The world is in a period of quantitative tightening, as central banks continue normalizing their balance sheets. This process, combined with official rate hikes, is pushing interest rates up and suppressing economic growth, which hurts capital value and poses challenges to real estate companies in implementing their business plans. At the same time, inflation remains high.

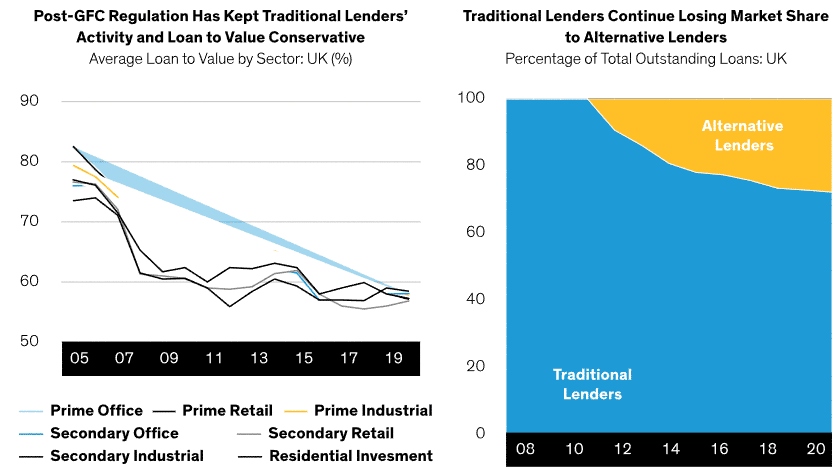

This is a challenging environment for commercial real estate debt lenders, as it is for most market segments. But at the same time, market dynamics are unveiling opportunities. Growing regulation since the global financial crisis has led banks to pull back from lending activities, reducing competition for originating loans. The effect is magnified in Europe, where banks make up the majority of the market (Display). The implementation of Basel IV, planned for 2023, is expected to accelerate this trend. Ultimately, however, success in the current landscape comes down to identifying good properties owned by strong sponsors with viable business plans—and structuring loans effectively.

Growing Regulation Is Reducing Bank Appetite, Driving Opportunity

Current analysis for illustrative purposes only.

As of December 31, 2020

Source: Bayes Business School, Commercial Lending Report and AllianceBernstein (AB)

How Inflation Dynamics Are Impacting Markets

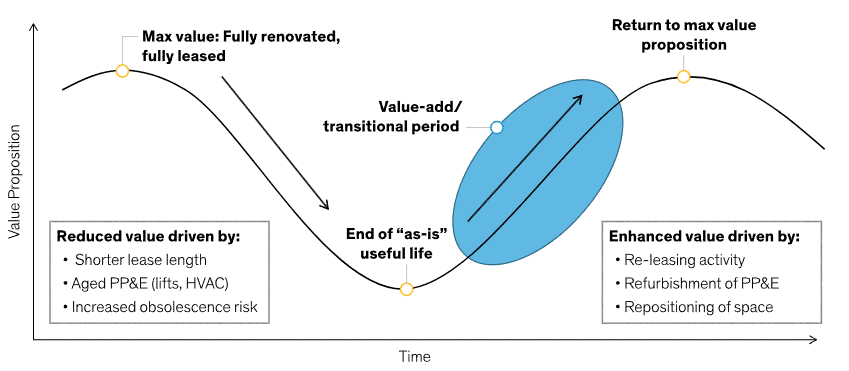

Inflation is a concern in the commercial real estate market. Rising expenses and costs of capital expenditure can depress margins and ultimately hurt asset values. In environments like this, it’s vital that lenders closely scrutinize borrowers’ and sponsors’ financial statements to ensure that borrowers have the wherewithal to execute their business plans—specifically in the value-add transitional space (Display).

Typical Commercial Real Estate Lifecycle

For illustrative purposes only. There can be no assurance that any investment objectives will be achieved.

PP&E: property, plant and equipment. HVAC: Heating, ventilation and air conditioning

As of August 31, 2022

Source: AB (AllianceBernstein)

Lenders must focus on whether a borrower has budgeted effectively, which includes having the financial capacity to absorb overruns—ensuring that completion risk lies with the equity. One benefit of being a real estate debt lender in a volatile environment is that property values don’t have to rise or even stay flat to generate returns. Loans structured with the right cushions, sponsors, collateral and business plans can expect to be insulated from market dynamics.

Lenders also need to closely monitor the impact on borrowers of this unusual economic cycle. In normal cycles, credit spreads decline as interest rates rise. This time around, rates are rising and so are spreads, as investors who anticipate a recessionary period pull back from the market. For borrowers, this means coupon payments are rising rapidly too. We think the focus should be on answering two key questions: Does the borrower have enough cash flow to continue servicing its debt? Does it have the balance-sheet strength and wherewithal to stick with the property through a challenging period?

