deal with climate events including drought, wildfires, and floods, the urgency to take action on climate change is tangible, and government regulations regarding GHG emissions are expanding.

Several international entities, national governments, regulatory agencies, and local municipalities have been responding to the existential threat of climate change by passing laws and regulations to reduce GHG emissions from the built environment. The number of regulations regarding environmental, social, and governance (ESG) topics has more than doubled from 2018 to 2020.4 We expect this trend to continue.

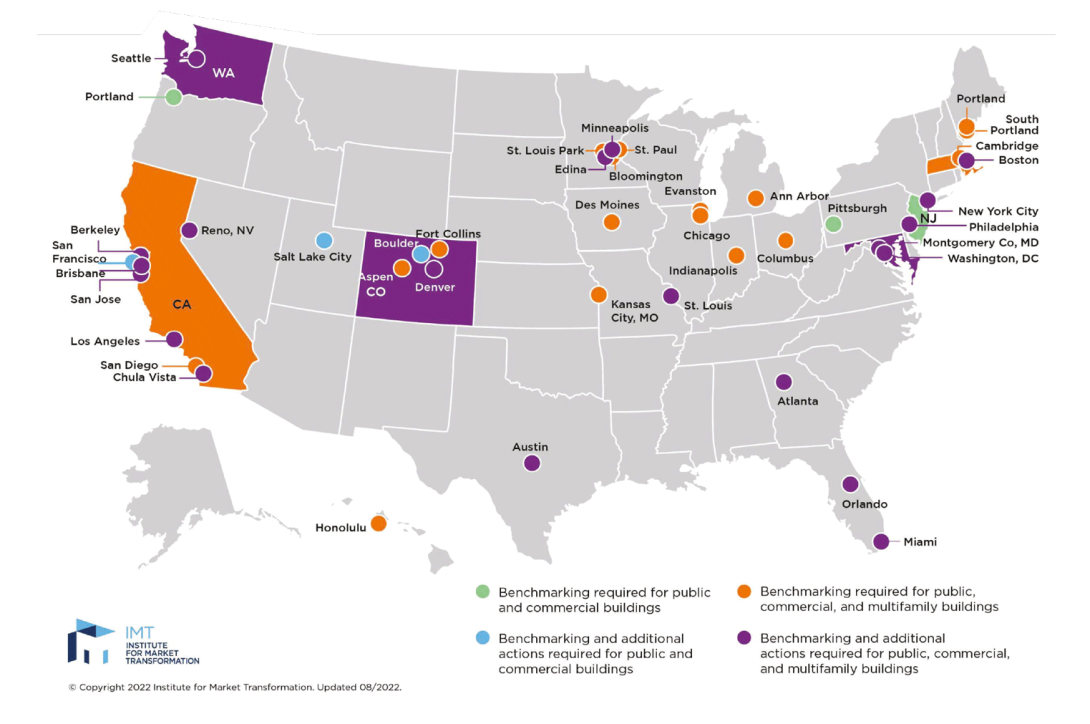

In the United States, most of the GHG regulations passed thus far by various cities and states require building owners to benchmark their energy data or emissions and report them to the local authorities.

