Regulatory momentum is building globally around identifying and managing insurance companies’ exposures to climate risks, with scenario analysis considered a key tool. Because climate scenario modeling is a nascent industry, insurers and investment managers play important roles in advancing its deployment and effectiveness.

Patterns of Climate Risk in the Insurance Industry

Insurers face transition and physical risks from climate change through their liabilities (the risks they choose to insure) and investments. Physical risks are prominent for general insurers, given that they insure against severe weather-related events such as flooding, wildfires, droughts and storms. Although the annual nature of most coverage offers some opportunity to respond—with pricing renewals reflecting better data and risk experience—pricing must remain competitive.

Life insurers must consider the impact of climate change on the lives of the people their policies protect, given that more severe weather patterns will likely affect health. Heat waves, for example, take an extreme physical toll and will likely claim more lives; milder winters, on the other hand, could mean weaker flu seasons, which may be a positive.

Insurers must also assess the impact of climate change on companies they invest in. This can be a daunting task, given the potential exposure to hundreds of firms. Those investment assets back insurance policies, so it’s vital to understand the potential impact of climate change. Scenario analysis is a natural tool, given the long-term, complex, uncertain and path-dependent problem.

Regulators Road Test Insurance Industry Exposure

Globally, regulators are beginning to align on the importance of climate scenario analysis for exploring exposure to a range of potential transition scenarios. It provides a more holistic view of risks in investment portfolios, can drive engagement with companies to advance change and even help plot a path for aligning portfolios with decarbonization objectives.

The International Association of Insurance Supervisors (IAIS), whose members cover 97% of the world’s insurance premiums, published a special report on climate change. It included an analysis of insurers’ asset exposures to climate risks, including a forward-looking basis using climate scenarios. This exercise can be viewed as a leading indicator to national regulators’ future efforts.

The study used three climate change scenarios from the Network for Greening the Financial System (NGFS). Each was translated into stresses across sectors and asset classes that were mapped to insurers’ asset bases, forming a quantitative view of the market-value impact. Assets were classified as “climate-relevant” or “non-climate relevant,” with a large portion lacking enough information to be included in the study.

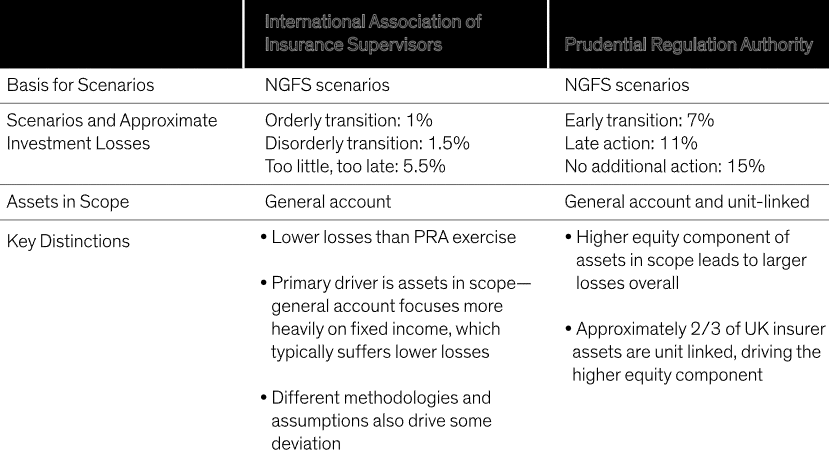

In all, 36% of assets were deemed climate relevant. Based on the analysis, insurers’ assets would lose around 1% in market value under an orderly transition scenario, about 1.5% under a disorderly transition scenario and 5.5% under a “too little, too late” scenario. Considering insurers’ level of capitalization, these impacts seem manageable.

These impacts were based on a single shock to in-scope general-account assets at one point in time; they didn’t consider changes in the asset base or future actions by insurers’ management teams. It’s not prudent to think that assumptions made in these areas would be meaningful, but it’s also imprudent to think that insurers won’t adapt their asset bases or work to reduce risk exposure. In our view, this means the results should be seen as indicative and directionally relevant—not a point estimate of true asset value declines.

National Action to Bolster Climate Risk Assessment and Management

During 2021, the UK’s Prudential Regulation Authority (PRA) held the Climate Biennial Exploratory Scenario (CBES). The exercise was designed to help participating banks and insurers better manage climate-related financial risks and better assess their exposure under different transition scenarios.

