Ninety One -

Getting the most out of emerging market debt

The fast view

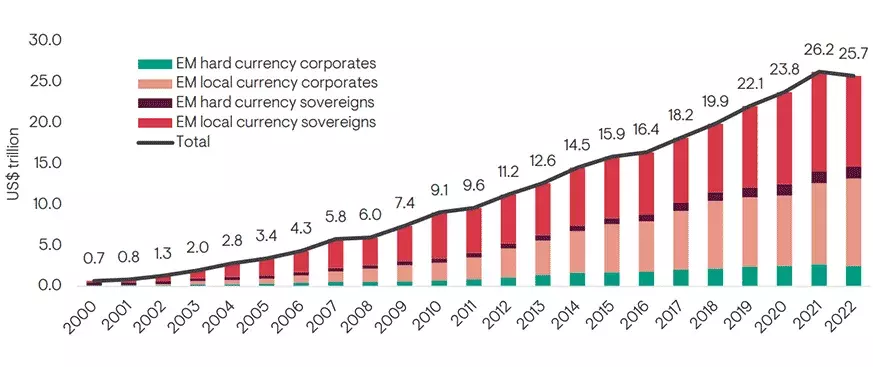

- Emerging market (EM) debt is a diverse investment universe underpinned by a wide range of growing economies and companies. But it is under-owned in many portfolios.

- EM fundamentals are robust: over the next few years, EM economic growth is set to outpace developed-market growth by the widest margin in a decade; and EM central banks are now in a strong position to start easing interest rates.

- Recent performance reflects this fundamental strength, yet yields across EM debt asset classes remain very high. This improves the income profile and return outlook while providing a buffer against future volatility.

- EM debt provides portfolio diversification benefits and offers active investors a rich hunting ground, given the diverse behaviour of individual asset classes across the cycle and the large dispersion across markets that sit within these.

- A blended EM debt strategy allows investors to benefit from the divergent dynamics across the asset class while also capturing bottom-up selection opportunities across and within markets.

Sign Up Now for Full Access to Articles and Podcasts!

Unlock full access to our vast content library by registering as an institutional investor .

Create an accountAlready have an account ? Sign in