Africa's Investment Outlook Depends on Macroeconomic Adjustments

The twin shocks of COVID and the invasion of Ukraine severely impacted Africa in recent years. Public finances became stretched, inflation soared, and monetary policy tightening strained access to the capital markets. While support from the international community softened the impact of these negative shocks, the adoption of prudent fiscal policies will be crucial for many Sub-Saharan African (SSA) countries to accelerate growth and achieve debt sustainability. However, certain countries find themselves in difficult structural positions that are not easy to correct quickly. Going forward, we expect to see increased dispersion due more to structural factors and policy-making initiatives. Yet, recent performance in the SSA region has been largely driven by technicals. For investors, this presents an opportunity to capitalize on the divergence of fundamentals within the region that are not currently being reflected by credit spreads.

While economies around the world were buffeted by the global shocks of recent years, credit fundamentals of African countries were especially hard-hit.1 First, public finances were stretched due to lower tax revenues and higher expenditures during the heights of the COVID pandemic. Then the invasion of Ukraine caused food prices to spike, significantly weighing on households’ purchasing power.

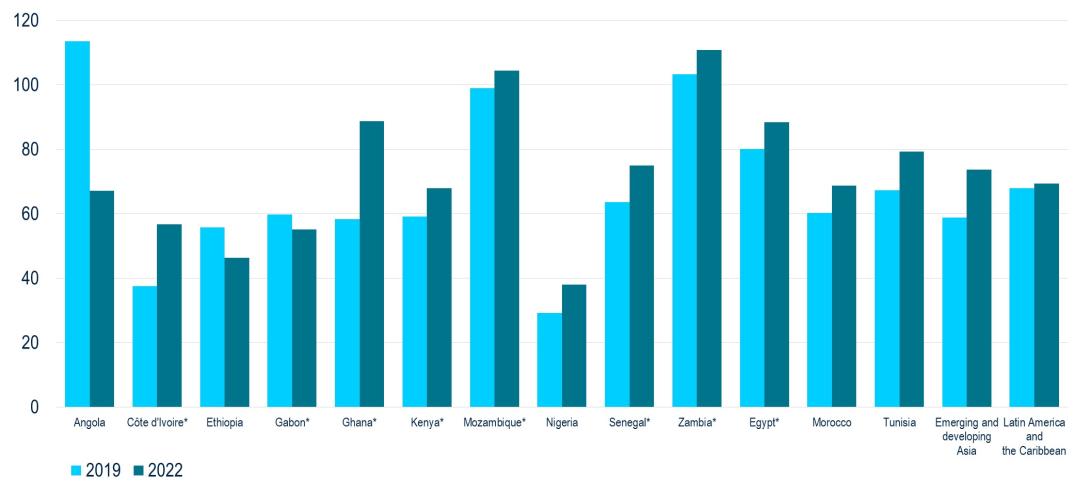

When evaluating high yield and frontier credits, analyzing an issuer’s growth trajectory is critical to determining its ability to service its debt going forward. As the twin deficits of many African countries widened on the back of these two shocks, another external tremor struck Africa: the monetary policy tightening in most developed markets made it impossible for many frontier markets to access the international capital markets. Consequently, many African currencies depreciated (further fueling inflation), the cost of debt service increased, and a few countries (e.g., Ghana and Zambia) defaulted on their debt. Only the oil exporting countries saw their debt situation improve (Figure 1).

Figure 1: Debt-to-GDP Rises Following Twin Global Shocks (%)

Source: IMF as of April 2023. (*) = countries that have adopted an IMF program.