As with the IAIS exercise, this effort used three NGFS scenarios as starting point: Net Zero 2050, Delayed Transition and Current Policies—a scenario that assumes no further actions beyond those already committed to. Other assumptions were incorporated to arrive at updated scenarios of early transition, late action and no additional action.

Insurers’ assets would lose around 7% under the early-action scenario, about 11% under the late-action scenario and 15% under a no-additional-action scenario. These results are much more severe than those of the IAIS exercise (Display), though the methodologies differed. For example, the most severe scenarios modeled under each exercise aren’t directly comparable.

Comparing Regulatory Exercises on Potential Climate Risk

Current analysis does not guarantee future results.

As of August 31, 2022

Source: International Association of Insurance Supervisors, Prudential Regulation Authority and AllianceBernstein (AB)

The nature of the assets in scope is likely the biggest driver of different outcomes. The UK’s large market for unit-linked assets accounts for about two-thirds of UK insurance assets, with a much higher equity allocation versus the general account. Because the IAIS exercise focuses only on general account assets, it will have a higher allocation to fixed income, which would lose much less market value.

The divergent results highlight an important aspect of climate scenario analysis: models may be methodologically advanced but are also in their infancy. The data has depth but still much room for improvement. As a result, outcomes should be a catalyst for more fundamental analysis, not a view of the absolute expected impact.

Who picks up the cost of investment losses? According to the CBES exercise, only a small fraction would fall on insurance company shareholders; the majority would fall on policyholders (or, in the case of European insurers using the Matching Adjustment under Solvency II, can be absorbed within the balance sheet*). This finding reinforces the importance of regulatory focus on this area—all prudential regulators have some variation on the objective of protecting policyholders.

Market specifics must be considered too. The UK’s unit-linked market is sizable, while those in many other regions are growing, as insurers have adapted their product sets to the low-interest-rate environment of the past 15 years. Within unit-linked products, investment risk sits with the policyholder; insurers must think carefully about how to demonstrate that they’re meeting their responsibilities for managing climate risk.

Regulators’ View: Managing Climate Risk Is Complicated…but Expected

The IAIS and PRA exercises reinforce that climate scenario analysis is critical. Regulators know the task is complex and will develop over time, but they expect insurers to adopt these approaches now in order to fully embed long-term climate–risk management into firm culture.

The IAIS and PRA aren’t the only regulatory bodies to act. The European Insurance and Occupational Pensions Authority, in an April 2021 opinion, outlined its expectations for national supervisors in overseeing insurers conducting climate change scenario analysis as part of their Own Risk and Solvency Assessment (ORSA).

This opinion was followed in December 2021 with a consultation on guidance to facilitate the implementation of materiality assessments and climate change scenario analysis in ORSA. A pilot exercise started in March 2022, with an imminent final publication likely to incorporate feedback from both the consultation and pilot exercise. France and Australia are among other examples of the regulatory push for progress.

How Insurers Can Get Ready for Climate-Related Regulatory Change

In our view, the direction of regulation is clear: regulators will expect insurers to embed forward-looking assessments of climate risk in their risk-management culture, with climate scenario analysis a key tool. Insurers can take several steps to achieve that goal and prepare for future regulatory change, including:

- Review the exercises described above in greater detail. The exercises are leading indicators of possible future requirements, and a path to understand how climate scenario analysis can provide a more comprehensive view of climate risk exposure.

- Scale efforts to the size and complexity of the business. A monoline insurer that backs liabilities with government bonds alone will likely find it easier to assess climate-change exposure than a globally exposed composite insurer would. Regulators will expect a proportional approach.

- Consider leveraging in-house expertise. An insurer’s investment department may be relatively new to this discipline, but other departments may be more advanced. Insurers (particularly reinsurers) have developed mechanisms to assess the impact of natural catastrophes in order to price risk accordingly. Connecting the dots internally can draw on existing expertise.

- Evaluate the time frame for assessing exposure. Insurers would typically consider forward-looking risk assessments in the context of a business-planning horizon. However, climate change may compel a much longer horizon.