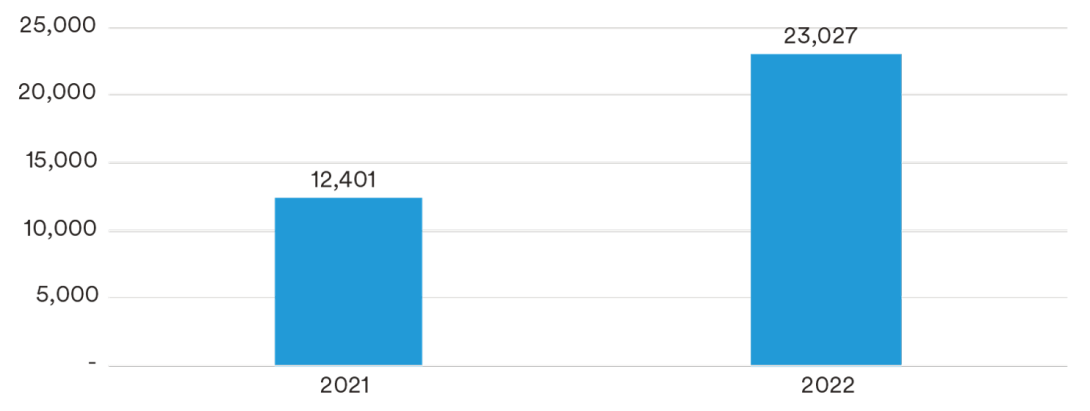

Within the last two years, we have seen municipalities begin transitioning from energy disclosures to specific emissions caps for real estate assets. In several cases, fines or carbon taxes were established, taking effect within the next few years. During the last year, incentives for energy efficiency and emissions reductions have multiplied, as shown in Figure 1. More tax credits and rebates have become available to real estate investors, enabling greater resources to meet regulatory thresholds.

We will examine the regulatory environment in the United States and in Europe, identifying some of the primary risks and opportunities in each market.

Figure 1 | US-based Incentives for Energy Efficiency

Data as of March 25, 2021 and 2022, respectively. Number of individual incentives for energy efficiency, each of which may be utilized by multiple properties (up to 1000+). Source Incentifined

The U.S. Landscape

Risks – Building Codes, Regulations, and Reporting

At the U.S. national level, President Biden has issued executive orders concerning carbon reductions and climate-related financial risk. He established a White House Office of Domestic Climate Policy and a National Climate Task Force, bringing 21 different federal agencies and departments together to address the climate crisis.5 They are tasked with achieving the targets set by the Biden administration: at least 50% reduction in nationwide net GHG emissions by 2030 and net-zero emissions by 2050.6 For real estate investors, it’s important to note that buildings are one of the five top sectors targeted for new policies and regulations to support reduced emissions in the U.S.

At the federal level, the primary regulatory risk to real estate investors is in reporting. Biden’s Executive Order on Climate-Related Financial Risk in May 2021 asks the Federal Acquisition Regulatory Council to require all major Federal suppliers—including real estate owners—to “publicly disclose greenhouse gas emissions and climate-related financial risk.”7 In addition, the U.S. Securities and Exchange Commission (SEC) launched an ESG Enforcement Task Force in March 2021 to identify material omissions or inaccuracies in issuers’ disclosure of climate risks8 and issued a risk alert in April 2021 saying that “the variability and imprecision of industry ESG definitions and terms can create confusion among investors.”9

In March 2022, the SEC announced its proposal for adding mandatory climate-risk disclosures in registration statements and periodic reports—such as Form 10-K filings— to improve consistency and comparability. The proposed rules would require, among other items:

- Qualitative descriptions of any climate-related risks that have had or are likely to have a material impact on the filer’s business.

- Disclosure of Scope 1 direct GHG emissions and Scope 2 emissions from purchased electricity, and large companies would also be required to disclose material Scope 3 emissions from their upstream and downstream value chain (including suppliers through to end users).10

The commercial real estate industry has expressed concerns over these rules, especially relating to Scope 3 emissions and how they will be defined, such as including tenant data, embodied emissions, and debt investment impacts. However difficult to obtain, these requirements are intended to meet investor demands for increased transparency regarding carbon and climate risks. U.S. investors who make carbon neutrality claims without sufficient precision and evidence, or who fail to disclose their emissions and material climate-related risks, may face increased scrutiny—and potential fines—from the SEC by 2024.11

Beyond the national level, local regulations and building-code changes related to energy efficiency and GHG emissions have already begun to impact real estate owners and investors in several major U.S. markets, including:

New York: Local Law 97 (LL97) requires most buildings over 25,000 square feet to reduce their GHG emissions 40% by 2030 and 80% by 2050, with enforcement and fines beginning in 2025.12

Boston: City Council recently changed its Building Energy Reporting and Disclosure Ordinance (BERDO) to the Building Emissions Reduction and Disclosure Ordinance, requiring buildings with 20,000 square feet or more to essentially reduce emissions 50% by 2030 and 100% by 2050 or face fines of up to $1000 per day.13

Los Angeles (L.A.): L.A.’s Green New Deal has established targets that all new buildings be net-zero carbon by 2030; all buildings—including existing buildings—achieve net-zero carbon by 2050; and that all buildings reduce energy use per square foot 22% by 2025, 34% by 2035, and 44% by 2050.14

Denver: Buildings larger than 25,000 square feet must reduce their energy usage 30% by 2030 and nearly 80% by 2040.15

There have been similar laws passed in St. Louis and Washington D.C., and many more are in development. Over 470 U.S. mayors from 48 states have joined the Climate Mayors coalition. We expect this type of regulation limiting emissions from real estate assets to become the dominant trend in building ordinances affecting real estate investors for the next 10 years or more.

