The ECB Delivers a (Final?) Dovish Hike

Today’s interest rate decision was a coin toss between a hawkish pause or a dovish hike, and the ECB delivered the latter. Citing inflation that remains too high and a weakening economy, the Bank’s signal was that policy rates are unlikely to rise from here.

But as economic weakness broadens, the risk is that the ECB has gone too far. And its message of higher rates for longer—without sufficiently defusing concerns that it might speed up its balance sheet contraction—could trigger fragmentation risk in Italy. The ECB will need to steer a careful course from here, surrounded by shark-infested waters.

Our Take on the Meeting

The ECB raised its deposit rate to 4.0% today, an all-time high since the launch of the euro. It cited uncomfortably high headline inflation of more than 5% as the key driver of its decision. Higher interest rates signal concern among ECB policymakers that underlying inflation could become embedded. That would make it harder to get back to the Bank’s 2% target.

Despite the backdrop of uncomfortably high inflation, the ECB recognised that the euro area economy is cooling. So, reflecting the recent data flow, it downgraded its outlook for GDP growth to 0.7% in 2023 and 1.0% in 2024. It maintained its projection for underlying inflation in 2023 at 5.1% and lowered its projection for 2024 to 2.9%. These downgrades are a strong signal that interest rates are unlikely to rise further.

That said, the Bank is keen to message that interest rates will need to remain higher for longer. We therefore don’t expect rate cuts until the data reveals a compelling downward trend in underlying inflation.

The ECB lowered its outlook for GDP growth in 2024 to 1.0%, but we view this as still too optimistic. Economic activity is weakening across the board, and the manufacturing slowdown is spilling over into services. Our base case calls for GDP growth of 0.5% in 2024, which is below consensus and half the ECB’s forecast. Indeed, today’s hike could tip the economic balance: it risks triggering a rapid economic slowdown and below-target inflation in the medium term.

To top it off, President Lagarde said there had been no discussion of ending the Bank’s pandemic emergency purchase programme (PEPP) reinvestments. This was a less forceful reply than we had expected in light of investor nervousness towards Italy.

Looking ahead, our base case is for stagnant growth in the euro area, coupled with high inflation and limited relief in terms of lower ECB rates. How the economy evolves from here is highly uncertain, but in our view, the balance has shifted to the downside.

Investor Reaction: All Is Well―For Now

Today’s ECB decision had little impact on government bonds, as investors had already priced in at least one more hike sometime this year.

The bond market’s initial reaction was for interest rates to head lower, and 10-year German Bund yields fell around 10 basis points (bps. There were two causes for this reaction. First, the ECB mentioned no additional balance sheet tweaks. In addition, its monetary policy statement used explicit language to show that it is probably done hiking rates:

"Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target."

Investors had also priced in a small risk that the ECB might tweak its PEPP reinvestments, which could have been negative for Italian government bonds (BTPs). That tweak failed to materialize, so BTP yields narrowed to Germany’s.

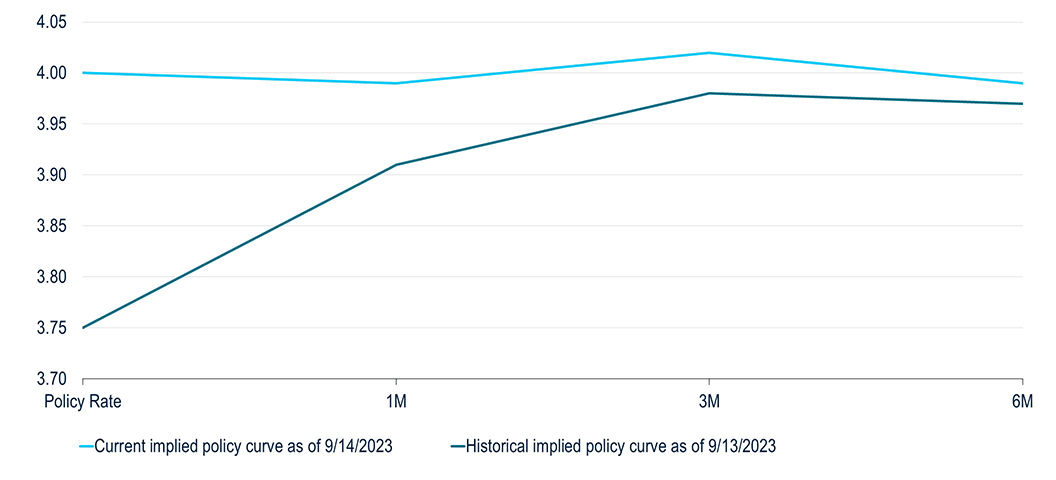

Figure 1: The ECB’s 0.25 percentage point hike matched what investors were expecting to happen in the next three months (%).