A More Restrictive Stance

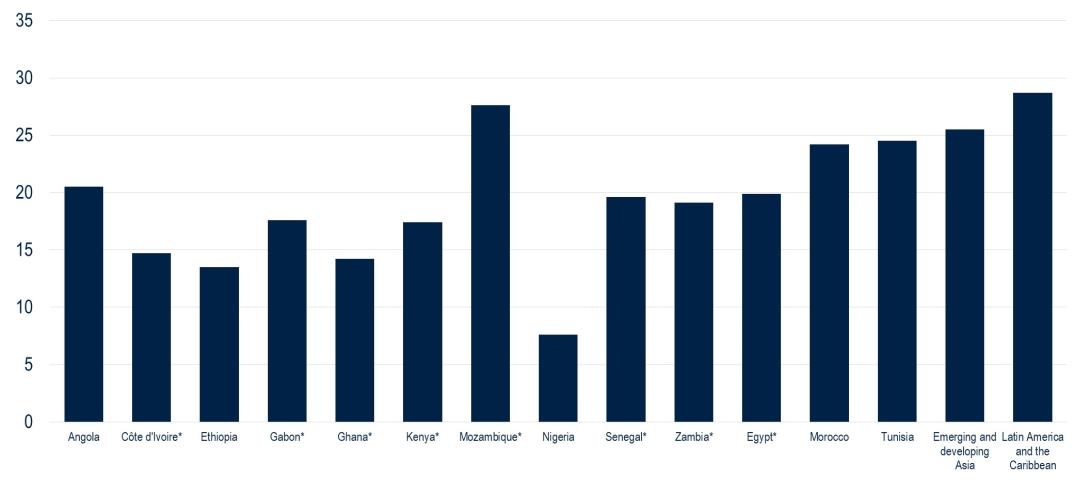

As a result, many SSA counties embarked on fiscal adjustment programs, often in the framework of a program from the International Monetary Fund. However, the adjustment path is challenging as most countries’ primary balances have deteriorated significantly over the past several years (Figure 2).

Figure 2: Primary Balances Have Largely Deteriorated (% of GDP)

Source: IMF, as of April 2023. (*) = countries that have adopted an IMF program.

In theory, adopting a more restrictive fiscal stance is not difficult: expenditures can be cut and taxes can be raised. This is especially true in SSA countries since their tax intake, as a percentage of GDP, is lower than in other emerging markets (Figure 3).

Figure 3: Average Tax Revenue as a Percentage of GDP—2017-2019 (%)

Source: IMF, as of April 2023. (*) = countries that have adopted an IMF program.

The main difficulty is political: the government may worry about fueling political unrest or hurting public sentiment ahead of an election cycle. Moreover, the ability to raise taxes without choking growth in the short run may be limited. Public sentiment and government popularity can likewise be negatively impacted by necessary currency and monetary policies, further delaying these adjustments.

Despite the difficulties of raising tax revenues, most countries in the region have entered IMF adjustment programs. These primarily include fiscal adjustments, mostly via the cut or the elimination of subsidies. While this is a welcome decision (in some countries, subsidies amounted to 4% of GDP), additional measures are needed.

An increased stock of debt and higher debt service costs is another challenge. An absence of foreign investors and the limited capacity by local investors to absorb domestic bonds makes it more difficult for these countries to meet their financing needs. The strong commitment of multilateral agencies has helped, but much work still needs to be done to permanently adjust government finances as budget and current account deficits can’t be forever financed by multilateral disbursements.

The External Adjustment

While adjusting the fiscal stance is mostly a matter of domestic policies, narrowing a current account deficit is more complicated. It requires earning foreign exchange via exports of goods and services while reducing foreign exchange spending for imports of goods and services. The former broadly depends on the country’s comparative advantages and global demand while the latter depends on domestic activity and the over/undervaluation of the exchange rate.

In terms of deficit financing, a moderate current account deficit may not be a problem if the country finances it via non-debt creating inflows, such as foreign direct investment (FDI).

Figure 4 shows the basic balance2 for SSA countries and for a couple of EMs in other regions. Unfortunately, the situation has not improved, and has actually deteriorated in certain cases.

Figure 4: The Basic Balance of SSAs Has Not Improved ($Bn.)

Source: Haver and IMF, as of April 2023. (*) = countries that have adopted an IMF program.

Source: Haver and IMF, as of April 2023. (*) = countries that have adopted an IMF program.