Other local regulations and ordinances are introducing energy benchmarking laws, which presumably could set the stage for future mandates. For example:

Columbus: Columbus City Council unanimously passed the Energy and Water Benchmarking and Transparency Ordinance in 2020 requiring buildings 50,000 square feet and over to track their whole-building energy and water use with the ENERGY STAR® Portfolio Manager® tool and share this data with the City by December 15, 2021.16

Colorado: The Colorado General Assembly passed bill HB21-1286 in June 2021 to improve energy efficiency and collect data on large buildings, imposing penalties of up to $5,000 for violations.17

The breadth of the initiatives is illustrated in Figure 2, which provides a current view of the initiatives we could identify within primary real estate investment markets across the U.S. We expect that as more cities implement benchmarking ordinances, they will begin to impose fines for violation of these ordinances, and then quickly transition to requiring reductions, complete with fines and penalties for buildings that fail to reduce their energy use and emissions. In recognition of this trend, ENERGY STAR Portfolio Manager began piloting a Building Emissions Calculator in February 2022, citing New York City’s Local Law 97 as a potential use case.

Figure 2 | U.S. City, County, and State Policies for Existing Buildings: Benchmarking, Transparency, and Beyond

Building Energy Use Benchmarking is the practice of comparing the measured energy performance of a facility to itself, its peers, or established norms, with the goal of informing and motivating performance improvement. Chart source: The Institute for Market Transformation

To address the myriad of local regulations and ordinances, and to simplify compliance for real estate owners and investors, the Real Estate Roundtable has been advocating for the federal government to “help establish consistent standards, methods, and data that reflect best available government and industry practices…to avoid a divergent ‘patchwork’ of varying climate laws that unduly complicate building owners’ compliance and regulators’ enforcement.”18 The Roundtable also advocated for a provision of the Clean Energy for America Act that increases the enhanced tax deduction for commercial buildings as greater energy efficiency is achieved above the most recent ASHRAE 90.1 standard,19 as well as incentives to property owners to install heat pumps and electric water heaters to electrify major building systems.20 These possibilities represent both opportunities and risks, depending upon whether the federal government chooses to impose them in a burdensome way or take the approach of offering greater incentives.