- Assess risk appetite…and how it might change. The appetite for climate risk will likely evolve over time. Some risks may be avoidable, but the impact of climate change is so broad that many risks can’t be avoided. Those factors must be monitored and managed over time.

- Consider governance structures. The institutional structures that an insurer has in place should be designed to ensure that climate risk analysis is considered in the appropriate forums that enable actions to be taken.

- Review stakeholder disclosures. When developing climate risk monitoring processes, insurers should take account of the specific disclosures that policyholders, shareholders and regulators would find most useful.

- Understand asset managers’ approaches to climate risk. Engaging with asset managers provides insight on their processes for considering forward-looking climate change risks, as well as how managers are working to incorporate scenario analysis.

Asset Managers: A Critical Link in Assessing Insurers’ Climate Risk

Many insurance companies partner with external asset managers, relying on them for insights about portfolio climate risk exposures—and to manage portfolios based on those insights. In our view, this makes scenario analysis a vital tool in maintaining alignment of interests between investment managers and insurers.

Existing scenario analyses are a good start, but more development is needed before portfolio managers can fully implement models in decisions. Each provider has a unique approach to data and analysis, with different strengths and weaknesses. As AB evaluated providers, we applied wide-ranging criteria, including the models’ structure and inputs. We found it extremely helpful to partner with Columbia University’s Earth Institute during this process, given its academic expertise in climate change.

Investors also need to work closely with vendors to customize the tool to the specific needs of their investment process, rather than working with a standard version. And no matter how sophisticated a model may be, the human touch is critical. The skill and experience of analysts are vital cogs in interpreting and integrating the results, given models’ idiosyncrasies.

For example, an insurance company held within an investment portfolio may present limited exposure to physical risks based on the model’s output, which is derived from the insurer’s office locations. Fundamental analysis is necessary to go beyond the model’s outputs, evaluating the firm’s exposures to physical risks through its policy liabilities, which can be much broader in geographic scope.

Climate Value at Risk: Assessing the Costs

Similar to the IAIS and BoE exercises, we apply three transition scenarios: 1.5-, 2.0- and 3.0-degrees. We consistently apply an “aggressive” physical risk scenario across all three, because our work with Columbia faculty indicated that this is more aligned with todays’ scientific consensus. For our process, we chose a Climate Value at Risk (CVaR) measure (Display), which refers to the economic value of physical and transition risks plus opportunities from technological advancements related to patents and green revenues.

Climate Value at Risk—Assessing the Costs

For illustrative purposes only.

As of December 31, 2021

Source: MSCI and AllianceBernstein (AB)

The ability to analyze CVaR at the company level facilitates an assessment of the output through different lenses—for instance, aggregating stocks at a sector level to assess those most exposed to physical risk. Investors can also assess dispersion in issuer impacts, which can highlight opportunities. Segmenting risk by type can help identify areas for engagement with company management teams. At the portfolio level, assessing metrics can help provide a holistic view of progress toward client and/or asset-manager climate goals.

An example helps illustrate the potential impact. An AB equity team integrates emissions, transition and physical risk, and technology insights from climate scenario analysis into company analysis, applying a penalty or bonus to the discount rate of each company. This comprehensive approach has resulted in a strategy with a significantly lower carbon footprint than the benchmark and mostly companies with high ESG ratings. The data has also enriched analysts’ engagement with, and insights on, companies.

The Future of Climate Scenario Analysis

Collaborating with a provider of climate scenario analysis enhances the investment process, despite the challenges of working with imperfect data. Providers collect unstructured data in a central location from various sources, and available models cover everything from temperature change to financial impact.

But the industry is young—a lot of refining is needed to make scenario analysis a more effective tool for investment decision-making. Risk and opportunity models are complex, but they still need even more complex interactions. Today, for example, transition and physical risks are often calculated separately and don’t interact. Over time, we envision general (global) circulation models that funnel down to a regional economic impact model, then finally drill down to corporate earnings and valuations. But a model like that would have many assumptions at each stage, which could delay development.

Integrating scenario analysis with the experience and expertise of fundamental research will speed the refinement of tools. Early adopters can help shape this evolution, working with providers to fine-tune everything from models to data. Progress has been significant in a short time, but more is needed.