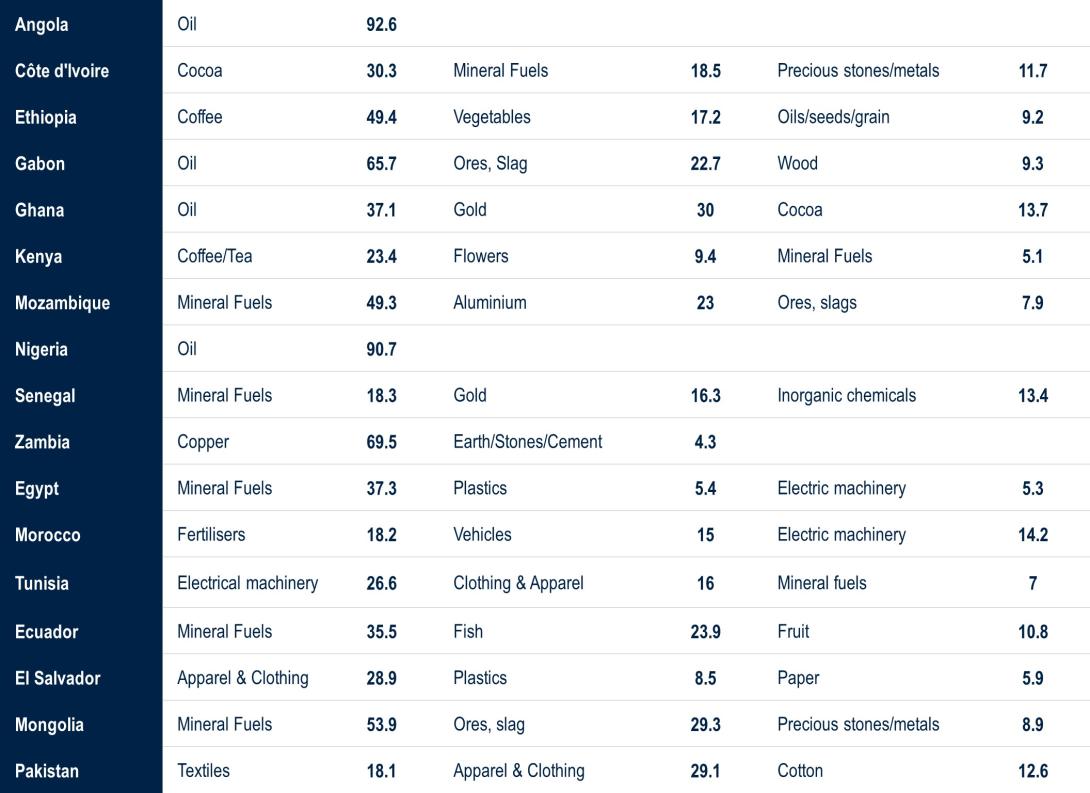

In some countries (e.g., Kenya and Egypt) remittances and the recovery of tourism prevented the current account deficit from deteriorating even more. But the outlook for many other countries remains challenging. In absence of a recession, exchange rate depreciation alone will not reduce imports. Most countries, in fact, import much needed investment goods, a crucial input for developing their economies, alongside oil and food. Exports, on the other hand, are often concentrated in commodities, and therefore exposed to cyclical volatility and less so to exchange rate movements (Figure 5). Moreover, some countries export soft commodities that, for the most part, have not experienced a rally in recent months and whose price outlook remains uncertain.

Figure 5: Composition of SSA Exports (%, 2022)

Source: ITC Trade Map, as of August 13, 2023. (*) = countries that have adopted an IMF program.

The China Challenge

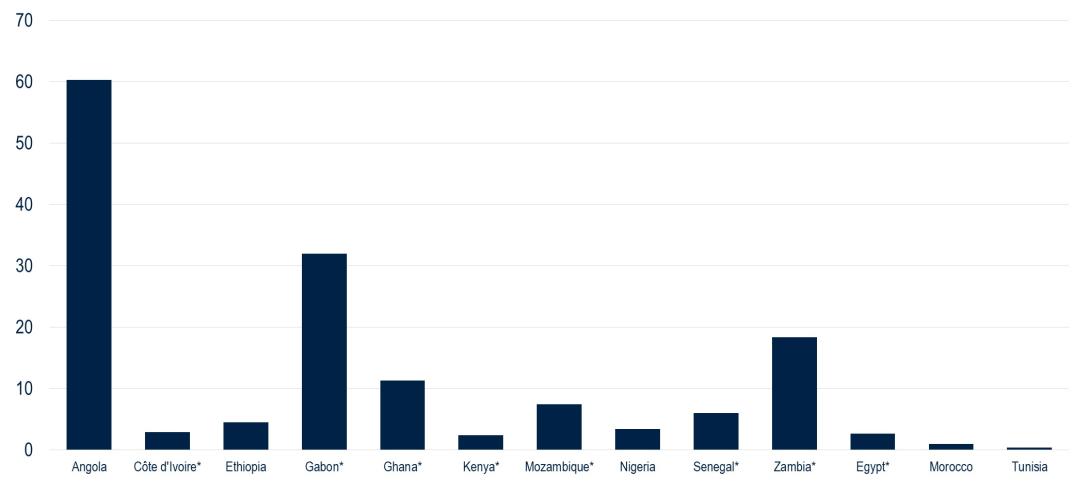

Since China has emerged as a major partner for Africa, it is worth highlighting whether these countries are exposed to the risk of a severe slowdown in China and China’s stance on debt restructuring. China is a major partner for Angola, Gabon, and Zambia, i.e., for some of the major exporters of hard commodities in the region (Figure 6).

