Half-time report: Interesting times indeed

At the start of 2023 we expected a recession to soon materialize, the Fed to stop hiking as a result, and the US dollar to peak. That hasn’t happened and the US stock market has rallied back towards record levels. We knew at the time the outlook was uncertain so we listed 10 factors that could impact our view. Half-way through the year and a surprising seven out of ten have already come into play.

- The ‘Goldilocks’ scenario was powered by AI

- The 60/40 asset allocation is alive and well

- The recession is still just over the horizon

In our monthly outlook at the start of the year (A bevy of black swans: Surprises that could derail the 2023 outlook – January 2023) we explored some positive and negative scenarios and tail risks that weren’t part of our base case, but could yet impact markets and asset allocation. While risks may dominate the market psyche for short periods without changing our fundamental outlook, when priced in, they provide investment opportunities.

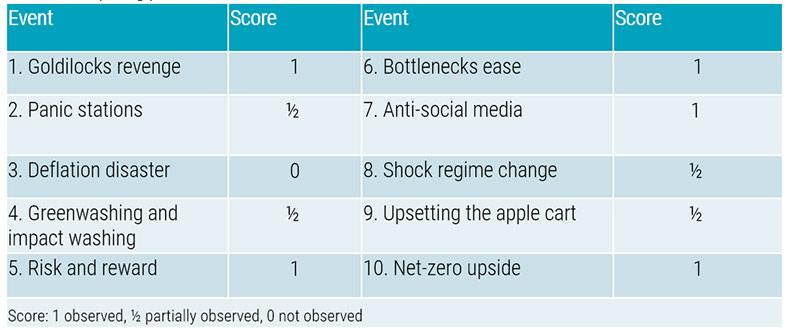

We are keeping score, and if these risks have been observed then we score a point, if not observed then no need to trouble the scorers, and we get half a point if an outcome is partially observed. Here is how the possible scenarios we identified at the start of 2023 are playing out so far:

Table 1: A surprising year in the markets

Source: Robeco

Goldilocks’ revenge

The first is ‘Goldilocks’ revenge’ – the economy won’t run too hot or too cold but just right. The economy has indeed shown resilience, despite a hawkish Fed and US equities and high yield have performed well. The AI ‘disinflationary’ gold rush has powered a narrow market with the top 2-3% of the S&P 500 index generating all the performance so far this year.

“We are still cautious and are now anti-consensus,” says Graham, senior portfolio manager with the Robeco Sustainable Multi-Asset Solutions team.

Panic stations – the Fed could review its inflation target

We posited that if the Fed becomes tired of low long-term rates, it could announce a break with the structural regime since the financial crisis and abandon its 2% inflation target. In the event the Fed and other central banks have stuck to their hawkish guns and inflation’s delayed return to 2% targets has been accepted by bond vigilantes, as has fiscal largesse.

“The rate cutting cycle will be a 2024 investment debate unless there’s a financial/economic accident,” says Graham.

Deflation disaster

We noted that by late 2023 deflation could have a higher number of hits than inflation according to newsflow data. So farhese fears have proved unfounded so far with labor markets and aggregate demand proving resilient, but Graham doesn’t rule out that deflation might be a destination much further down the line.

“Inflation will be stickier than economist models are predicting. Thus interest rates will need to be higher for longer so there is an increased chance of an inflation target undershoot,” he says.

Greenwashing and impact washing

It was obvious sustainability claims were coming under scrutiny from regulators, media and investors but we questioned whether it would prompt action from impacted institutions. Since the start of the year we have observed a split in US clients’ requirements on sustainability issues, downgrading of SFDR Article 9 funds to Article 8, and firms quitting the Net Zero Asset Management Initiative or stepping back from sustainability claims and delisting themselves from UN PRI.

“The regulatory environment continues to evolve, with marginally increased clarity in some areas. We have made it our mission to embrace the sustainability framework, and our SDG framework is available with open access for clients and academics,” says Graham.

Risk and reward

In 2022, risk-profile funds (cautious, balanced and aggressive) delivered returns within 50 bps of each other despite different levels of equity and bond allocations. Reality has bitten in 2023, and correlations have fallen.

“60/40 is alive and kicking and we continue to expect correlations to be lower than in 2022,” says Graham.

Bottlenecks ease

After Russia invaded Ukraine in 2022 it boosted commodity prices and exacerbated the cost-push inflation from post-Covid supply chain bottlenecks. These factors were expected to persist but commodity prices have fallen in 2023 and supply chain issues have eased considerably. This is good news in terms of the inflation fight but also underscores a cooling economy around the world.

“China’s consumers did not have the helicopter money benefit seen in US and Europe, hence are taking longer to recover. People have been disappointed by this sluggish growth in a major global engine like China but it is now priced into Chinese equity prices,” says Graham.

Anti-social media

We anticipated there could be some regulation of large technology and social media platforms as data protection issues come to the fore, but it still hasn’t hit its stride despite it being a lawmaker focus in the US and Europe. This hasn’t impacted markets in 2023 with no change in equity market leadership, with big tech riding the AI wave.

“We continue to think that the stocks that led the last bull market will not lead the long-term recovery, so this is not a new bull market as far as we are concerned. We also expect big tech will look quite different in years to come,” says Graham.

Shock regime change

As the first year this century without a G7 election we wondered whether political turmoil impacting financial markets, as the UK endured in 2022 with three prime ministers and a brief gilt market crash, might strike somewhere else. In reality the incumbents have stayed in place so far.

“The real volatility in 2023 has stemmed from the liquidity mismatch that hit US mid-size banks, rather than the political sphere. Volatility in bonds is still elevated though and we can’t predict these tail risks, but whatever the event happens to be, it will create opportunities,” says Graham.

Upsetting the apple cart

Slow discovery of investments that were only funded because cash was ‘free’ was identified as a possible source of trouble at the start of the year, but so far a few real estate structures have collapsed but nothing big enough to spillover into public markets.

“This is still a clear and present danger so buyer beware as private assets were big beneficiaries of cheap money.”

Net-zero upside

The evidence about climate change continues to mount and COP27 highlighted that political will is key. In the long run, achieving energy security means investing more in green technologies and climate solutions to close the gap between ambition and implementation.

“We are experiencing continued commitment from governments, backed with actual cash, to fund the clean energy transition, more through necessity and FOMO rather than politicians having a vision. We also believe this additional spending will add to short-term inflationary pressures.“

Conclusion: Staying agile

We do not have perfect foresight on events that affect market returns, but a score of 7/10 is high given the tail risk nature of these events and the inherent contradictions.

Sign Up Now for Full Access to Articles and Podcasts!

Unlock full access to our vast content library by registering as an institutional investor .

Create an accountAlready have an account ? Sign in