To sum things up, effective scenario analysis is much more than a tool for helping insurers meet their regulatory requirements. It can help ensure that their assets are being managed with a holistic view of potential climate risk exposure. It can also help drive engagement** with company management teams on key topics and ensure that portfolios are managed in alignment with insurers’ climate objectives.

*Matching Adjustment (MA) users will have a degree of insulation from rising spreads in credit assets stemming from potential climate-related losses. The adjustment is designed to recognize that, when insurers back certain long-term liabilities (primarily annuities) with a well-matched asset portfolio held to maturity, they’re not materially exposed to the risk of selling those assets in unfavorable conditions. As a result, they shouldn’t suffer the volatility in their solvency position that spread changes bring, and can essentially “bank” some of the future returns they earn for bearing credit risk. There’s a clear question about the extent to which spread changes reflect a real change in credit risk that should not affect the magnitude of the benefit conferred by the MA—and ultimately the insurer’s overall capital requirement. This aspect, while not driven by climate change considerations alone, is a focus for the BoE in its current review of Solvency II.

**Engaging with management teams of companies in investment portfolios can be a highly effective tool for insurers on both sides of their balance sheets. Climate change physically affects insurers’ assets. Engaging with companies that proliferate emissions likely helps insurers address transition risk to invested assets by encouraging companies to adopt practices that will make them successful, viable businesses in the transition to a lower-carbon world. Engagement can also help insurers address physical risks that may be covered within their liabilities over the long run.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

About the Authors

Dmytro Mukhin, PhD, FSA, CFA

Dmytro Mukhin is a Managing Director and North America Senior Insurance Strategist in the Global Business Development Group. In this role, he partners with insurance companies and AB’s investment and insurance accounting teams to evaluate strategic asset allocations, peer comparisons, risk/stress scenario tests and capital efficiency to help insurance clients think about optimal portfolio structure and implementation. Prior to joining AB in 2022, Mukhin was a member of the Global Insurance Solutions Strategy & Analytics group at J.P. Morgan Asset Management (JPMAM) for seven years. Before JPMAM, he was head of Annuity ALM at Voya Financial. Mukhin’s career track also includes two other asset management companies, both in Boston: Wellington Management, where he was a vice president and fixed-income quantitative analyst, and Standish Mellon Asset Management, where he focused on investment strategy and risk analysis for insurers and other liability-conscious clients. Prior to that, Mukhin was a senior actuarial associate at MetLife. He started his professional career at Conseco Services. Mukhin holds a PhD in mathematical economics from Purdue University. He is a Fellow of the Society of Actuaries and a CFA charterholder. Location: New York

Sara Rosner

Sara Rosner is the Director of Environmental Research and Engagement on the Responsible Investing team. She co-chairs the firm’s ESG Research, Training and Thought Leadership Group and manages AB’s collaboration with Columbia University’s Columbia Climate School, which focuses on enhancing investors’ ability to integrate climate change considerations into their decision-making and investment processes. Prior to joining the firm in 2018, Rosner performed research for the Columbia Center on Sustainable Investment, where she worked on projects related to the United Nations Sustainable Development Goals and renewable energy alternatives in the extractive industry. She spent most of her early career as a journalist covering energy and infrastructure finance in the Americas for Euromoney Institutional Investor. Rosner is a global member of 100 Women in Finance and a financial literacy volunteer with the High Water Women Foundation. She holds a BS in international studies, magna cum laude, from Pepperdine University and an MS in sustainability management from Columbia University. Location: New York

Richard Roberts, ACCA, CFA

Richard Roberts is a Vice President and Director of EMEA Insurance Solutions. Working closely with the Insurance Portfolio Management team and AB’s client advisors, he is responsible for partnering with insurers across the EMEA region to develop solutions that meet the unique requirements of this industry, be it yield, diversification, solvency efficiency or targeting sustainability objectives. Roberts also supports the development of insurance thought leadership for direct consumption by EMEA insurers across a broad variety of topics. Prior to joining AB in 2022, he was a global insurance investment director for abrdn, where he was responsible for supporting the development of insurance investment solutions for clients across the EMEA and Asia regions. Before this, Roberts spent 13 years with Zurich Insurance in a variety of insurance investment roles, culminating in the role head of balance sheet investments for their UK business, where he was responsible for investment strategy across both Life and Property & Casualty general accounts. He is a chartered accountant and a CFA charterholder. Location: London