A Rangebound Study in Long U.S. Corporates

One of the themes from our first-quarter outlook focused on the rangebound environment across global fixed income. When navigating the range for long U.S. corporates, the key factor isn’t market timing. Rather, it’s recognizing the contours of the channel and the factors contributing to the range. With this context, we believe long-duration U.S. corporates may be attractive for institutional investors, such as pension plan sponsors and insurance accounts, due to several factors including:

- the likely peak in the Fed funds rate;

- the sector’s historically elevated yields;

- pension plans’ improved funding status;

- limited long-duration supply;

- and attractive valuations relative to equities.

At this point in the market cycle, the long U.S. corporate sector is a fitting example of an asset class in a range defined by a combination of factors. As investors anticipated that the Fed was approaching the peak in its policy rates—with the presumption that rate cuts would eventually follow—they logically piled into long-duration, high-quality assets in 2023. As a result, long corporates easily outperformed the broader corporate index last year.1

Long corporates’ outperformance was accompanied by tighter spreads and a flatter spread curve, which may raise valuation questions for some participants. However, those conditions require a notable degree of context when looking ahead.

At the forefront, spread curve flattening tends to occur during periods of elevated yields (Figure 1). The increase in yields has contributed to a brisk tailwind for long corporates given the consistent demand from yield-based buyers and limited, long-dated issuance.

Figure 1

Flatter 10s/30s corporate spread curves tend to accompany elevated U.S. IG yields (lhs: bps; rhs: %)

Source: J.P. Morgan

We expect continued demand from accounts seeking duration to match their liabilities or from those seeking a certain yield level to persist as yields on the long-corporate benchmark have stabilized in an apparent channel with a 5% lower bound (Figure 2).

Figure 2

Although long corporate yields are off their cycle peaks, they remain near decade highs in a potential range with a 5% lower bound (%)

Source: Bloomberg

This demand may include pension plan sponsors as they engage in various transactions related to managing their defined benefit liabilities or exiting the pension business altogether.2 The funded ratio of the 100 largest U.S. plans now exceeds 100% following the recent gains in their growth assets, likely led by equities, and the multi-year increase in long-term interest rates, which reduced their liability valuations.

While there are multiple ways to track pension activity, such as open contracts on long-term futures, another proxy is through U.S. Treasury stripping activity as accounts seek various forms of long-duration assets. Figure 3 shows a steady relationship between Milliman funding ratios and the level of stripping activity. Although STRIPS pertain to the U.S. Treasury complex, we regard the demand for these zero-coupon assets in a similar context to the pension-related demand for high-quality, long-duration corporates.

For reference, Milliman's base case sees the funded status improving to nearly 104% in 2024 and more than 105% in 2025.3 If that estimate comes to fruition, pension plan sponsors may continue to shift away from equities or other risk assets and choose to hedge more, or all, of their remaining liabilities through additional allocations to long-duration fixed income.

Figure 3

U.S. Treasury stripping activity continues to rise as pension plan funding ratios exceed 100% (ratio; lhs: %; rhs: US$ billion)