Figure 6: China, a Major Partner of Hard Commodity Exporters (% of total exports)

ITC Trade Map, as of July 13, 2023. (*) = countries that have adopted an IMF program.

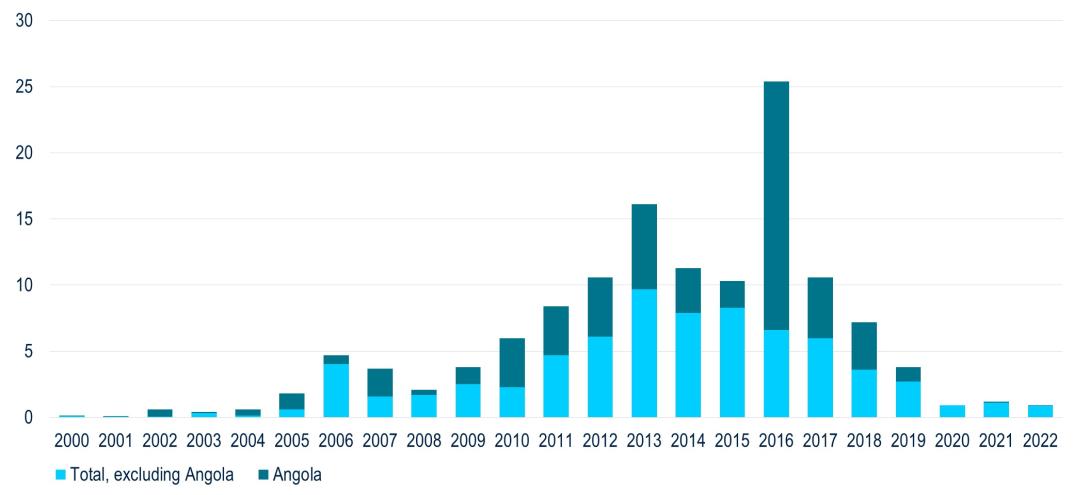

China has also been a major lender to the region, but the flows have slowed down in recent years. This moderation is due to both a more prudent approach on the part of China and to concerns amongst borrowing countries that the debt burden was becoming too high, with a handful of African countries (e.g. Zambia and Ethiopia) either receiving or seeking debt relief (Figures 7 and 8).

Figure 7: Chinese Loans to SSA Countries ($Bn.)

Source: Boston University Global Development Policy Center. 2022. Chinese Loans to Africa Database, as of April 25, 2022.

Figure 8: Public and Publicly Guaranteed Debt to China ($Bn.)

Source: World Bank, International Debt Statistics, as of December 31, 2021. (1) The audit conducted under the Common Framework has uncovered other Chinese debts. The total Chinese debt for Zambia is $6.1 billion.

Source: World Bank, International Debt Statistics, as of December 31, 2021. (1) The audit conducted under the Common Framework has uncovered other Chinese debts. The total Chinese debt for Zambia is $6.1 billion.

In this respect, debt restructuring negotiations under the Common Framework have been progressing very slowly because of Chinese objections to the proposed solutions to achieve debt restructuring. More recently, an agreement on Zambia’s debt restructuring has been achieved “in principle” but a Memorandum of Understanding is still to be signed. All these factors lead us to believe that China’s lending to the region will be smaller than in the past and possibly more focused in certain countries or economic projects.

The expected smaller flows from China will likely be replaced by more assistance from the G7 and continuous multilateral assistance. At the recent G20 meeting in India, the African Union was admitted to the group and, therefore, African countries will be able to promote the development case for the region. The recent endorsement of the Lobito-DRD-Zambia railway by the European Union and the United States is an example of the increased engagement in Africa on the part of the G7.

