Sustainability-Linked Bonds: An Appealing Concept that Disappoints

Sustainability-linked bonds (“SLBs”) are a recent addition to the ESG (environmental, social, and governance) fixed income family: an SLB’s coupon increases if its issuer fails to meet a self-imposed sustainability target by a set date.

That innovative coupon step-up, linked to sustainability, is the key difference between SLBs and Green, Social and Sustainability (GSS) bonds.

Just like GSS bonds, SLBs can serve as tools to boost their issuers’ sustainability credentials. Unfortunately, these promising bonds share one other trait with GSS debt: the way they’re structured now, they often disappoint when it comes to ESG impact.1

An Attractive Alternative to GSS Bonds

Italian utility Enel was the first company to issue an SLB, in 2019. Enel agreed to increase the bond’s coupon by 0.25 percentage points (pp) if it failed to raise its share of renewable capacity to 55% by 2021, a target it has since achieved.

Since then, Enel has become the largest issuer of SLBs, with nearly $25 billion outstanding tied to various sustainability goals. The company has gone farther still, pledging to only issue sustainability-linked debt going forward.

SLBs’ greater flexibility than GSS bonds was what initially attracted Enel2: GSS bond proceeds are ring-fenced to fund only green or social projects3, but SLB proceeds can finance any purpose, from acquisitions and working capital to general corporate purposes.

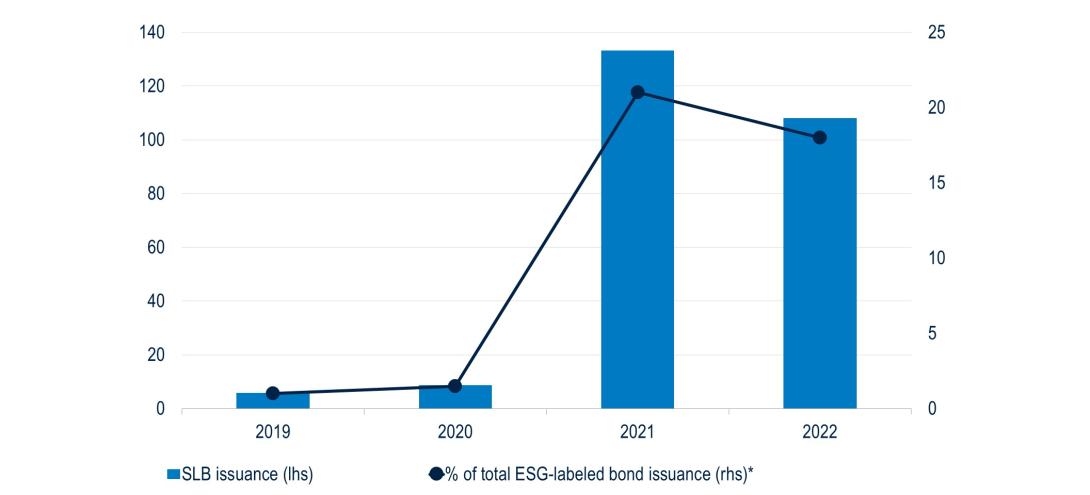

Since Enel’s debut, SLBs’ flexibility has attracted many firms eager to tap the ESG market but unable to issue GSS bonds because they lack green or social projects. As a result, SLB issuance has grown rapidly, from $6 billion in 2019 to more than $100 billion in 2022.

Figure 1: SLB issuance has grown rapidly, from $6 billion in 2019 to more than $100 billion in 2022. (lhs: $ billions; rhs: %)

Source: PGIM Fixed Income * Total ESG-labeled bond issuance includes GSS bonds and SLBs.

How We Assess SLBs

Not all SLBs are as robust as Enel's. At PGIM Fixed Income, our framework for assessing SLBs considers, first, how material the key performance indicators (KPIs)4 are that an issuer has chosen. In other words, we look at how well an SLB's targets reflect that issuer's environmental or social impacts.