Source: PGIM Fixed Income, Milliman, Bloomberg

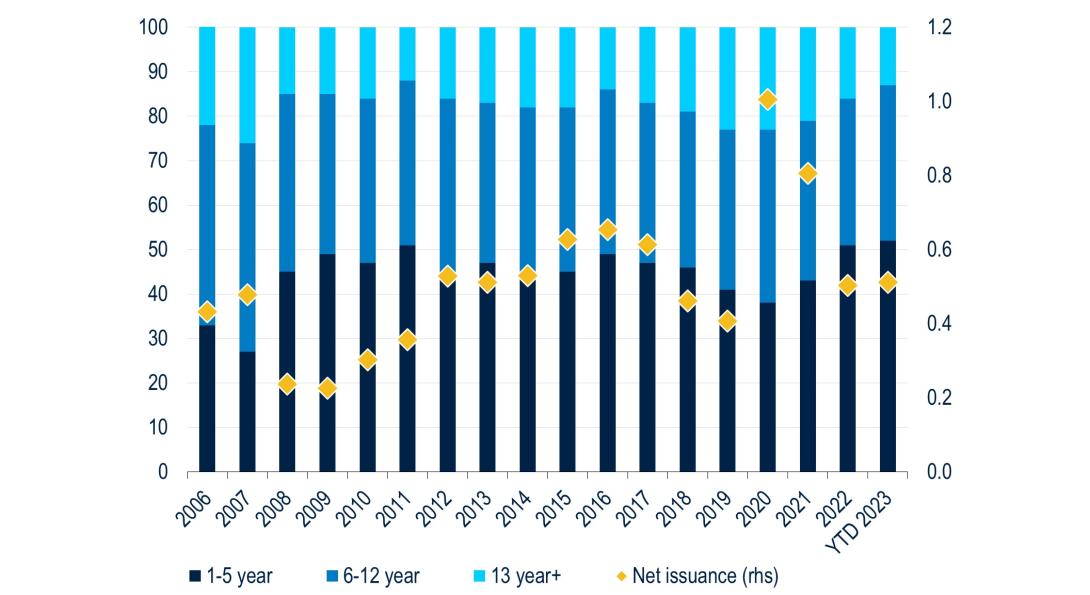

This steady demand comes amid a supportive supply picture. Figure 4 shows that issuance of 13+ years is consistently the lowest of the segments shown with 2023 coming in at the low end of the range. Meanwhile, the trend of declining net issuance of U.S. corporates over the last couple of years should continue given the expectations for approximately zero net new issuance in 2024.

Figure 4

The sector’s favorable supply/demand technical backdrop may persist given expectations for very little net issuance in 2024 (lhs: %; rhs: US$ trillion)

Source: J.P. Morgan

However, as non-financial entities wrap up reporting their quarterly results, we anticipate a pending uptick in gross long-end issuance. Considering the expectations for long-dated supply, investors may be making room for the new paper, resulting in a minor, re-steepening of the spread curve. When combined with the range bound conditions in the long Treasury bond following the less-than-dovish FOMC meeting and the stronger-than-expected January payroll report, long yields may continue to trade within the recent established range referenced in Figure 2.

For investors with a total return perspective, yields that remain rangebound may mean that most of their returns come from income, rather than capital appreciation from declining yields. Given those prospects, there may be multiple reasons why investors seek additional exposure to long corporates, starting with valuations relative to equities. After all, fixed income spent much of the past two years repricing, while equities did not and continued to set new highs in 2024. As a result, the yield on the long U.S. IG sector recently climbed above the earnings yield on the S&P 500 for the first time in more than a decade (Figure 5).

Figure 5

Fixed income’s prior repricing in contrast to equities leaves IG yields notably above the S&P 500’s earnings yield (%)

Source: PGIM Fixed Income, Bloomberg, Morgan Stanley

We’ll reiterate the other potential reasons that also appeared in our first-quarter outlook. In terms of a long-term income hedge, if another unexpected shock forces central banks to cut rates dramatically, investors who hunkered down in money market funds and similar vehicles will face reinvestment risk after failing to lock in elevated yields for a prolonged period of time. Furthermore, in a risk off event—such as the Silicon Valley Bank and Credit Suisse crisis in the Spring of 2023—high-quality, long-duration corporates may provide some ballast to a portfolio’s total return potential.

