European High Yield—Planning for Yields to Peak Soon

- In the first of a series of posts on European high yield, we look at the sector’s compelling characteristics, including elevated yields, enhanced credit quality, short duration, and moderate default expectations.

- We then view these attributes in the context of external parameters, including how our expectations for monetary policy and inflation influence timing considerations.

- Indeed, as a peak in European inflation approaches, investors may be over-estimating how high the European Central Bank (ECB) will hike interest rates.

- The difficulty of timing market conditions underscores that allocation decisions need to be considered before interest rates and credit spreads peak.

The year yields more than doubled

Concerns about the global economy, rising inflation, and tighter central bank policies have raised bond yields around the world. When looking at European high yield specifically, the sector yielded an average of 8.61% at the end of September (Figure 1)—which was higher than the 8.10% yield at the depths of the COVID crisis and only trails the levels from the Global Financial Crisis of 2008-09 (26.91%) and the European sovereign debt crisis of 2011-12 (10.90%).

Figure 1: European high-yield bond yields have more than doubled this year

Source: PGIM Fixed Income and Bloomberg, as of 30 September 2022.

Compelling characteristics

Yields—Yields in European high yield have more than doubled in 2022 in an environment of increasing long-term government bond yields as well as widening credit spreads, which have also nearly doubled from 318 to 632 bps through the end of September. The effective yield that investors receive is even higher when issuers repay their bonds early, for which they pay a premium, and capital gains are amortized over a shorter time period. Such refinancings typically take place a year before maturity.

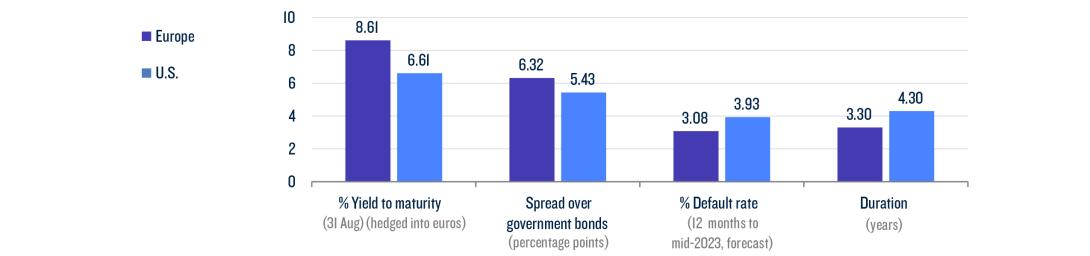

By comparison, U.S. high-yield bonds had a euro-hedged yield to maturity of 6.61%, but a spread over U.S. Treasury bills of only 543 bps (Figure 2). Furthermore, many investors seeking euro-denominated income from U.S. bonds need to pay hedging costs, which lowers nominal returns and makes European high yield more attractive by comparison.

Figure 2: European high-yield bonds compare favourably to U.S. high-yield bonds

Source: PGIM Fixed Income and Bloomberg, as of 30 September 2022.

Credit Quality—Although European high yield spreads are nearly 90 bps wider than their U.S. counterparts, the average credit rating of European high-yield bonds is BB-, one notch higher than their U.S. peers. Furthermore, BB-rated bonds, for example, make up 69% of the European index and only 53% of the U.S. high-yield index. So, European high yield presents the combination of higher credit spreads and stronger credit quality.

Duration—As an indication of sensitivity to changes in interest rates, European high-yield bonds have a relatively short duration of only 3.4 years whereas U.S. high-yield bonds have a duration of 4.3 years, making them more volatile during periods of rising interest rates.

Defaults—Considering the relatively high credit quality, recent European high yield defaults have remained historically low, and we only expect a moderate increase in 2023. In the 12 months to 31 July 2022, credit rating agency Moody’s assigned a default rating to just 1.95% of European high-yield bonds. If we exclude Russia and Ukraine from Moody’s list, that proportion falls to less than 0.5%, which is far less than the sector’s 2.94% 10-year trailing average.

Moody’s European and U.S. baseline forecasts sees defaults of 3.08% and 3.93%, respectively, for the 12 months to mid-2023. Our analysis projects European defaults of 2.5% of par value in 2023, which we expect to outperform due to our credit selection and active management. Our second post in the series explores our default rate analysis under a range of economic scenarios.

While investors tend to focus on the sector’s pertinent characteristics, such as elevated yields, enhanced credit quality, short durations, and moderate default expectations, external parameters—including interest rates, inflation, and timing—are critical as well.

Policy interest rates approach peak hawkishness as inflation levels also peak

Central banks in most developed markets have raised interest rates this year, and markets expect that they will still go substantially higher.