Next, we assess if those KPIs represent an ambitious improvement over its “business as usual.” We also assess how transparent an issuer is as it progresses towards those targets.

Additionally, we assess the SLB’s structural features: are its sustainability target dates appropriate, given the bond’s tenor? And does the coupon step-up provide enough financial incentive (for the issuer) and compensation (for the investor)?

Weakness in any of these criteria leads us to view the SLB as no more "ESG" than its vanilla counterparts.5 Ultimately, we want to see an SLB that advances its issuer's sustainability, beyond what its vanilla bonds achieve.

At Best

The primary benefit of a well-structured SLB is to reinforce an issuer’s commitment to its sustainability transition. An issuer that ties a significant portion of its financing cost to its SLB targets is less likely to abandon those targets.

However, pinning down SLBs that meet the standards for an uplift in our ESG framework6 is difficult. In 2020, the International Capital Markets Association (ICMA) released its Sustainability-Linked Bond Principles,7 with detailed best practice guidelines for structuring SLBs. Later, ICMA also published over 300 recommended KPIs.

ICMA’s KPIs are detailed, but their uptake has been patchy. Many bonds get several things right, but most fall short of an uplift in our ESG framework for one or more reasons.

To illustrate: a large metals and mining company structured an SLB that we reviewed with a coupon step-up penalty of 0.50 percentage points (pp). This SLB’s KPIs were material to its operations, and its sustainability targets were ambitious. They required steep reductions in scope 1,2, and 3 emissions,8 aligned with the Paris Agreement’s goal of limiting global temperature increase to below 2°C.

At first glance, this 0.50 pp step-up is a meaningful financial penalty, compared to the paltry market standard step-up of 0.25 pp. However, the step-up would kick in for only three payments towards the end of the bond’s lifetime, two years after the target observation date. As a result, the increased interest expense would be minimal. And even if the step-up kicked in immediately, it would be a small percentage of the issuer’s interest expense, given its high debt.

The financial penalty of this SLB was therefore trivial. As a result, we considered it a non-factor in incentivizing management to achieve its sustainability targets. SLBs like these, with material KPIs and ambitious targets, almost fit the ticket but fall short of the gold standard. That gold standard is, admittedly, almost nonexistent in the market today.

At Worst

There is another potential downside. Increasing an issuer’s focus on its sustainability targets, by tying their achievement to financing costs, can discourage that issuer from raising its ambitions or from focusing on more material KPIs that are harder to address.

According to ICMA, companies should select KPIs that are “relevant, core and material to their overall business, and of high strategic significance to their current and/or future operations.” Unfortunately, many SLBs fail to meet these basic standards.

For example: a food producer’s recent SLB had a 0.25 pp coupon step-up penalty, linked to reducing scope 1 and 2 emissions. But over 96% of this issuer’s emissions come from upstream scope 3 sources, so the KPI was hardly material. In addition, the SLB’s sustainability target lacked ambition, because the decrease in emissions that it required was slight.

Moreover, many outstanding SLBs have vague caveats and carve-outs for M&A and force majeure events. To date, just two index-eligible SLBs have had their step-up features triggered after missing a target: Polish refiner PKN Orlen, in November 2021, and Greece’s Public Power Corporation, in March 2023. Many step-up events are scheduled from the end of 2023, so they remain untested to date. It’s unclear to what extent issuers might invoke caveats and carve-outs by then, to avoid interest penalties.

Several SLBs also have call provisions with call dates before their target observation dates. We haven’t seen it yet, but issuers of such SLBs could call the bond to avoid the reputational risk associated with missing the target.

Room for Improvement

SLBs best suit issuers that don’t have eligible green or social investment projects but still require a sustainable transition. In their current form, however, we mostly view these instruments as marketing tools, to – sometimes cosmetically – boost an issuer’s sustainability credentials, at best.