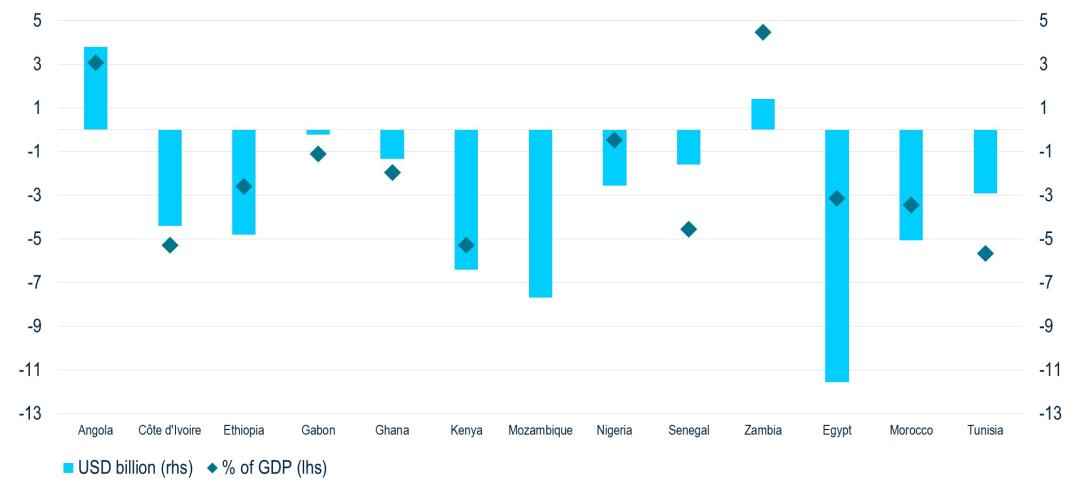

Current Account Deficits

Current account deficits are expected to persist through 2024 for all countries in the region except for Angola (an oil exporter) and Zambia (which will benefit from the recent debt restructuring with China and possibly from the improvement in copper production and exports). In some cases, current account deficits are smaller than the conventional “crisis threshold” of 5% of GDP (Figure 9). But the nominal financing needs (e.g., Egypt and Senegal) are significant.

Figure 9: Current Account Balance Forecast3 (2024 Projections) (LHS % of GDP, RHS $Bn.)

Source: IMF, as of April 2023.

Assuming limited, if any, access to international capital markets, multilateral involvement, together with strategies to incentivize FDI, will be needed. Egypt is promoting FDI inflows to finance its wide current account deficit, but the strategy hinges on the success of its privatisation process. On the other hand, Senegal is forecast to have a significant deficit as a percentage of GDP but with limited USD-denominated financing needs which, along with the recently pledged money from Europe and Canada to aid in its energy transition, should relieve any financing pressure.

Investment Outlook

Entering 2023, we had forecast increasing differentiation among emerging high yield credits. Performance within SSA credits this year has largely been driven by positioning and technicals. The more recent increase in concessional financing is a welcome, if somewhat unexpected, positive. We believe the more constructive relationship between the Bretton Woods Institutions and countries that have borrowed from China is a structural positive. For many countries, IMF program conditionality will result in improved governance, investment flows, and stronger, more sustainable growth. For others, structural impediments will remain too much to overcome. The lack of dispersion in performance has arisen from complacency that existing buffers will be sufficient and a hope that there will be smaller financing needs in the future.

For investors, this presents an opportunity to capitalize on the divergence of fundamentals that are not accurately reflected in credit spreads. The greatest dispersion in returns is likely to come from single-B credits because we’re at a crucial point in time where countries have a window of opportunity to get back on the right path. Our goal is to identify where there is the ability and the political willingness to adjust.

The concessional financing, reserve buffers, and domestic bond issuance that have been used to support growth, have allowed countries to avoid painful adjustments. For many countries there is simply a disconnect between what they need to be doing to adjust policies and what is feasible given pressure from their constituencies. While we acknowledge that recent policy decisions have been a positive in Nigeria and Kenya, we are taking a cautious approach since needed reforms go beyond what has already been done and they may cause political tensions and a reversal of policies. Can Kenya consolidate its deficit and narrow a persistent current account deficit; are they at the mercy of weaker economic growth in Europe and rising energy prices? Can Nigeria fix the large negative real interest rates given liquidity pressures on the Naira and figure out a way to improve revenue collection in an economy that has a large informal sector? These issues aren’t fixed easily especially now that buffers have been reduced, debt levels are higher, and debt service eats up more of a countries budget. Will these countries head down the path of Ghana and Zambia?