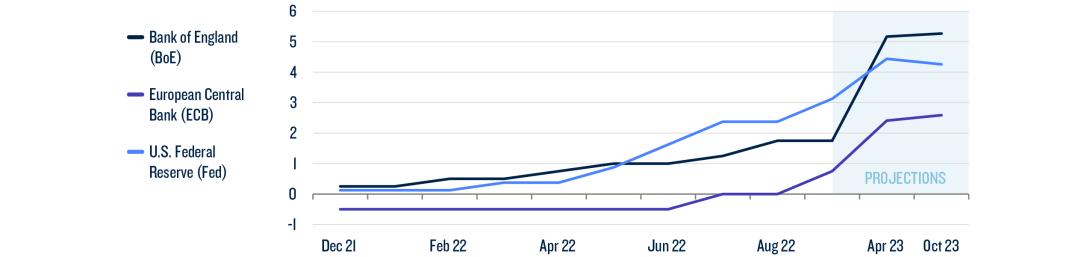

- Since July, the ECB raised its main policy rate by 125 bps to 0.75% over the course of two hikes. Bond market prices currently predict that the ECB’s main interest rate will rise to 3.5% by July 2023. But we expect that the Eurozone economy will enter a recession later this year, and real GDP will contract by 1.4% in 2023. Therefore, we anticipate the ECB policy rate will rise to at least 1.5% by year-end before peaking somewhat above 2.0% in 2023, which is our high-end estimate of the neutral rate.

- The Bank of England started hiking interest rates in December 2021. Since then, it has raised its base rate seven times to 2.25%, and more interest rates are expected.

- The U.S. Federal Reserve has raised its target for the federal funds rate five times this year to a midpoint of 3.125%. Bond prices predict that it will rise to 4.5% by March 2023 (Figure 3).

Figure 3: Market-implied central bank interest rate forecasts appear overly hawkish

Source: PGIM Fixed Income and Bloomberg, as of 30 September 2022.

Our estimates indicate that market-implied expectations of central bank policy rates may be reaching “peak hawkishness,” and investors may be overestimating how much central banks will hike going forward. Investor expectations for monetary policy tightening has boosted bond yields to multi-year highs, and we expect that the ECB will fall short of such hawkish expectations. Despite the uncertainty around the timing, the attraction of investing in this scenario is that the opportunity exists before the ECB pivots away from tightening policy and fighting inflation to providing monetary stimulus to encourage growth.

Given central banks’ collective efforts thus far, we think they will generally be successful, and inflation will abate from February next year—the anniversary date of the Russia/Ukraine-driven spikes in energy prices. As a result, we project Eurozone inflation will decelerate from an average of 8.4% in 2022 to 2.8% in 2023. Our projections through 2023 and beyond indicate a range of inflation that is generally lower than the consensus estimates observed in Figure 4. A scenario where the lower-end of that range materialises would provide additional support for bond prices and lower interest rates.

Figure 4: Eurozone inflation projections: peaking this year, declining after

Source: PGIM Fixed Income, Haver Analytics.

When is the right time to invest?

We expect bond yields to fluctuate as Russian gas cuts, central bank rate hikes, and economic data continue to trigger volatility in coming months. Europe’s fundamental economic backdrop suggests that yields and spreads may rise over the near term, which warrants caution.

Yet, these factors also set the stage for a peak in yields and spreads soon, which are important trigger points for investors as they consider allocation timing. This approach indicates an interesting entry point from which investors can generate attractive long-term returns.

Read More from PGIM Fixed Income

Source(s) of data (unless otherwise noted): PGIM Fixed Income as of 24 October 2022.

PGIM Fixed Income operates primarily through PGIM, Inc., a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended, and a Prudential Financial, Inc. (“PFI”) company. Registration as a registered investment adviser does not imply a certain level or skill or training. PGIM Fixed Income is headquartered in Newark, New Jersey and also includes the following businesses globally: (i) the public fixed income unit within PGIM Limited, located in London; (ii) PGIM Netherlands B.V., located in Amsterdam; (iii) PGIM Japan Co., Ltd. (“PGIM Japan”), located in Tokyo; (iv) the public fixed income unit within PGIM (Hong Kong) Ltd. located in Hong Kong; and (v) the public fixed income unit within PGIM (Singapore) Pte. Ltd., located in Singapore (“PGIM Singapore”). PFI of the United States is not affiliated in any manner with Prudential plc, incorporated in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom. Prudential, PGIM, their respective logos, and the Rock symbol are service marks of PFI and its related entities, registered in many jurisdictions worldwide.

These materials are for informational or educational purposes only. The information is not intended as investment advice and is not a recommendation about managing or investing assets. In providing these materials, PGIM is not acting as your fiduciary. Clients seeking information regarding their particular investment needs should contact their financial professional. These materials represent the views and opinions of the author(s) regarding the economic conditions, asset classes, securities, issuers or financial instruments referenced herein. Distribution of this information to any person other than the person to whom it was originally delivered and to such person’s advisers is unauthorized, and any reproduction of these materials, in whole or in part, or the divulgence of any of the contents hereof, without prior consent of PGIM Fixed Income is prohibited. Certain information contained herein has been obtained from sources that PGIM Fixed Income believes to be reliable as of the date presented; however, PGIM Fixed Income cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. PGIM Fixed Income has no obligation to update any or all of such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy or accept responsibility for errors. All investments involve risk, including the possible loss of capital. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any security or other financial instrument or any investment management services and should not be used as the basis for any investment decision. No risk management technique can guarantee the mitigation or elimination of risk in any market environment. Past performance is not a guarantee or a reliable indicator of future results and an investment could lose value. No liability whatsoever is accepted for any loss (whether direct, indirect, or consequential) that may arise from any use of the information contained in or derived from this report. PGIM Fixed Income and its affiliates may make investment decisions that are inconsistent with the recommendations or views expressed herein, including for proprietary accounts of PGIM Fixed Income or its affiliates.