At worst, an SLB’s ESG label can deliberately distract from an issuer’s inadequate transition plans. Such SLBs may even discourage issuers from setting more ambitious targets, for fear that they publicly miss them.

Ensuring that KPIs are material, ambitious, measurable, transparent, and part of a broader sustainability strategy is key to our assessment. SLBs deserve a seat at the table in the family of ESG-labeled debt, but their impact is set to remain capped if the market doesn’t evolve.

1 For a critical review of GSS bonds issued by banks and real estate firms, please see our earlier blogs “Green Bank Bonds: Abuse of Proceeds?” and “The Surprising Lack of ESG in ESG-Labeled Real Estate Bonds”.

2 “Why Enel turned to sustainability-linked bonds.” Environmental Finance, 14 June 2022.

3 In practice, issuers typically use general cash, in an amount equal to what they raised with GSS bonds, to finance eligible green and social projects.

4 KPIs are the quantitative performance metrics, like % of renewable installed capacity, that an issuer is setting targets against to measure its sustainability performance.

5 We already capture an issuer’s vanilla bonds’ sustainability targets and performance in our forward looking ESG Impact Ratings.

6 For an overview of our uplift process for GSS bonds, please refer to our Green Bond Framework.

7 International Capital Market Association (ICMA). Sustainability-Linked Bond Principles. June 2020.

8 In essence, scope 1 emissions are those that a company produces itself, scope 2 emissions are produced on its behalf to generate the electricity it purchases, and scope 3 emissions are those for which a company is indirectly responsible along its value chain.

Read More From PGIM Fixed Income

Source(s) of data (unless otherwise noted): PGIM Fixed Income, as July 20, 2023.

For Professional Investors only. Past performance is not a guarantee or a reliable indicator of future results and an investment could lose value. All investments involve risk, including the possible loss of capital.

PGIM Fixed Income operates primarily through PGIM, Inc., a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended, and a Prudential Financial, Inc. (“PFI”) company. Registration as a registered investment adviser does not imply a certain level or skill or training. PGIM Fixed Income is headquartered in Newark, New Jersey and also includes the following businesses globally: (i) the public fixed income unit within PGIM Limited, located in London; (ii) PGIM Netherlands B.V., located in Amsterdam; (iii) PGIM Japan Co., Ltd. (“PGIM Japan”), located in Tokyo; (iv) the public fixed income unit within PGIM (Hong Kong) Ltd. located in Hong Kong; and (v) the public fixed income unit within PGIM (Singapore) Pte. Ltd., located in Singapore (“PGIM Singapore”). PFI of the United States is not affiliated in any manner with Prudential plc, incorporated in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom. Prudential, PGIM, their respective logos, and the Rock symbol are service marks of PFI and its related entities, registered in many jurisdictions worldwide.

These materials are for informational or educational purposes only. The information is not intended as investment advice and is not a recommendation about managing or investing assets. In providing these materials, PGIM is not acting as your fiduciary. PGIM Fixed Income as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Investors seeking information regarding their particular investment needs should contact their own financial professional.

These materials represent the views and opinions of the author(s) regarding the economic conditions, asset classes, securities, issuers or financial instruments referenced herein. Distribution of this information to any person other than the person to whom it was originally delivered and to such person’s advisers is unauthorized, and any reproduction of these materials, in whole or in part, or the divulgence of any of the contents hereof, without prior consent of PGIM Fixed Income is prohibited. Certain information contained herein has been obtained from sources that PGIM Fixed Income believes to be reliable as of the date presented; however, PGIM Fixed Income cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. PGIM Fixed Income has no obligation to update any or all of such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy.

Any forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fee. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any security or other financial instrument or any investment management services and should not be used as the basis for any investment decision. PGIM Fixed Income and its affiliates may make investment decisions that are inconsistent with the recommendations or views expressed herein, including for proprietary accounts of PGIM Fixed Income or its affiliates.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and while generally supported by a government, government agency or private guarantor, there is no assurance that the guarantor will meet its obligations. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be suitable for all investors. Diversification does not ensure against loss.

