We have seen a very significant repricing of fixed income, but panic and volatility can also provide opportunities.

Speed read

- Inflationary pressure has accelerated and risks to growth are increasing

- A horrendous start to the year has resulted in much improved valuations

- Debt levels have never been higher and the safety net has been removed

US Treasuries this year had their worst January-to-April period since 1788. On top of that, credit spreads widened. By all standards, we have seen a very significant repricing of fixed income. The world looks grim and it would be easy to extrapolate the bear market. But panic and volatility can also provide opportunities.

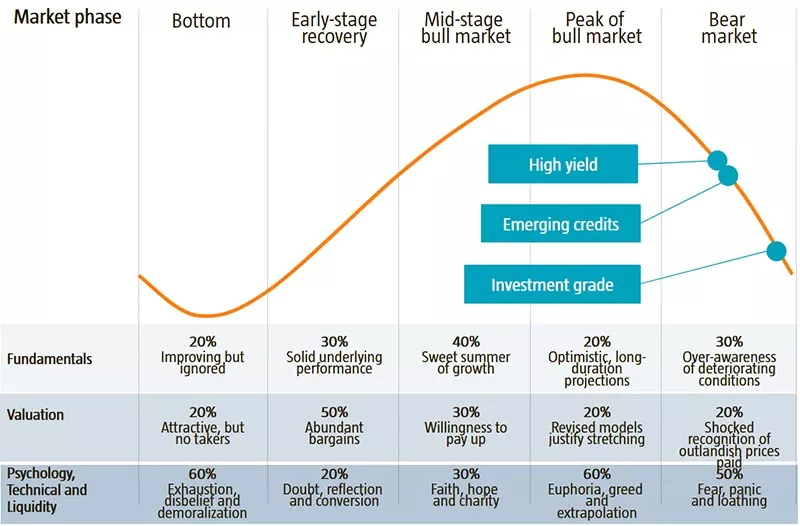

We already see a few pockets of the market that are starting to look attractive. Investment grade looks cheap at these levels and investors able to withstand the volatility and who are prepared to take a longer investment horizon could start buying. High yield is not there yet, although we believe that the quality names in high yield already look attractive.

How did the world get into this mess? “The policy response to Covid-19 seemed like a great cure during the health crisis, but the combination of massive fiscal and monetary stimulus now turns out to have been an over-extension of an era of largesse that is one of the key ingredients for the disease called inflation,” says Sander Bus, Co-head of Robeco’s Credit team.

Trouble ahead

While many parts of the economy are still red-hot, leading indicators are increasingly pointing to recession risk. Consumer confidence, producer confidence, inverted yield curves and housing affordability all indicate that trouble is coming. This should not be a surprise given the aggressive monetary tightening that we are now seeing in response to raging inflation.

Central banks currently have no option other than to tighten financial conditions further in order to slow their economies and restore the demand-supply balance. Clear evidence of inflation coming down is needed before they can stop tightening. The chances that inflation pressures would somehow simply disappear of their own accord are slim.

That had been what policymakers hoped for when they still used the word ‘transitory’ in 2021. But the ‘t’ word has been long canceled. “If history since 1955 is a guide, we have to conclude, as Larry Summers and Alex Domash first posited, that from current levels of inflation and labor market overheating, Fed tightening has always resulted in a recession,” says Jamie Stuttard, Robeco Credit Strategist.

Inflation is overshooting

Inflation is overshooting in the US and in Europe, while it remains a bit more moderate in China. In the US, it is most clear that the key trigger was excess fiscal stimulus at a time when the output gap had already closed. In Europe, there is also an element of too much fiscal spending, and on top of that a food and energy crisis on the back of the war in Ukraine, together with imported inflation via the foreign exchange channel.

Inflation has caused a shock to real incomes not seen in the US since the 1970s. This, coupled with the sharp tightening in financial conditions, with the fragile China macro backdrop to boot, implies a real risk of recession in our view. There are more parallels to the 1970s episode. Policymakers at that time also argued that inflation was transitory since it was initially triggered by external shocks.

