The unique climate change risks facing insurers

- Global warming brings unique risk to both assets and liabilities

- Robeco can help to analyze and mitigate carbon risks in portfolios

- Solutions available to reduce the carbon footprints of investments

Climate change presents insurers with unique risks, from paying weather-related claims to finding lower-carbon investments. A new white paper by Robeco examines the whole issue and offers some solutions.

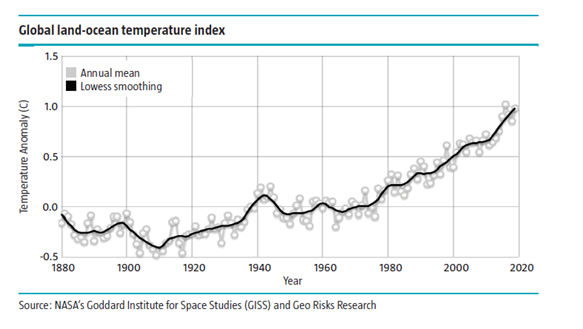

Global warming has become undeniable and no industry has greater exposure to its risks than the insurance sector. It’s not only the rising costs from claims for damage to property caused by increasingly severe weather. Insurers invest the premiums they receive in financial markets to gain enough returns to fund their liabilities.

These investee companies are themselves exposed to climate risk, particularly through the need to decarbonize in the transition to a low-carbon economy. This creates a double whammy for insurers and it urgently needs addressing.

Multiple angles

A new white paper from the insurance team at Robeco entitled ‘Climate change: a problem that insurance companies can’t afford to ignore’ examines the issue from multiple angles. First, there are the costs: the ever-increasing bill for claims from storm damage or flooding raises the question about what will be insurable in the future. Businesses near the coast or on flood plains may find themselves being rejected for cover.

The far bigger problem, though, comes from where insurance money is invested. Insurers tend to invest across a wide spectrum of stocks and bonds to spread their risks and raise as much return as possible within their risk budgets. This includes companies that are more exposed to climate change risks than others, plus those that face risks from the need to transition to a lower-carbon business model, such as fossil fuel providers and utilities.

Asset exposure to climate risk

EIOPA, the insurance regulator in Europe, says more than 10% of European insurers’ investment assets are in sectors exposed to the effects of transitioning in response to climate change. But there could be many other losers across sectors as a result of the unknowable and unquantifiable effects of this fundamental shift. And that is where the real risk may lie.

Regulators are now beginning to stress test insurers for their ability to pay future claims. “Where undertakings have long-term assets to match long-term liabilities, they should consider whether climate change would impact either their ability to hold these assets over that timeframe or their expected cash flows,” EIOPA says.

Assessing risk in portfolios

At the portfolio level, Robeco has developed ‘climate transition risk’ sensitivity and stress scenario dashboards to provide an overview of the climate susceptibility of fixed income and equity portfolios. These dashboards show a portfolio’s exposure to climate risk, through the distributions of its climate scores, both in absolute terms and relative to its benchmark, and the potential impacts on the portfolio’s value and its performance relative to the benchmark.

It is also important to distinguish between equity and fixed income portfolios, since more defensive bond strategies carry less climate investment risk, less return potential and less influence on the company (through voting, which can only be done with equities) than a more aggressive portfolio. Insurers tend to prefer defensive portfolios that can be up to 90% focused on fixed income, so this can be an important consideration.

Solutions to reduce carbon footprints

Some portfolios target a lower carbon footprint than the benchmark from the outset, such as those that invest in companies making a net positive contribution to the UN’s Sustainable Development Goals (SDGs). Several of the 17 goals are related to combatting global warming, while SDG 13 (climate action) targets it directly.

For insurance fixed income portfolios, Robeco has built customized tooling that enables insurance constraints to be managed, while building in carbon reductions that do not significantly impact expected yields and/or returns.

Even passive portfolios can have their carbon intensity reduced through enhanced indexing, which removes the more carbon-intensive stocks from the benchmark being followed, but without creating a significant tracking error.

Finally, active ownership through voting and engagement can be a powerful tool. Robeco has routinely engaged with oil and gas companies to speed up their transition away from fossil fuels into renewable forms of energy.

The challenge of our times

In all, the challenges resulting from climate change for insurers are evident, but at the same time they are in a privileged position to be part of the solution. If insurance companies choose to reduce their exposure to companies that are contributing to climate change or actively encourage them to make profound changes to their business models, they could act as a powerful force for good.

Find out more on this topic in our “The unique climate change risks facing insurers” paper.

Important Information

Robeco Institutional Asset Management B.V. (Robeco B.V.) has a license as manager of Undertakings for Collective Investment in Transferable Securities (UCITS) and Alternative Investment Funds (AIFs) (“Fund(s)”) from The Netherlands Authority for the Financial Markets in Amsterdam. This document is solely intended for professional investors, defined as investors qualifying as professional clients, who have requested to be treated as professional clients or who are authorized to receive such information under any applicable laws. Robeco B.V and/or its related, affiliated and subsidiary companies, (“Robeco”), will not be liable for any damages arising out of the use of this document.

The contents of this document are based upon sources of information believed to be reliable and comes without warranties of any kind. Any opinions, estimates or forecasts may be changed at any time without prior notice and readers are expected to take that into consideration when deciding what weight to apply to the document’s contents. This document is intended to be provided to professional investors only for the purpose of imparting market information as interpreted by Robeco. It has not been prepared by Robeco as investment advice or investment research nor should it be interpreted as such and it does not constitute an investment recommendation to buy or sell certain securities or investment products and/or to adopt any investment strategy and/or legal, accounting or tax advice.

All rights relating to the information in this document are and will remain the property of Robeco. This material may not be copied or used with the public. No part of this document may be reproduced, or published in any form or by any means without Robeco’s prior written permission. Investment involves risks. Before investing, please note the initial capital is not guaranteed. This document is not directed to, nor intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, document, availability or use would be contrary to law or regulation or which would subject Robeco B.V. or its affiliates to any registration or licensing requirement within such jurisdiction.

This document may be distributed in the US by Robeco Institutional Asset Management US, Inc. (“Robeco US”), an investment adviser registered with the US Securities and Exchange Commission (SEC). Such registration should not be interpreted as an endorsement or approval of Robeco US by the SEC. Robeco B.V. is considered “participating affiliated” and some of their employees are “associated persons” of Robeco US as per relevant SEC no-action guidance. SEC regulations are applicable only to clients, prospects and investors of Robeco US. Robeco US is located at 230 Park Avenue, 33rd floor, New York, NY 10169.

© Q1/2021 Robeco

Sign Up Now for Full Access to Articles and Podcasts!

Unlock full access to our vast content library by registering as an institutional investor .

Create an accountAlready have an account ? Sign in