In the United Kingdom, information is issued by PGIM Limited with registered office: Grand Buildings, 1-3 Strand, Trafalgar Square, London, WC2N 5HR. PGIM Limited is authorised and regulated by the Financial Conduct Authority (“FCA”) of the United Kingdom (Firm Reference Number 193418). In the European Economic Area (“EEA”), information is issued by PGIM Netherlands B.V., an entity authorised by the Autoriteit Financiële Markten (“AFM”) in the Netherlands and operating on the basis of a European passport. In certain EEA countries, information is, where permitted, presented by PGIM Limited in reliance of provisions, exemptions or licenses available to PGIM Limited under temporary permission arrangements following the exit of the United Kingdom from the European Union. These materials are issued by PGIM Limited and/or PGIM Netherlands B.V. to persons who are professional clients as defined under the rules of the FCA and/or to persons who are professional clients as defined in the relevant local implementation of Directive 2014/65/EU (MiFID II). In certain countries in Asia-Pacific, information is presented by PGIM (Singapore) Pte. Ltd., a Singapore investment manager registered with and licensed by the Monetary Authority of Singapore. In Japan, information is presented by PGIM Japan Co. Ltd., registered investment adviser with the Japanese Financial Services Agency. In South Korea, information is presented by PGIM, Inc., which is licensed to provide discretionary investment management services directly to South Korean investors. In Hong Kong, information is provided by PGIM (Hong Kong) Limited, a regulated entity with the Securities & Futures Commission in Hong Kong to professional investors as defined in Section 1 of Part 1 of Schedule 1 (paragraph (a) to (i) of the Securities and Futures Ordinance (Cap.571). In Australia, this information is presented by PGIM (Australia) Pty Ltd (“PGIM Australia”) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). PGIM Australia is a representative of PGIM Limited, which is exempt from the requirement to hold an Australian Financial Services License under the Australian Corporations Act 2001 in respect of financial services. PGIM Limited is exempt by virtue of its regulation by the FCA (Reg: 193418) under the laws of the United Kingdom and the application of ASIC Class Order 03/1099. The laws of the United Kingdom differ from Australian laws. In Canada, pursuant to the international adviser registration exemption in National Instrument 31-103, PGIM, Inc. is informing you that: (1) PGIM, Inc. is not registered in Canada and is advising you in reliance upon an exemption from the adviser registration requirement under National Instrument 31-103; (2) PGIM, Inc.’s jurisdiction of residence is New Jersey, U.S.A.; (3) there may be difficulty enforcing legal rights against PGIM, Inc. because it is resident outside of Canada and all or substantially all of its assets may be situated outside of Canada; and (4) the name and address of the agent for service of process of PGIM, Inc. in the applicable Provinces of Canada are as follows: in Québec: Borden Ladner Gervais LLP, 1000 de La Gauchetière Street West, Suite 900 Montréal, QC H3B 5H4; in British Columbia: Borden Ladner Gervais LLP, 1200 Waterfront Centre, 200 Burrard Street, Vancouver, BC V7X 1T2; in Ontario: Borden Ladner Gervais LLP, 22 Adelaide Street West, Suite 3400, Toronto, ON M5H 4E3; in Nova Scotia: Cox & Palmer, Q.C., 1100 Purdy’s Wharf Tower One, 1959 Upper Water Street, P.O. Box 2380 - Stn Central RPO, Halifax, NS B3J 3E5; in Alberta: Borden Ladner Gervais LLP, 530 Third Avenue S.W., Calgary, AB T2P R3.

© 2023 PFI and its related entities.

2023-5567

Sign Up Now for Full Access to Articles and Podcasts!

Unlock full access to our vast content library by registering as an institutional investor .

Create an accountAlready have an account ? Sign in