Even though they were all temporary shocks, together they caused individuals to expect higher inflation, entrenching the inflationary dynamics further and contributing to a self-reinforcing spiral of wage-price inflation. We do not see inflation spiraling out of control yet, but it is a scenario that central banks are desperate to avoid, given this type of inflation can be very difficult to fight.

Healthy corporates, but check the debt levels

Corporate profit margins are at cyclical highs, which is not uncommon on the eve of an economic slowdown. Corporates enjoyed strong pricing power in 2020 and 2021, with supply constraints and government support helping to lift margins. Earnings are 20-40% above 2019 levels in all key regions.

One important element to judge corporate health is to look at companies’ interest rate sensitivity. Companies that have high gearing and a lot of floating-rate debt on the balance sheet are clearly more vulnerable.

For Europe, the situation is even more challenging given the gas squeeze and terms of trade developments that have lifted gas and electricity prices in euro terms to very elevated levels. The overhang of the energy crisis is negative for Europe but at the same time will constrain the ECB from lifting rates as aggressively as the Fed.

Since we have overweight positions in European banks and many clients have the global financial crisis still top of mind, we think we should make some remarks about this segment. During Covid, a substantial amount of SME credit risk was shifted from bank balance sheets to government entities via the use of state-backed loans. This tool was used mainly in southern Europe, with Italy now having more than 10% of GDP in state-backed loans.

This means that when defaults increase, banks are partly shielded as some losses will end up at the government. According to Victor Verberk, Co-head of the Robeco Credit team, “We conclude that healthy capital positions and probably lower credit losses compared to earlier episodes of economic stress should help banks to weather the storm. We feel comfortable that banks will not be the epicenter of stress in the next recession”.

Valuations are becoming more attractive

Spreads on all segments of the credit market are now undoubtedly above median spreads. Euro investment grade and Euro high yield have even reached top quartile.

Market cycle | Mapping our view on market segments

Source: Robeco, June 2022

For investment grade, we have reached levels where we feel comfortable running portfolio betas just above 1. For high yield and emerging debt portfolios we have reduced the underweight beta as well, but are not yet in positive territory for all portfolios.

We are more cautious on high yield than on investment grade. The ratio between high yield and investment grade spreads is tight by historical standards, which leaves room for underperformance of high yield on a risk-adjusted basis. “We believe that the lower end of the credit spectrum is particularly vulnerable. A recession will increase idiosyncratic risk and dispersion in this segment. This is still insufficiently priced,” says Bus.

The technicals are tough

Central bank policy is clearly the dominant driver of asset prices this year. There is much uncertainty about the amount of monetary tightening required to achieve price stability and a return of inflation rates back down to mandated targets, without overshooting into deflation. This uncertainty is creating very high volatility in fixed income markets.

During the sell-off this year we saw days that reminded us of March 2020 and September 2008, with very poor liquidity conditions. It is also a reminder that investment bank balance sheets are not the same as before the global financial crisis. More regulation, more stringent risk management and a lower appetite for physical inventory means investment banks are unable to act as a shock absorber.

This is why we see liquidity rapidly deteriorating in markets where everyone is looking for the exit. “It once again stresses the importance of being contrarian in these markets,” says Verberk. “One can be wrongfooted by aggressive bear market rallies and should try to take risk when most people let go – and vice versa. Market liquidity is very fragile, and one should use that to your benefit.”

Conclusion

All in all, valuations suggest a somewhat more constructive stance to credit markets, but at the same time fundamentals and technicals are still weak. During QE we learnt not to fight the Fed – and the same holds this time around during tightening. The Fed is combatting inflation, and market weakness is collateral damage that they are accepting. Spreads could very well widen even more, at which point we will consider increasing the beta further.

“Recession risk has increased and the market has moved towards that scenario as well,” says Bus. “Nevertheless, we are not yet in the phase of capitulation and unjustified cheapness. These opportunities might very well occur in the next three to six months.“

Download the publication