Opportunities – Tax Credits and Discounts

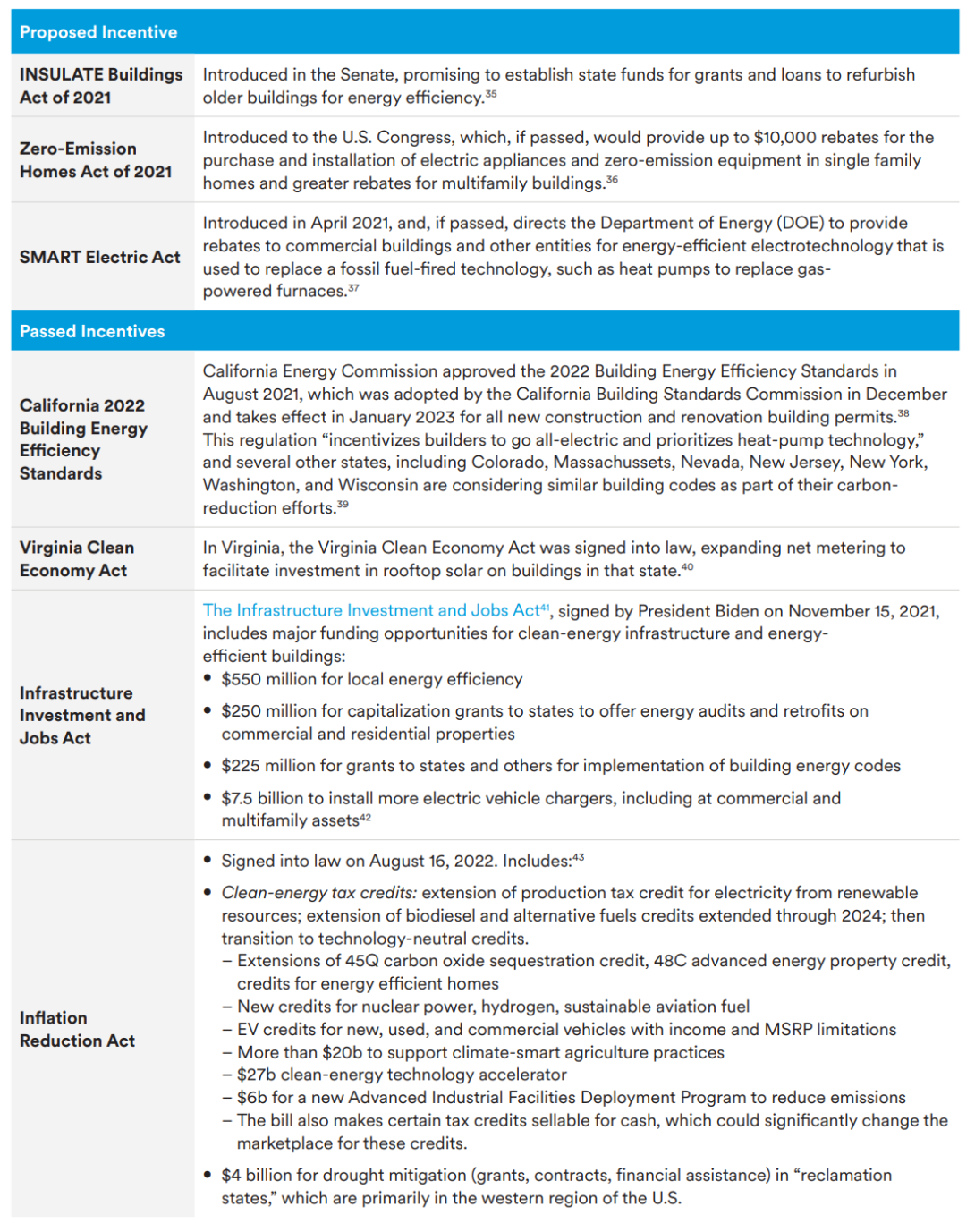

At the national level, many opportunities for incentives—such as tax credits, rebates, and discounts—have been passed or are on the horizon. On August 16, 2022, President Biden signed into law the Inflation Reduction Act (IRA), which contains numerous climate and energy provisions including new, extended, and expanded tax credits.21 More details on passed and proposed incentives are included in the Appendix of this document.

Meanwhile, DOE’s Better Buildings program shares free resources for building owners to address energy efficiency and recently launched the Better Climate Challenge, offering real estate investors the opportunity to be recognized as an industry leader and access technical expertise and assistance from DOE and other building owners. To join the Better Climate Challenge, building owners must commit to 50% operational emissions reduction within 10 years, including all Scope 1 and Scope 2 emissions, and achieve these reductions without the use of offsets, though Renewable Energy Credits (RECs)22 are allowed.23 MetLife Investment Management (MIM) is an Inaugural Partner of the Better Climate Challenge and looks forward to collaborating with DOE and the industry. MIM has also joined the ULI Greenprint Center’s Net Zero Framework24 with a comparable emissions reduction goal.

There are several ways for investors and building owners to take advantage of these opportunities, including through upgrades of older infrastructure to new energy efficient and smart equipment. These types of upgrades can save operational capital expenditures as well as reduce potential for fines related to regulations such as New York’s LL97 or the others mentioned above. There are also many incentives available to real estate investors to reduce carbon emissions and advance carbon neutrality goals, but they can be challenging to identify. We expect this difficulty to increase as incentives proliferate at both the national and local level. Early adopters of carbon reduction technology will have a better opportunity to take advantage of these incentives as they generally have limited timeframes or funding pools. The U.S. Office of Energy Efficiency & Renewable Energy provides links to some opportunities on their website at https://www.energy.gov/eere/buildings/state-and-local-incentives to help real estate owners and investors begin to find and take advantage of these incentive opportunities.