Source: PGIM Fixed Income.

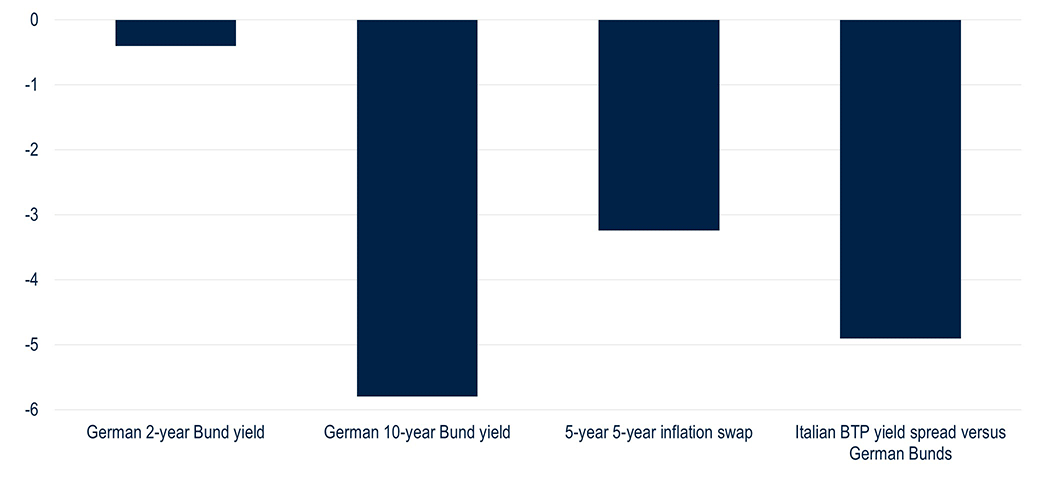

Figure 2: The ECB’s decision led to lower long-dated yields, lower inflation expectations, and tighter spreads for Italian government bonds over German government bonds (pp).

Source: PGIM Fixed Income.

In the near term, Thursday's ECB decision may, counterintuitively, support bond markets. It signals a serious commitment to fighting inflation in the face of weakening euro area growth. That puts a lid on term yields and helps reduce volatility in European government bonds. Separately, robust U.S. activity is helping global risk appetite.

European risk assets, including corporate bonds, may well benefit from that combination: lower volatility means tighter euro spreads and higher equity prices.

But the ECB’s decision to hike in the face of weak growth raises questions about possible medium-term damage to the euro area economy. Is the ECB overtightening? Probably. But, for now, risk markets are pushing that problem down the road. Investors dislike inflation-related volatility, so the less of that, the better.

Read More From PGIM Fixed Income

The comments, opinions, and estimates contained herein are based on and/or derived from publicly available information from sources that PGIM Fixed Income believes to be reliable. We do not guarantee the accuracy of such sources or information. This outlook, which is for informational purposes only, sets forth our views as of this date. The underlying assumptions and our views are subject to change. Past performance is not a guarantee or a reliable indicator of future results.

Source(s) of data (unless otherwise noted): PGIM Fixed Income, as September 14, 2023.

For Professional Investors only. Past performance is not a guarantee or a reliable indicator of future results and an investment could lose value. All investments involve risk, including the possible loss of capital.

PGIM Fixed Income operates primarily through PGIM, Inc., a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended, and a Prudential Financial, Inc. (“PFI”) company. Registration as a registered investment adviser does not imply a certain level or skill or training. PGIM Fixed Income is headquartered in Newark, New Jersey and also includes the following businesses globally: (i) the public fixed income unit within PGIM Limited, located in London; (ii) PGIM Netherlands B.V., located in Amsterdam; (iii) PGIM Japan Co., Ltd. (“PGIM Japan”), located in Tokyo; (iv) the public fixed income unit within PGIM (Hong Kong) Ltd. located in Hong Kong; and (v) the public fixed income unit within PGIM (Singapore) Pte. Ltd., located in Singapore (“PGIM Singapore”). PFI of the United States is not affiliated in any manner with Prudential plc, incorporated in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom. Prudential, PGIM, their respective logos, and the Rock symbol are service marks of PFI and its related entities, registered in many jurisdictions worldwide.

These materials are for informational or educational purposes only. The information is not intended as investment advice and is not a recommendation about managing or investing assets. In providing these materials, PGIM is not acting as your fiduciary. PGIM Fixed Income as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Investors seeking information regarding their particular investment needs should contact their own financial professional.

