RBC Global Asset Management

Positioning ourselves for where we are going, not where we’ve been

Tim Leary, Senior Portfolio Manager on the BlueBay U.S. Fixed Income Team, discusses where we expect the market to go through the end of the year.

RBC Global Asset Management

Positioning ourselves for where we are going, not where we’ve been

Tim Leary, Senior Portfolio Manager on the BlueBay U.S. Fixed Income Team, discusses where we expect the market to go through the end of the year.

Antares Capital

Episode 230: The Convergence of Insurers and Asset Managers

SAVE

the DATE

INSURANCE INVESTMENT

LEADERS' SYMPOSIUM

SAVE

the DATE

INSURANCE INVESTMENT

LEADERS' SYMPOSIUM

Wednesday - Thursday

July 16-17, 2025

What's Trending

What's Trending

Data and Technology

View All

SS&C Technologies

Can Your Insurance Investment Accounting Platform Scale as You Grow?

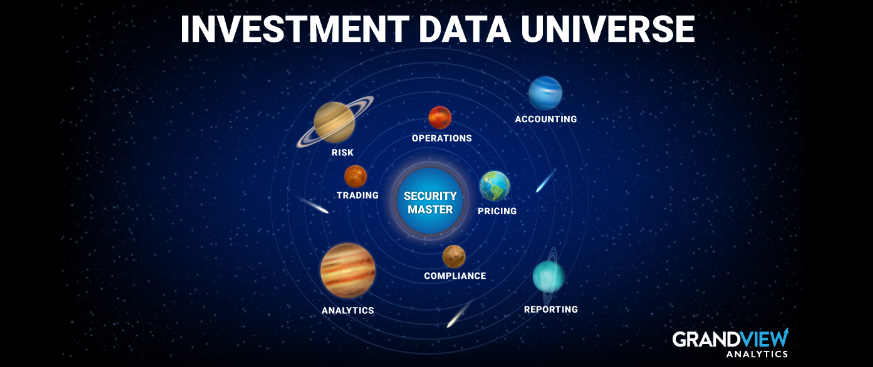

Grandview Analytics

Security Master: The Nexus of the Investment Data Universe

Private Credit

View All

RBC Global Asset Management

The Navigator: Not your father's LevFin market

MetLife Investment Management

The Role of Private Credit in the Transition to A Low Carbon Economy

Real Assets

View All

Macquarie Asset Management

Perspectives - Infrastructure debt: First among equals

Regulation and Accounting

View All

SS&C Technologies

Can Your Insurance Investment Accounting Platform Scale as You Grow?

Sign Up Now for Full Access to Articles and Podcasts!

Unlock full access to our vast content library by registering as an institutional investor

Register