The European Picture

Ahead of the U.S., the European Parliament backed climate neutrality by 2050 for the EU and its 27 member-states in October 2020. The European Commission has set a 2030 target of reducing GHG emissions by at least 55% compared to 1990 levels.25 Since buildings represent 36% of EU emissions,26 the European target includes an ambition to renovate up to 35 million buildings within the EU by 2030.27

Most recently, the Sustainable Finance Disclosure Regulation (SFDR), which was published in March 2021, requires reporting on carbon impacts for any fund marketed in the EU starting in January 2023, including real estate funds.28

- In addition, the EU Taxonomy regulation primarily defines the economic activities that may be considered environmentally sustainable,29 but it also requires portfolios in scope for the SFDR to disclose how and to what extent the investments include environmentally sustainable activities.30

Real estate investors with funds or holdings in Europe must comply with these reporting requirements or face sanctions from EU regulators. U.S.-based funds with European investors must also comply with SFDR.

The European Commission is considering a proposal to extend the current EU Emissions Trading System to buildings, with emissions caps and a new emissions trading system for buildings starting in 2026.31 This could allow buildings with significantly lower emissions to sell their own carbon credits to other buildings or entities within the carbon trading system. With EU carbon prices hitting a record high of nearly €100 per metric ton of CO2e in February 202232, carbon trading could offer an additional revenue stream for real estate assets with reduced carbon or that achieve carbon-neutral operations sooner than required.

At the country level, many European nations are offering their own incentives to reduce emissions. Investors with European real estate should investigate the incentives available in the countries where their properties are located.

The Future View

For real estate investors with funds listed in the U.S. and Europe, reporting on climate neutrality goals and progress in reducing carbon emissions is a legislative reality in 2022 and for the foreseeable future. In municipalities around the world, we expect that more building ordinances will cap emissions from real estate assets and impose fines and penalties for excessive emissions similar to what New York, Boston, Washington D.C., Denver, and other cities have already enacted. At the same time, incentives will proliferate, and smart real estate investors will take advantage of these rebates and credits to improve building systems, reduce emissions, and increase their bottom line.

Real estate investors should also consider the impact of emissions regulations on asset value. To comply with emission-reduction requirements, cash flow during a 10-year holding period or loan term may be impacted.

Failure to comply with these laws may affect the property’s reversion or leave the asset stranded and unsellable because its emissions are higher than legislative or regulatory standards.33 MIM is quantifying this impact on asset values by using ENERGY STAR® scores as a proxy for the level of risk that a building’s emissions may have on reversion cap rates.

As more cities and utilities work toward 100% renewable energy production to comply with energy production regulations in the U.S. and Europe, it will become easier for real estate assets to achieve carbon neutrality for operational emissions, since the purchased electricity coming from the local utility will eventually be from renewable sources by default. And as regulations force heating and cooling equipment and other appliances to become more efficient,34 buildings will benefit from reduced energy load. The question is whether that transition will be fast enough to prevent the worst effects of climate change on both our real estate assets and the planet. As real estate investors, we cannot simply wait for governments and utilities to act. We must share the responsibility of accelerating the transition to a carbon-free future by committing to carbon reduction and taking action now with strategies such as working with our tenants and residents to reduce energy consumption and embrace renewable energy.

Investors who follow this approach over the next several years can benefit from burgeoning incentives and energy savings, while establishing a leadership position for carbon reduction in our industry.

Investors who lag behind may not only miss out on these incentives and savings, but they may also face fines and other penalties from the growing legislative and regulatory framework supporting carbon neutrality.

In our next and final paper in this series, we will provide an overview of results and updates on what has happened since the COP 26 Summit in Glasgow. The report will take a critical look at current carbon neutrality pledges and evaluate whether those efforts are sufficient for the defining decade ahead.