These materials represent the views and opinions of the author(s) regarding the economic conditions, asset classes, securities, issuers or financial instruments referenced herein. Distribution of this information to any person other than the person to whom it was originally delivered and to such person’s advisers is unauthorized, and any reproduction of these materials, in whole or in part, or the divulgence of any of the contents hereof, without prior consent of PGIM Fixed Income is prohibited. Certain information contained herein has been obtained from sources that PGIM Fixed Income believes to be reliable as of the date presented; however, PGIM Fixed Income cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. PGIM Fixed Income has no obligation to update any or all of such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy.

Any forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fee. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any security or other financial instrument or any investment management services and should not be used as the basis for any investment decision. PGIM Fixed Income and its affiliates may make investment decisions that are inconsistent with the recommendations or views expressed herein, including for proprietary accounts of PGIM Fixed Income or its affiliates.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and while generally supported by a government, government agency or private guarantor, there is no assurance that the guarantor will meet its obligations. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be suitable for all investors. Diversification does not ensure against loss.

In the United Kingdom, information is issued by PGIM Limited with registered office: Grand Buildings, 1-3 Strand, Trafalgar Square, London, WC2N 5HR. PGIM Limited is authorised and regulated by the Financial Conduct Authority (“FCA”) of the United Kingdom (Firm Reference Number 193418). In the European Economic Area (“EEA”), information is issued by PGIM Netherlands B.V., an entity authorised by the Autoriteit Financiële Markten (“AFM”) in the Netherlands and operating on the basis of a European passport. In certain EEA countries, information is, where permitted, presented by PGIM Limited in reliance of provisions, exemptions or licenses available to PGIM Limited under temporary permission arrangements following the exit of the United Kingdom from the European Union. These materials are issued by PGIM Limited and/or PGIM Netherlands B.V. to persons who are professional clients as defined under the rules of the FCA and/or to persons who are professional clients as defined in the relevant local implementation of Directive 2014/65/EU (MiFID II). In certain countries in Asia-Pacific, information is presented by PGIM (Singapore) Pte. Ltd., a Singapore investment manager registered with and licensed by the Monetary Authority of Singapore. In Japan, information is presented by PGIM Japan Co. Ltd., registered investment adviser with the Japanese Financial Services Agency. In South Korea, information is presented by PGIM, Inc., which is licensed to provide discretionary investment management services directly to South Korean investors. In Hong Kong, information is provided by PGIM (Hong Kong) Limited, a regulated entity with the Securities & Futures Commission in Hong Kong to professional investors as defined in Section 1 of Part 1 of Schedule 1 (paragraph (a) to (i) of the Securities and Futures Ordinance (Cap.571). In Australia, this information is presented by PGIM (Australia) Pty Ltd (“PGIM Australia”) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). PGIM Australia is a representative of PGIM Limited, which is exempt from the requirement to hold an Australian Financial Services License under the Australian Corporations Act 2001 in respect of financial services. PGIM Limited is exempt by virtue of its regulation by the FCA (Reg: 193418) under the laws of the United Kingdom and the application of ASIC Class Order 03/1099. The laws of the United Kingdom differ from Australian laws. In Canada, pursuant to the international adviser registration exemption in National Instrument 31-103, PGIM, Inc. is informing you that: (1) PGIM, Inc. is not registered in Canada and is advising you in reliance upon an exemption from the adviser registration requirement under National Instrument 31-103; (2) PGIM, Inc.’s jurisdiction of residence is New Jersey, U.S.A.; (3) there may be difficulty enforcing legal rights against PGIM, Inc. because it is resident outside of Canada and all or substantially all of its assets may be situated outside of Canada; and (4) the name and address of the agent for service of process of PGIM, Inc. in the applicable Provinces of Canada are as follows: in Québec: Borden Ladner Gervais LLP, 1000 de La Gauchetière Street West, Suite 900 Montréal, QC H3B 5H4; in British Columbia: Borden Ladner Gervais LLP, 1200 Waterfront Centre, 200 Burrard Street, Vancouver, BC V7X 1T2; in Ontario: Borden Ladner Gervais LLP, 22 Adelaide Street West, Suite 3400, Toronto, ON M5H 4E3; in Nova Scotia: Cox & Palmer, Q.C., 1100 Purdy’s Wharf Tower One, 1959 Upper Water Street, P.O. Box 2380 - Stn Central RPO, Halifax, NS B3J 3E5; in Alberta: Borden Ladner Gervais LLP, 530 Third Avenue S.W., Calgary, AB T2P R3.

© 2023 PFI and its related entities.

2023-6729

Sign Up Now for Full Access to Articles and Podcasts!

Unlock full access to our vast content library by registering as an institutional investor .

Create an accountAlready have an account ? Sign in