Quant Chart: Inside the Mind of the C-Suite

As the end of Q2 2023 earnings season approaches, it’s crucial for investors to utilize earnings calls for in-depth insights. More than just a source of numerical data, these calls provide a narrative around financial performance, revealing strategies, risks, opportunities, and market dynamics. C-suite executives provide context to the financial numbers and elaborate on key decisions, while the question and answer sessions can reveal unreported details. Hence, earnings calls are a powerful tool for a comprehensive understanding of a company’s financial outlook alongside public accounting data.

However, unlike accounting or market data, earnings call transcripts are full of natural language and present unstructured data. This is where Natural Language Processing (NLP) becomes crucial in extracting meaningful insights from earnings calls. NLP can help decode complex financial language, identify sentiment, and highlight key themes discussed during the call.

Historically, word count methods, i.e., “Bag of Words,” have long been a widely used technique for analyzing text data. However, it comes with its limitations and shortcomings. For example, information about the relationship between words within a document is lost. Using more modern NLP inference, making use of the embeddings of textual data, context can be taken into account.

To show an example, in 2021, an analyst at a NVIDIA earnings call stated:

"I think that there’s like four or five of the big currencies are going to move or at least they’re moving or they’re on a path to move from proof-of-work to proof-of-stake.

Despite the term “blockchain” not being directly mentioned, the embeddings of the sentence help identify the reference to blockchain technology.

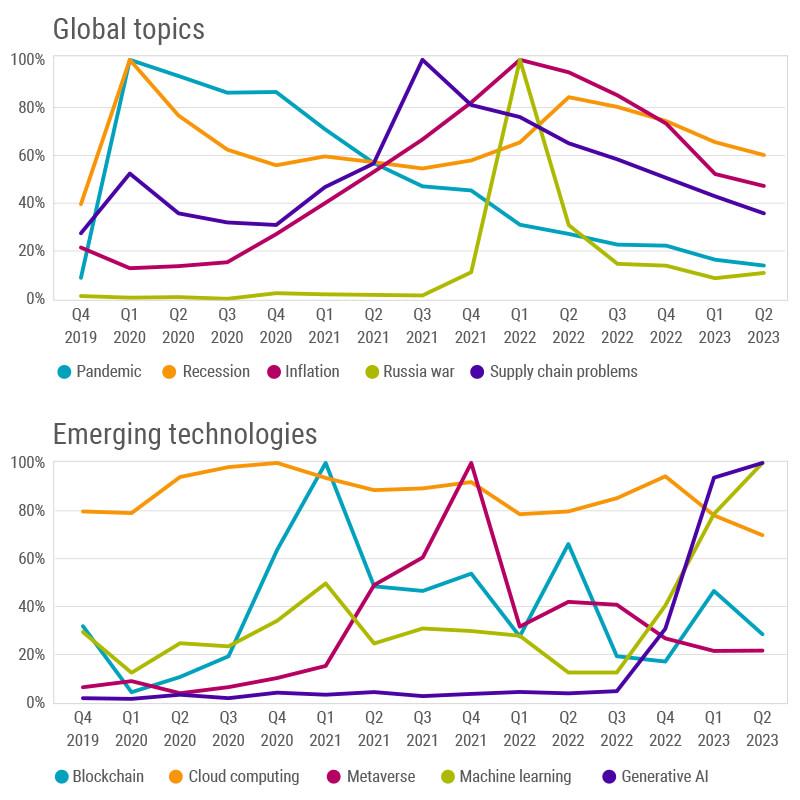

Figure 1 | Topic intensity during earnings call conferences of S&P 500 companies.

Source: Robeco, FactSet. The figure shows the intensity of how various topics have been discussed in earnings call conferences over the last 15 quarters. The upper chart illustrates the intensity of selected global topics, while the lower chart shows the intensity of emerging technologies. For each company and quarter, the portion of sentences about a specific topic is computed and averaged over all earning calls within that quarter. Subsequently, each topic’s intensity is normalized such that the peak is represented as 100%. The analysis includes all constituents of the S&P 500, and the sample period ends on August 4, 2023, with 81% of the S&P 500 constituents already having their Q2 2023 earnings call conferences.

Using NLP techniques, we can infer which macro trends analysts and companies discuss during earning calls conferences. The upper chart in Figure 1 reveals that at the beginning of 2020, unsurprisingly, “pandemic” and ”recession” were the dominating topics. In the final quarter of 2021, supply chain problems dominated the C-suite’s minds, followed by concerns over the Russia-Ukraine conflict and inflation during the first quarter of 2022.

Even more fascinating, NLP can also be employed to identify emerging technologies, as shown in the lower chart in Figure 1. While cloud computing remains a consistent topic of discussion, we also observe some other topics rise and fall. For instance, blockchain was the trending topic during the third quarter of 2020 until the first quarter of 2021, while it was the metaverse in the last quarter of 2021. These peaks coincide with the Bitcoin rally from October 2020 until March 2021 and Facebook’s renaming to Meta in October 2021. In the current Q2 2023 earnings season, machine learning, especially generative AI, is the hot topic, continuing the trend that started in the final quarter of 2022.

The analysis above showcases the application of NLP for dynamic theme detection using earnings calls. To explore how such tools might be used for dynamic quantitative theme investing, we invite you to contact your Robeco sales representative.

Sign Up Now for Full Access to Articles and Podcasts!

Unlock full access to our vast content library by registering as an institutional investor .

Create an accountAlready have an account ? Sign in