Mercer

Mercer

https://www.mercer.com/

Gary Sems

US Sales Director

Gary.Sems@mercer.com

Office: +1 864-240-5430

Eryn Bacewich

Head of Insurance Solutions

Eryn.Bacewich@mercer.com

About Mercer

Our DNA is investment advice and for more than 50 years we have looked beyond any individual house view across the global investment universe to bring unique perspectives to portfolios - throughout research, advice and solutions.

As a partner to your investment portfolio, you can trust that we’ll assess suitable opportunities to build portfolios designed to deliver your investment objectives, based on what matters to you most.

Our expertise lies in intellectual capital and generating ideas for long-term investment. We observe markets carefully and select the managers who we believe to be the best at navigating them, with our strategists working with our decision-makers to shift client portfolios either towards an opportunity or away from danger. Using this process, and with support from our world-class research team, we have grown to be the largest investment solutions provider by assets in the world*, managing more than $617bn.**

* As defined in CIO magazine’s 2024 Outsourced CIO Buyer’s Guide Survey, worldwide discretionary AUM as of 31.12.2023 as reported by each firm to ai-CIO.

**Mercer, 31 December 2024. Please see here for more details on our AUM.

A partner to your insurance investment portfolio

Investment Considerations for Insurers in 2026

OCIO for Insurers: A Partner to Your Portfolio

Composition of the Capital Efficient Universe as of June 30, 2024

Episode 254: Demystifying OCIO for Insurance Companies

Olaolu Aganga is U.S. Chief Investment Officer at Mercer, and Stephanie Thomas is a Senior Investment Consultant at Mercer.

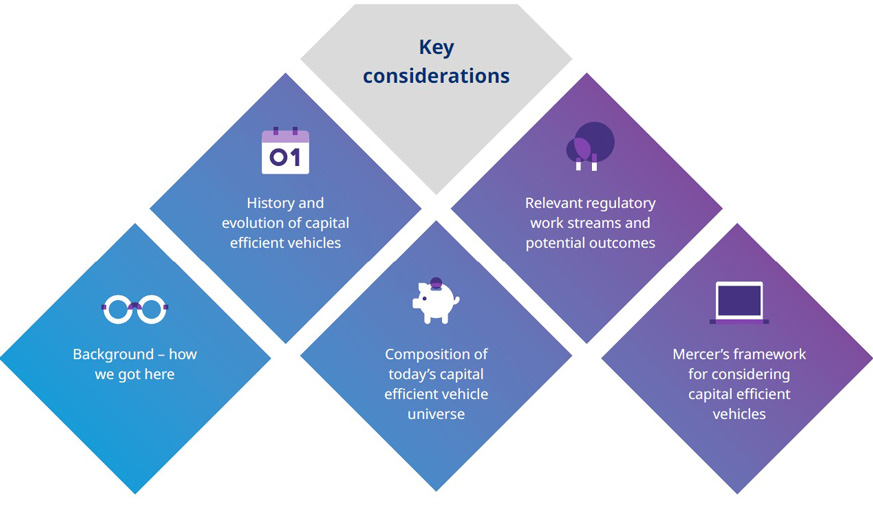

The evolution of capital efficient structures

While the events of the most recent year have introduced significant uncertainty in capital markets, we expect insurance companies to continue increasing their allocations to private markets. For certain insurers, these investments are executed through various forms of vehicles with favorable cost-adjusted yields (capital efficient vehicles). Insurers favor these vehicles for many reasons, including the potential to reduce administrative costs, efficiently engage with specialist managers, seek material downside risk protection through structural protections, and benefit from lower capital charges. At Mercer, we have monitored the development of these structures over many years and seek to provide more clarity to clients on the various implications of these vehicles. With increased scrutiny and expected regulatory changes on the horizon, it is important to better understand this topic and the various tradeoffs.

PODCAST

PODCAST