While we think the road ahead could be bumpy for some countries, there are others with stronger track records and better starting points. We continue to favor countries with trade surpluses, such as Angola and Cote d’Ivoire. While Angola has growth challenges and is in need of investment, it has sowed the seeds for economic improvement as its non-oil economy becomes more of the growth engine. Investors take comfort in the country’s track record of fiscal prudency and willingness to enact tough policy choices. Cote d’Ivoire has a dynamic, well diversified economy that will benefit from the fiscal reform efforts under the current IMF program. Senegal has a more challenging starting point, but the onset of oil production could be a game changer as it will greatly increase growth and reduce its energy import needs. If it adheres to the IMF program and to fiscal prudency, it could see a dramatic improvement in fundamentals. We see an opportunity in these countries because we believe they have a better ability to generate sustained growth to consolidate their budgets and reduce their levels of debt.

While we often talk about our credit barbell between emerging market investment grade and high yield credits, we also see a credit barbell opportunity within the high yield universe. We have preferred higher-quality high yield assets, but we now also see value in select distressed credits, including some that are in default due to attractive valuations and better market technicals. The risks that we have identified in a country such as Kenya have already materialized in Ghana. We are looking for more clarity around its restructuring, but Ghana presents an opportunity for investors in upcoming years. With a diversified economy and political stability, Ghana should be a destination for FDI. China’s participation in the common framework has been a big impediment to a timely restructuring in Zambia, but China should be less of a hindrance in other countries where it plays less of a pivotal role. In the case of Zambia, we seem to be close to a resolution that will allow the country to take advantage of its copper and cobalt resources. We’re mindful that these low-rated countries are susceptible to event risk and unforeseen events, so we prefer shorter duration bonds where repayment risks are more quantifiable and select distressed opportunities where risk rewards are asymmetrically positive.

1 In this note we focus on Africa ex-South Africa, with a closer focus on Sub-Saharan Africa.

2 Defined as the sum of the current account balance and net FDI inflows.

3 Mozambique’s current account deficit as a percentage of GDP is forecast at 34.6% but the country receives large amounts of FDI.

Read More From PGIM Fixed Income

The comments, opinions, and estimates contained herein are based on and/or derived from publicly available information from sources that PGIM Fixed Income believes to be reliable. We do not guarantee the accuracy of such sources or information. This outlook, which is for informational purposes only, sets forth our views as of this date. The underlying assumptions and our views are subject to change. Past performance is not a guarantee or a reliable indicator of future results.

Source(s) of data (unless otherwise noted): PGIM Fixed Income, as September 11, 2023.

For Professional Investors only. Past performance is not a guarantee or a reliable indicator of future results and an investment could lose value. All investments involve risk, including the possible loss of capital.

PGIM Fixed Income operates primarily through PGIM, Inc., a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended, and a Prudential Financial, Inc. (“PFI”) company. Registration as a registered investment adviser does not imply a certain level or skill or training. PGIM Fixed Income is headquartered in Newark, New Jersey and also includes the following businesses globally: (i) the public fixed income unit within PGIM Limited, located in London; (ii) PGIM Netherlands B.V., located in Amsterdam; (iii) PGIM Japan Co., Ltd. (“PGIM Japan”), located in Tokyo; (iv) the public fixed income unit within PGIM (Hong Kong) Ltd. located in Hong Kong; and (v) the public fixed income unit within PGIM (Singapore) Pte. Ltd., located in Singapore (“PGIM Singapore”). PFI of the United States is not affiliated in any manner with Prudential plc, incorporated in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom. Prudential, PGIM, their respective logos, and the Rock symbol are service marks of PFI and its related entities, registered in many jurisdictions worldwide.

These materials are for informational or educational purposes only. The information is not intended as investment advice and is not a recommendation about managing or investing assets. In providing these materials, PGIM is not acting as your fiduciary. PGIM Fixed Income as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Investors seeking information regarding their particular investment needs should contact their own financial professional.

These materials represent the views and opinions of the author(s) regarding the economic conditions, asset classes, securities, issuers or financial instruments referenced herein. Distribution of this information to any person other than the person to whom it was originally delivered and to such person’s advisers is unauthorized, and any reproduction of these materials, in whole or in part, or the divulgence of any of the contents hereof, without prior consent of PGIM Fixed Income is prohibited. Certain information contained herein has been obtained from sources that PGIM Fixed Income believes to be reliable as of the date presented; however, PGIM Fixed Income cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. PGIM Fixed Income has no obligation to update any or all of such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy.