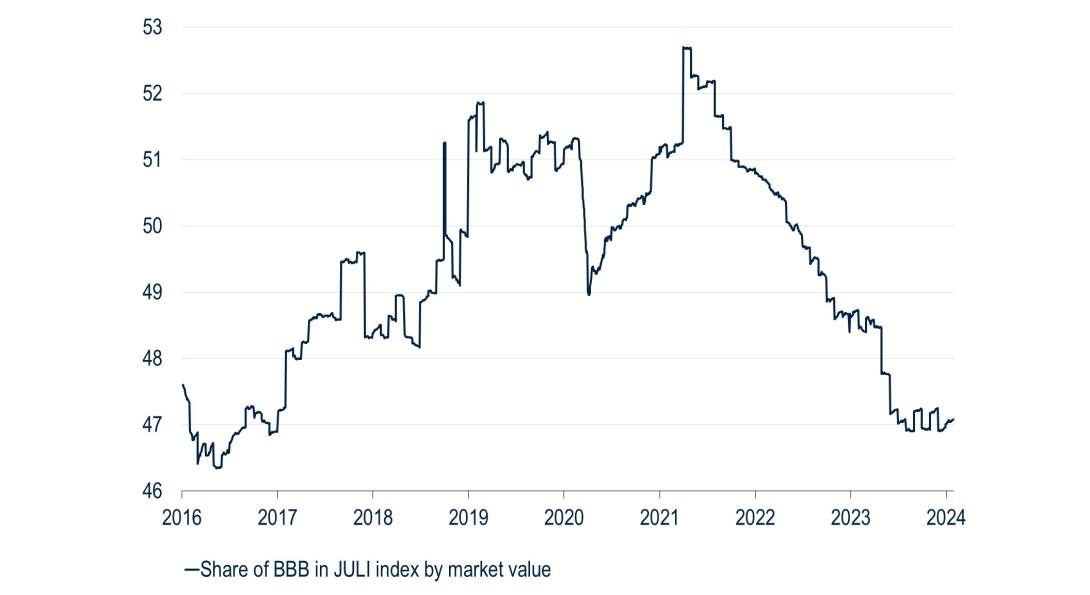

A final point pertains to yield-based buyers and total return investors as each could be affected by negative credit migration in long-duration corporates. For example, Moody's found that more than a third of A-rated credits were downgraded over the course of 10 years.4 More than 50% of the U.S. IG index was rated BBB as of March 2021, but management teams have maintained a cautious posture amid the Fed's historically rapid hiking cycle (not to mention other risks), and the share of BBBs in the index fell to 47% as of early 2024, which was the lowest level since late 2016 (Figure 6).5 Furthermore, the credit migration in an individual portfolio may be mitigated by accurate, bottom up industry and issuer selection from a deep team of credit analysts throughout the course of a market cycle.

Figure 6

The quality composition of the U.S. IG Index has improved in recent years with the multi-year low in BBB representation (%)

Source: J.P. Morgan

Conclusion

We highlighted the long U.S. corporate space as it’s a logical consideration given the Fed’s presumptive rate cuts. In addition to our expectations for the Fed, consistent demand, limited supply, and valuation considerations relative to equities have also helped to define the sector’s range. With this context, rather than timing potential exposure to a particular point in the range, we suggest investors continue familiarizing themselves with these factors and how long corporates might align with their respective investment objectives.

Read More From PGIM Fixed Income

1 The referenced outperformance is on a total return basis.

2 Plan sponsors are increasingly using pension risk transfers (PRT) as an approach to exiting the pension business. PRT volume reached more than $71.3 billion in 2023, an increase of nearly 10% from 2019’s volume of $65.4 billion, according to Pensions & Investments.

3 The Milliman projections are based on a 5.8% median asset return and a discount rate of 5.0%.

4 US Corp rating migration. 10-Years Long Average Rating Migration Rates: January 1, 1993-Dec 31, 2020. Moody's Default and Rating Analytics, Historical Rating Transitions, withdrawals excluded.

5 According to J.P. Morgan and based on the JULI Index by market value.

The comments, opinions, and estimates contained herein are based on and/or derived from publicly available information from sources that PGIM Fixed Income believes to be reliable. We do not guarantee the accuracy of such sources or information. This outlook, which is for informational purposes only, sets forth our views as of this date. The underlying assumptions and our views are subject to change. Past performance is not a guarantee or a reliable indicator of future results.

Source(s) of data (unless otherwise noted): PGIM Fixed Income, as of February 9, 2024.

For Professional Investors only. Past performance is not a guarantee or a reliable indicator of future results and an investment could lose value. All investments involve risk, including the possible loss of capital.

PGIM Fixed Income operates primarily through PGIM, Inc., a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended, and a Prudential Financial, Inc. (“PFI”) company. Registration as a registered investment adviser does not imply a certain level or skill or training. PGIM Fixed Income is headquartered in Newark, New Jersey and also includes the following businesses globally: (i) the public fixed income unit within PGIM Limited, located in London; (ii) PGIM Netherlands B.V., located in Amsterdam; (iii) PGIM Japan Co., Ltd. (“PGIM Japan”), located in Tokyo; (iv) the public fixed income unit within PGIM (Hong Kong) Ltd. located in Hong Kong; and (v) the public fixed income unit within PGIM (Singapore) Pte. Ltd., located in Singapore (“PGIM Singapore”). PFI of the United States is not affiliated in any manner with Prudential plc, incorporated in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom. Prudential, PGIM, their respective logos, and the Rock symbol are service marks of PFI and its related entities, registered in many jurisdictions worldwide.

These materials are for informational or educational purposes only. The information is not intended as investment advice and is not a recommendation about managing or investing assets. In providing these materials, PGIM is not acting as your fiduciary. PGIM Fixed Income as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Investors seeking information regarding their particular investment needs should contact their own financial professional.

These materials represent the views and opinions of the author(s) regarding the economic conditions, asset classes, securities, issuers or financial instruments referenced herein. Distribution of this information to any person other than the person to whom it was originally delivered and to such person’s advisers is unauthorized, and any reproduction of these materials, in whole or in part, or the divulgence of any of the contents hereof, without prior consent of PGIM Fixed Income is prohibited. Certain information contained herein has been obtained from sources that PGIM Fixed Income believes to be reliable as of the date presented; however, PGIM Fixed Income cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. PGIM Fixed Income has no obligation to update any or all of such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy.