Eventually, the economy will begin to move, and expectations are that rates will ultimately decline again—or at least that credit spreads will normalize and start to fall. Until that happens, loans for transitions that are still under way should include interest-rate guarantees.

Reduced Market Liquidity Could Translate into an Advantage

Liquidity in the commercial real estate lending market has changed in recent months. After a strong second half of 2021 and first quarter of 2022, lenders have pulled back for two main reasons: the high volume of loan originations over the past nine months, and concerns about the macro environment and the implications of quantitative tightening.

The withdrawal of typical sources of lending flows, including balance-sheet bank lenders, commercial mortgage-backed securities and some life insurance companies, has created a vacuum that alternative lenders can fill. Also, many of the typically competitive alternative lenders, who use warehouse lines of credit and commercial real estate collateralized loan obligations to achieve their targeted yields, have found challenges in both the availability and cost of financing.

This environment has created an opportunity for unlevered, unregulated lenders to provide loans with lower leverage, better structure and more attractive pricing. This opportunity won’t last indefinitely, but it provides a great backdrop for deploying capital with a better risk-adjusted profile. Lenders who select assets and sponsors prudently while practicing conservative, equity-like underwriting can play market makers rather than market takers—which is the case when the backdrop is more benign.

In Europe, which is historically a less liquid market than the US and lags that market, we suspect these dynamics will take longer to play out. On the other hand, the magnitude of the impact on risk-adjusted returns may be greater because of the relative illiquidity. European lending depends much more on banks, which have stepped back for now. As we see it, this could create even more opportunities over a 12- to 18-month horizon.

The Path Forward for Commercial Real Estate Debt

The US commercial real estate market comprises different asset types and distinct geographies, making it nuanced and difficult to paint with a broad brush.

In order to assess lending today, both supply/demand fundamentals and market technical factors (inflation and interest rates) need to be considered. The Fed’s quantitative easing and interest-rate hikes, coupled with changing fundamentals in certain sectors, has caused recessionary fears and disrupted overall liquidity. The spread between buyers and sellers in certain areas is wide, causing transaction volumes to slow. However, with bank financing less available today, lenders less dependent on that channel are seeing a steady stream of financing opportunities.

While the commercial real estate debt market is somewhat different in Europe than it is in the US, we’re seeing a similar gap in capitalization rates between willing buyers and sellers. People who have to transact in the current uncertain environment don’t know exactly where the values are, which makes equity investments much more risky.

From a big-picture perspective, we think it’s sensible for commercial real estate debt lenders to moderate risk taking and demand a higher spread than they did six months ago. In an environment with fewer transactions and a supply/demand imbalance of debt capital, there are risks in the market. But from a forward-looking perspective, this also seems like an appropriate time to take advantage of select opportunities with greater influence over loan parameters.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

About the Authors

Peter J. Gordon

Peter J. Gordon is Chief Investment Officer and Head of Commercial Real Estate Debt (CRED) in AB’s Real Estate Debt Group. CRED oversees nearly $6 billion in committed capital from insurance companies, pension funds and banks, across three vintage closed-end funds and various other institutional mandates. Gordon has been gaining experience in the US commercial real estate markets since 2001 and has also spent four years in construction management. Previously, he ran origination for and was managing director of Commercial Real Estate Debt. Prior to joining the firm in 2016, Gordon served as managing director and head of commercial real estate (CRE) whole loan originations at Angelo, Gordon & Co., a global alternative investment-management firm, where he led the CRE whole loan team, responsible for sourcing, pricing, financing and structuring transactions as well as managing assets in the investment portfolio. Prior to that, Gordon was a senior member of the real estate finance and investment banking groups at both Goldman Sachs and Morgan Stanley, where he was involved in all aspects of commercial real estate lending, from originations for balance-sheet and commercial mortgage-backed securities to loan structuring, syndication and securitization. Gordon holds a BS in mathematics from the University of St Andrews in Scotland and an MBA from Columbia University. Location: New York & Los Angeles

Clark Coffee

Clark Coffee is the Chief Investment Officer and Head of European Commercial Real Estate Debt. His previous business, Lacarne Capital, was acquired by AB in 2020 to establish the firm’s real estate debt business in Europe. Previously, Coffee was head of Tyndaris Real Estate, where he was responsible for building the business into a top-10 real estate debt fund in Europe. Prior to that, he co-headed origination for Deutsche Bank’s European commercial real estate credit business and oversaw the risk management and restructuring of more than 2 Billion Euro of troubled loans during the global financial crisis. Coffee holds a BA in economics from Lake Forest College and an MBA from the University of Michigan. Location: London/Frankfurt