Appendix

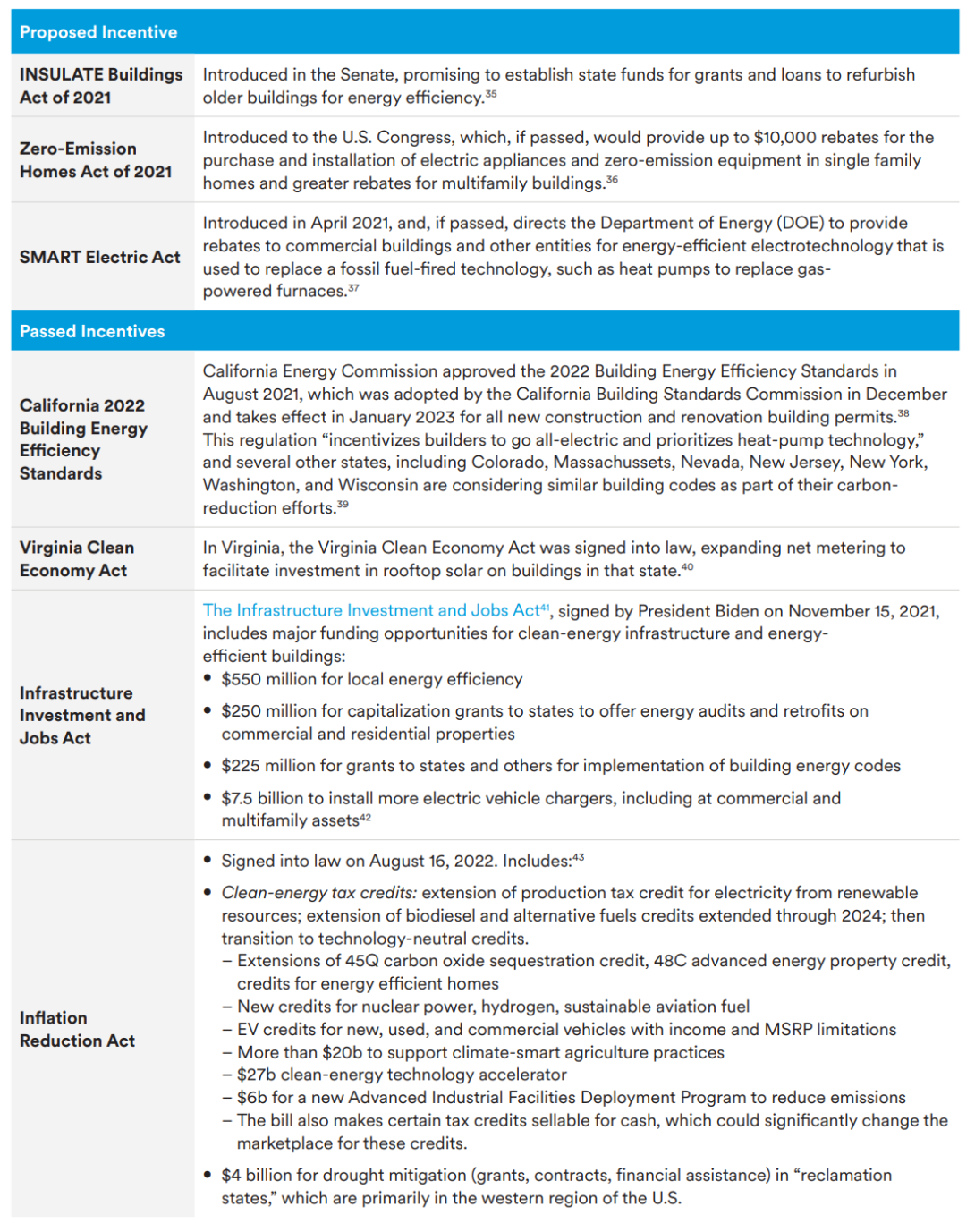

At the national level, many opportunities for incentives—such as tax credits, rebates, and discounts—have been passed or are on the horizon. The following section details various incentives that have been passed or proposed to help accelerate the transition to a carbon neutral future. A snapshot of the incentives is provided in Figure 3.

Figure 3 | Government Incentives: Proposed and Passed

Endnotes

1 https://daily.jstor.org/how-19th-century-scientists-predicted-global-warming/

2 https://www.nasa.gov/topics/earth/features/climate_by_any_other_name.html

3 https://www.epa.gov/clean-air-act-overview/progress-cleaning-air-and-improving-peoples-health

4 https://www.msci.com/who-will-regulate-esg

5 https://www.whitehouse.gov/briefing-room/statements-releases/2021/01/27/fact-sheet-president-biden-takes-executive-actionsto-tackle-the-climate-crisis-at-home-and-abroad-create-jobs-and-restore-scientific-integrity-across-federal-government/