The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients or prospects. No determination has been made regarding the suitability of any securities, financial instruments or strategies for particular clients or prospects. For any securities or financial instruments mentioned herein, the recipient(s) of this report must make its own independent decisions.

Conflicts of Interest: PGIM Fixed Income and its affiliates may have investment advisory or other business relationships with the issuers of securities referenced herein. PGIM Fixed Income and its affiliates, officers, directors and employees may from time to time have long or short positions in and buy or sell securities or financial instruments referenced herein. PGIM Fixed Income and its affiliates may develop and publish research that is independent of, and different than, the recommendations contained herein. PGIM Fixed Income’s personnel other than the author(s), such as sales, marketing and trading personnel, may provide oral or written market commentary or ideas to PGIM Fixed Income’s clients or prospects or proprietary investment ideas that differ from the views expressed herein. Additional information regarding actual and potential conflicts of interest is available in Part 2A of PGIM Fixed Income’s Form ADV.

In the United Kingdom, information is issued by PGIM Limited with registered office: Grand Buildings, 1-3 Strand, Trafalgar Square, London, WC2N 5HR. PGIM Limited is authorised and regulated by the Financial Conduct Authority (“FCA”) of the United Kingdom (Firm Reference Number 193418). In the European Economic Area (“EEA”), information is issued by PGIM Netherlands B.V., an entity authorised by the Autoriteit Financiële Markten (“AFM”) in the Netherlands and operating on the basis of a European passport. In certain EEA countries, information is, where permitted, presented by PGIM Limited in reliance of provisions, exemptions or licenses available to PGIM Limited under temporary permission arrangements following the exit of the United Kingdom from the European Union. These materials are issued by PGIM Limited and/or PGIM Netherlands B.V. to persons who are professional clients as defined under the rules of the FCA and/or to persons who are professional clients as defined in the relevant local implementation of Directive 2014/65/EU (MiFID II). In certain countries in Asia-Pacific, information is presented by PGIM (Singapore) Pte. Ltd., a Singapore investment manager registered with and licensed by the Monetary Authority of Singapore. In Japan, information is presented by PGIM Japan Co. Ltd., registered investment adviser with the Japanese Financial Services Agency. In South Korea, information is presented by PGIM, Inc., which is licensed to provide discretionary investment management services directly to South Korean investors. In Hong Kong, information is provided by PGIM (Hong Kong) Limited, a regulated entity with the Securities & Futures Commission in Hong Kong to professional investors as defined in Section 1 of Part 1 of Schedule 1 (paragraph (a) to (i) of the Securities and Futures Ordinance (Cap.571). In Australia, this information is presented by PGIM (Australia) Pty Ltd (“PGIM Australia”) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). PGIM Australia is a representative of PGIM Limited, which is exempt from the requirement to hold an Australian Financial Services License under the Australian Corporations Act 2001 in respect of financial services. PGIM Limited is exempt by virtue of its regulation by the FCA (Reg: 193418) under the laws of the United Kingdom and the application of ASIC Class Order 03/1099. The laws of the United Kingdom differ from Australian laws. In Canada, pursuant to the international adviser registration exemption in National Instrument 31-103, PGIM, Inc. is informing you that: (1) PGIM, Inc. is not registered in Canada and is advising you in reliance upon an exemption from the adviser registration requirement under National Instrument 31-103; (2) PGIM, Inc.’s jurisdiction of residence is New Jersey, U.S.A.; (3) there may be difficulty enforcing legal rights against PGIM, Inc. because it is resident outside of Canada and all or substantially all of its assets may be situated outside of Canada; and (4) the name and address of the agent for service of process of PGIM, Inc. in the applicable Provinces of Canada are as follows: in Québec: Borden Ladner Gervais LLP, 1000 de La Gauchetière Street West, Suite 900 Montréal, QC H3B 5H4; in British Columbia: Borden Ladner Gervais LLP, 1200 Waterfront Centre, 200 Burrard Street, Vancouver, BC V7X 1T2; in Ontario: Borden Ladner Gervais LLP, 22 Adelaide Street West, Suite 3400, Toronto, ON M5H 4E3; in Nova Scotia: Cox & Palmer, Q.C., 1100 Purdy’s Wharf Tower One, 1959 Upper Water Street, P.O. Box 2380 - Stn Central RPO, Halifax, NS B3J 3E5; in Alberta: Borden Ladner Gervais LLP, 530 Third Avenue S.W., Calgary, AB T2P R3.

© 2022 PFI and its related entities.

2022-6203

Sign Up Now for Full Access to Articles and Podcasts!

Unlock full access to our vast content library by registering as an institutional investor .

Create an accountAlready have an account ? Sign in