Any forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fee. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any security or other financial instrument or any investment management services and should not be used as the basis for any investment decision. PGIM Fixed Income and its affiliates may make investment decisions that are inconsistent with the recommendations or views expressed herein, including for proprietary accounts of PGIM Fixed Income or its affiliates.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and while generally supported by a government, government agency or private guarantor, there is no assurance that the guarantor will meet its obligations. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be suitable for all investors. Diversification does not ensure against loss.

In the United Kingdom, information is issued by PGIM Limited with registered office: Grand Buildings, 1-3 Strand, Trafalgar Square, London, WC2N 5HR. PGIM Limited is authorised and regulated by the Financial Conduct Authority (“FCA”) of the United Kingdom (Firm Reference Number 193418). In the European Economic Area (“EEA”), information is issued by PGIM Netherlands B.V., an entity authorised by the Autoriteit Financiële Markten (“AFM”) in the Netherlands and operating on the basis of a European passport. In certain EEA countries, information is, where permitted, presented by PGIM Limited in reliance of provisions, exemptions or licenses available to PGIM Limited under temporary permission arrangements following the exit of the United Kingdom from the European Union. These materials are issued by PGIM Limited and/or PGIM Netherlands B.V. to persons who are professional clients as defined under the rules of the FCA and/or to persons who are professional clients as defined in the relevant local implementation of Directive 2014/65/EU (MiFID II). In certain countries in Asia-Pacific, information is presented by PGIM (Singapore) Pte. Ltd., a Singapore investment manager registered with and licensed by the Monetary Authority of Singapore. In Japan, information is presented by PGIM Japan Co. Ltd., registered investment adviser with the Japanese Financial Services Agency. In South Korea, information is presented by PGIM, Inc., which is licensed to provide discretionary investment management services directly to South Korean investors. In Hong Kong, information is provided by PGIM (Hong Kong) Limited, a regulated entity with the Securities & Futures Commission in Hong Kong to professional investors as defined in Section 1 of Part 1 of Schedule 1 (paragraph (a) to (i) of the Securities and Futures Ordinance (Cap.571). In Australia, this information is presented by PGIM (Australia) Pty Ltd (“PGIM Australia”) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). PGIM Australia is a representative of PGIM Limited, which is exempt from the requirement to hold an Australian Financial Services License under the Australian Corporations Act 2001 in respect of financial services. PGIM Limited is exempt by virtue of its regulation by the FCA (Reg: 193418) under the laws of the United Kingdom and the application of ASIC Class Order 03/1099. The laws of the United Kingdom differ from Australian laws. In Canada, pursuant to the international adviser registration exemption in National Instrument 31-103, PGIM, Inc. is informing you that: (1) PGIM, Inc. is not registered in Canada and is advising you in reliance upon an exemption from the adviser registration requirement under National Instrument 31-103; (2) PGIM, Inc.’s jurisdiction of residence is New Jersey, U.S.A.; (3) there may be difficulty enforcing legal rights against PGIM, Inc. because it is resident outside of Canada and all or substantially all of its assets may be situated outside of Canada; and (4) the name and address of the agent for service of process of PGIM, Inc. in the applicable Provinces of Canada are as follows: in Québec: Borden Ladner Gervais LLP, 1000 de La Gauchetière Street West, Suite 900 Montréal, QC H3B 5H4; in British Columbia: Borden Ladner Gervais LLP, 1200 Waterfront Centre, 200 Burrard Street, Vancouver, BC V7X 1T2; in Ontario: Borden Ladner Gervais LLP, 22 Adelaide Street West, Suite 3400, Toronto, ON M5H 4E3; in Nova Scotia: Cox & Palmer, Q.C., 1100 Purdy’s Wharf Tower One, 1959 Upper Water Street, P.O. Box 2380 - Stn Central RPO, Halifax, NS B3J 3E5; in Alberta: Borden Ladner Gervais LLP, 530 Third Avenue S.W., Calgary, AB T2P R3.

© 2023 PFI and its related entities.

2023-6632

Sign Up Now for Full Access to Articles and Podcasts!

Unlock full access to our vast content library by registering as an institutional investor .

Create an accountAlready have an account ? Sign in