6 https://www.whitehouse.gov/briefing-room/statements-releases/2021/04/22/fact-sheet-president-biden-sets-2030-greenhousegas-pollution-reduction-target-aimed-at-creating-good-paying-union-jobs-and-securing-u-s-leadership-on-clean-energytechnologies/

7 https://www.whitehouse.gov/briefing-room/presidential-actions/2021/05/20/executive-order-on-climate-related-financial-risk/

8 https://www.sec.gov/news/press-release/2021-42

9 https://www.sec.gov/files/esg-risk-alert.pdf

10 https://www.sec.gov/news/press-release/2022-46

11 https://www.sec.gov/files/33-11042-fact-sheet.pdf

12 https://www1.nyc.gov/site/sustainablebuildings/ll97/local-law-97.page

13 https://www.abettercity.org/news-and-events/blog/berdo-2.0-decarbonizing-existing-large-buildings-in-boston

14 https://plan.lamayor.org/targets/targets_plan.html

15 https://www.lightnowblog.com/2022/01/denver-ordinance-first-to-require-decarbonization-energy-efficiency-for-all-buildings25000-sq-ft/

16 https://www.columbus.gov/sustainable/benchmarking/

17 http://leg.colorado.gov/bills/hb21-1286

18 https://www.rer.org/docs/default-source/policy-agendas/2022-policy-agenda/interactive-rer-policy-agenda-2022.pdf

19 https://www.rer.org/detail/2021/04/23/gop-senators-outline-infrastructure-plan-biden-announces-u.s.-emissions-goal-at-globalsummit

20 https://www.rer.org/docs/default-source/tax-related-misc-documents/reconciliation_greentaxcode_sfc_wm_letter_final_111621. pdf?sfvrsn=2e948603_3

21 https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/19/fact-sheet-the-inflation-reduction-act-supportsworkers-and-families/#:~:text=The%20Inflation%20Reduction%20Act%20will%20protect%20Medicare%20recipients%20from%20 catastrophic,for%20the%20first%20time%20ever.

22 https://www.epa.gov/sites/default/files/2018-03/documents/gpp_guide_recs_offsets.pdf

23 https://betterbuildingssolutioncenter.energy.gov/better-climate-challenge

24 https://americas.uli.org/research/centers-initiatives/greenprint-center/city-engagement/ulis-net-zero-imperative/

25 https://www.europarl.europa.eu/news/en/press-room/20201002IPR88431/eu-climate-law-meps-want-to-increase-2030-emissionsreduction-target-to-60

26 https://energy.ec.europa.eu/topics/energy-efficiency/energy-efficient-buildings/energy-performance-buildings-directive_en

27 https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/delivering-european-green-deal_en

28 https://www.esg-specialist.com/reflecting-on-sfdr-one-year-on/

29 https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance/eu-taxonomy-sustainable-activities_en

30 https://www.spglobal.com/esg/insights/a-short-guide-to-the-eu-s-taxonomy-regulation

31 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52021PC0551

32 https://www.reuters.com/business/energy/europes-carbon-price-nears-100-euro-milestone-2022-02-04/

33 https://esgclarity.com/real-estate-assets-will-be-stranded-for-environmental-failures-2/

34 https://www.achrnews.com/articles/145707-rooftops-set-to-become-more-energy-efficient

35 https://www.congress.gov/bill/117th-congress/senate-bill/2066/actions

36 https://climatecrisis.house.gov/sites/climatecrisis.house.gov/files/Zero-Emission Homes Act Fact Sheet.pdf

37 https://www.congress.gov/bill/117th-congress/house-bill/2369

38 https://www.energy.ca.gov/programs-and-topics/programs/building-energy-efficiency-standards/2022-building-energy-efficiency

39 https://grist.org/fix/building-codes-can-slash-emissions-pollution/

40 https://www.governor.virginia.gov/newsroom/all-releases/2020/april/headline-856056-en.html

41 https://www.congress.gov/bill/117th-congress/house-bill/3684/text

42 https://www.aceee.org/blog-post/2021/08/energy-efficiency-funds-infrastructure-bill-should-tee-historic-investments-fall

43 https://www.congress.gov/bill/117th-congress/house-bill/5376

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”) solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor. This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK. MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such). For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414. For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities. For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law. 1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.