Any forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fee. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any security or other financial instrument or any investment management services and should not be used as the basis for any investment decision. PGIM Fixed Income and its affiliates may make investment decisions that are inconsistent with the recommendations or views expressed herein, including for proprietary accounts of PGIM Fixed Income or its affiliates.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and while generally supported by a government, government agency or private guarantor, there is no assurance that the guarantor will meet its obligations. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be suitable for all investors. Diversification does not ensure against loss.

In the United Kingdom, information is issued by PGIM Limited with registered office: Grand Buildings, 1-3 Strand, Trafalgar Square, London, WC2N 5HR.PGIM Limited is authorised and regulated by the Financial Conduct Authority (“FCA”) of the United Kingdom (Firm Reference Number 193418). In the European Economic Area (“EEA”), information is issued by PGIM Netherlands B.V., an entity authorised by the Autoriteit Financiële Markten (“AFM”) in the Netherlands and operating on the basis of a European passport. In certain EEA countries, information is, where permitted, presented by PGIM Limited in reliance of provisions, exemptions or licenses available to PGIM Limited including those available under temporary permission arrangements following the exit of the United Kingdom from the European Union. These materials are issued by PGIM Limited and/or PGIM Netherlands B.V. to persons who are professional clients as defined under the rules of the FCA and/or to persons who are professional clients as defined in the relevant local implementation of Directive 2014/65/EU (MiFID II). In Switzerland, information is issued by PGIM Limited, London, through its Representative Office in Zurich with registered office: Kappelergasse 14, CH-8001 Zurich, Switzerland. PGIM Limited, London, Representative Office in Zurich is authorised and regulated by the Swiss Financial Market Supervisory Authority FINMA and these materials are issued to persons who are professional or institutional clients within the meaning of Art.4 para 3 and 4 FinSA in Switzerland. In certain countries in Asia-Pacific, information is presented by PGIM (Singapore) Pte. Ltd., a regulated entity with the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management and an exempt financial adviser. In Japan, information is presented by PGIM Japan Co. Ltd., registered investment adviser with the Japanese Financial Services Agency. In South Korea, information is presented by PGIM, Inc., which is licensed to provide discretionary investment management services directly to South Korean investors. In Hong Kong, information is provided by PGIM (Hong Kong) Limited, a regulated entity with the Securities & Futures Commission in Hong Kong to professional investors as defined in Section 1 of Part 1 of Schedule 1 of the Securities and Futures Ordinance (Cap.571). In Australia, this information is presented by PGIM (Australia) Pty Ltd (“PGIM Australia”) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). PGIM Australia is a representative of PGIM Limited, which is exempt from the requirement to hold an Australian Financial Services License under the Australian Corporations Act 2001 in respect of financial services. PGIM Limited is exempt by virtue of its regulation by the FCA (Reg: 193418) under the laws of the United Kingdom and the application of ASIC Class Order 03/1099. The laws of the United Kingdom differ from Australian laws. In Canada, pursuant to the international adviser registration exemption in National Instrument 31-103, PGIM, Inc. is informing you that: (1) PGIM, Inc. is not registered in Canada and is advising you in reliance upon an exemption from the adviser registration requirement under National Instrument 31-103; (2) PGIM, Inc.’s jurisdiction of residence is New Jersey, U.S.A.; (3) there may be difficulty enforcing legal rights against PGIM, Inc. because it is resident outside of Canada and all or substantially all of its assets may be situated outside of Canada; and (4) the name and address of the agent for service of process of PGIM, Inc. in the applicable Provinces of Canada are as follows: in Québec: Borden Ladner Gervais LLP, 1000 de La Gauchetière Street West, Suite 900 Montréal, QC H3B 5H4; in British Columbia: Borden Ladner Gervais LLP, 1200 Waterfront Centre, 200 Burrard Street, Vancouver, BC V7X 1T2; in Ontario: Borden Ladner Gervais LLP, 22 Adelaide Street West, Suite 3400, Toronto, ON M5H 4E3; in Nova Scotia: Cox & Palmer, Q.C., 1100 Purdy’s Wharf Tower One, 1959 Upper Water Street, P.O. Box 2380 -Stn Central RPO, Halifax, NS B3J 3E5; in Alberta: Borden Ladner Gervais LLP, 530 Third Avenue S.W., Calgary, AB T2P R3.

© 2024 PFI and its related entities.

2024-1322

Sign Up Now for Full Access to Articles and Podcasts!

Unlock full access to our vast content library by registering as an institutional investor .

Create an accountAlready have an account ? Sign in