Japan: With all bases loaded, ready for a homerun?

An alignment of the three main financial markets in Japan makes the country ripe for opportunities, says multi-asset investor Arnout van Rijn.

- Multi-asset team believes the stock market and currency both offer upside

- The JGB bond market should benefit from removing the yield ceiling

- The equity, bond and yen bases are loaded – and the batter is a big hitter

The equity, bond and currency markets are all at inflection points that make them promising for investment, he says. And as baseball is the most popular sport in the country, it offers a neat analogy of how the bases are loaded, and the batter is getting ready to hit the pitcher's ball.

It means that the country’s assets that have long been in the doldrums from decades of recession, an artificially controlled bond market, and an undervalued currency could at last start appearing in greater volumes in investment portfolios, says Van Rijn, Portfolio Manager with Robeco Sustainable Multi-Asset Solutions. They can each be assigned a base according to how close they are to achieving that homerun.

Third base – equities

Starting with the equity market, the team is already ‘long’ on it, using derivatives that predict it will continue to go up from recent highs. “This trade already has momentum and may be the first to complete its run around the infield,” Van Rijn says.

“Most casual observers are still waiting for the news that the Nikkei 225 (a silly price-weighted index) will take out the old high from 34 years ago at 38,915.87. That is currently about 6% away. There will be headlines aplenty once that happens.”

“Local investors have made a compound 1.5% annualized return after 34 years on holding stocks, compared with a US investor who has enjoyed a compound annual growth rate of 10.7%.”

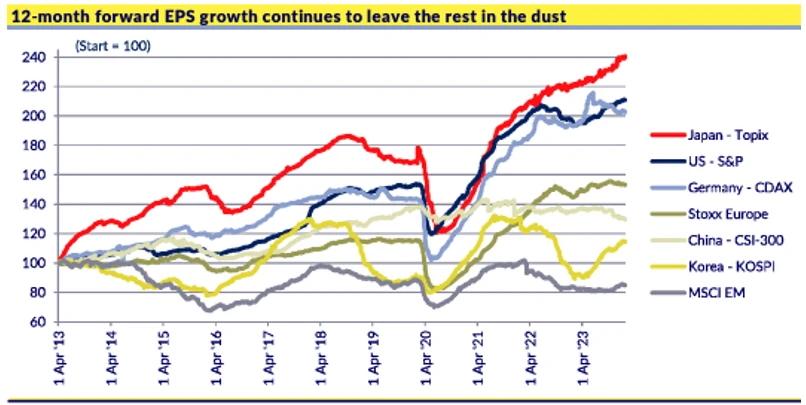

Japan has the highest expected forward earnings per share growth of any major market. Source: CLSA, Bloomberg, February 2024.

“Thanks to the much friendlier shareholder return policies though over the past ten years, local returns have been 10.1% annualized – a big improvement on the 0% on savings and 0.5% on bonds over that same decade. So, local investors have started to listen.”

Van Rijn says Japanese companies are under pressure from both foreign and domestic investors, along with the government and the financial markets regulator to return more capital to shareholders.

“The herd is finally moving,” he says. “Listed Japanese companies have been expanding share buyback programs, which totaled JPY 9.6 trillion (USD 64 billion) in 2023, setting a new high for a second consecutive year. Yet the percentage of Japanese companies that trade below their book value is still remarkably high at 50%.”

Second base – government bonds

Government bonds are safe at the second base, amid expectations that yields will rise now that the Bank of Japan has removed the ceiling that prevented them from going above 1.0%. They are currently at 0.7%, while real interest rates are still negative.

As bond values trade inversely with yields, a rising yield makes the bond price fall. The multi-asset team is subsequently ‘short’ on the 10-year Japanese Government Bond (JGB), meaning it expects to gain from future bond price falls.

“There must be upside to yields since last October, when the BoJ tweaked its policy by dropping the defense of the 1.0% maximum upper level for JGB yields,” Van Rijn says. “This all needs to be done carefully, as financial repression must continue in the interest of debt sustainability.”

“Even if inflation were to reach 2% consistently, Japan would not be able to afford to pay 2% on its debts, let alone a positive real rate. Local insurers and banks will continue to support their government at negative real rates. Also be mindful that academics will tell you that r* (the natural rate of interest) in Japan is about -1%.”

“Also, here distortion of the market is clear, with more than 50% of JGBs held by the BoJ. Still, if short-term rates bounce off zero to reach 0.25%, some term premium will need to be offered, so rates of between 1-1.5% are our base case.”

First base – the yen

Finally, the prospect of the Japanese yen rising in value has prompted the team to take the unusual step of going long on both the currency and the equity market at the same time. “Here, we have waited for the negative momentum to abate,” Van Rijn says.

“We believe the coast is clearing and have dipped a toe in the water. The currency is about 30% undervalued on a real effective exchange rate basis. Our model indicates that even with the current spreads, the yen has 5-7% upside.”

“It seems counterintuitive to be long Japanese equity and long the currency at the same time. Over the past decades, the obvious trade was to be short the currency when you wanted to go long the equity.”

“Corporate profitability, however, has become far less dependent on international trade, and many companies have learned over many ‘expensive yen’ years to immunize themselves from the vagaries of the forex market. Still, the tail risk of the world's largest monetary experiment keeps us nimble with tight stop-loss levels.”

Enter the batter – Ueda-san the hitman!

So, with the bases loaded, who is wielding the baseball bat? It is none other than the Governor of the Bank of Japan, Kazuo Ueda.

“For any chance of a successful homerun in Japan, we need a good hitter. Here we have to rely on Ueda to play his cards well,” Van Rijn says. “Though dovish too, Ueda seems to be more open-minded than his predecessor – but due to his short tenure, he is an unpredictable hitter.”

“Could he do something unpredictable? Will he have the guts to do anything on that day, assuming the US Federal Reserve is likely to sit tight and hold rates when it next meets in March? Ueda has already indicated that he intends to stay dovish, so even removing the negative interest rate policy (NIRP) would require a bit more evidence of inflation, and especially wage inflation, reaching the 2% target.”

Pitcher Powell

“Finally, our friendly pitcher is Fed Chairman Jerome Powell. Recently, most of the action in all three segments of Japanese financial markets was driven by the Fed’s actions and words. For our Japanese bets to perform well, we need more stability in US rate and equity markets.”

“Powell decides on rates, and we expect him to cut less than what is currently priced in. This will give Ueda more time to hike without causing undesirable capital flows. Time for a homerun!”

Sign Up Now for Full Access to Articles and Podcasts!

Unlock full access to our vast content library by registering as an institutional investor .

Create an accountAlready have an account ? Sign in