Central bank watcher: Peaking and tweaking

The rise in long-term yields and the broader tightening of financial conditions has been noticed by central bankers. At both the recent ECB and Fed meeting this was mentioned as one of the factors behind their decision to keep rates on hold, in addition to signs of moderating inflation pressures.

- The Fed leans back from further tightening

- Now is not the time for the PBoC to take it easy

- The ECB takes into account external tightening

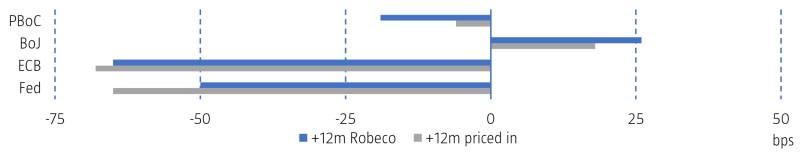

To preserve tighter conditions, central bankers will likely avoid sounding too dovish. Still, central bank rates in the US and Eurozone have likely reached their peak. It would take a re-acceleration of inflation pressures in combination with easier conditions for the Fed to restart hiking. The bar for the ECB seems even higher, given the very weak growth backdrop. In Japan, monetary policy is gradually shifting towards tighter conditions. The recent further tweak of the yield curve control policy prompted an underperformance of the 5-10-year segment of the curve. We foresee that this direction and pace of travel in policy and curve will continue. The policy outlook remains different for the PBoC, where we anticipate stable to lower policy rates over the medium term.

Outlook for central banks policy rates

Source: Bloomberg, Robeco, change 12m ahead, based on money market futures and forwards; 6 November 2023.

Sign Up Now for Full Access to Articles and Podcasts!

Unlock full access to our vast content library by registering as an institutional investor .

Create an accountAlready have an account ? Sign in