SS&C Technologies

SS&C Technologies

80 Lamberton Road

Windsor, CT 06095

Dennis Moore

Senior Sales Executive

Dennis.Moore@sscinc.com

860-214-9580

About SS&C Technologies

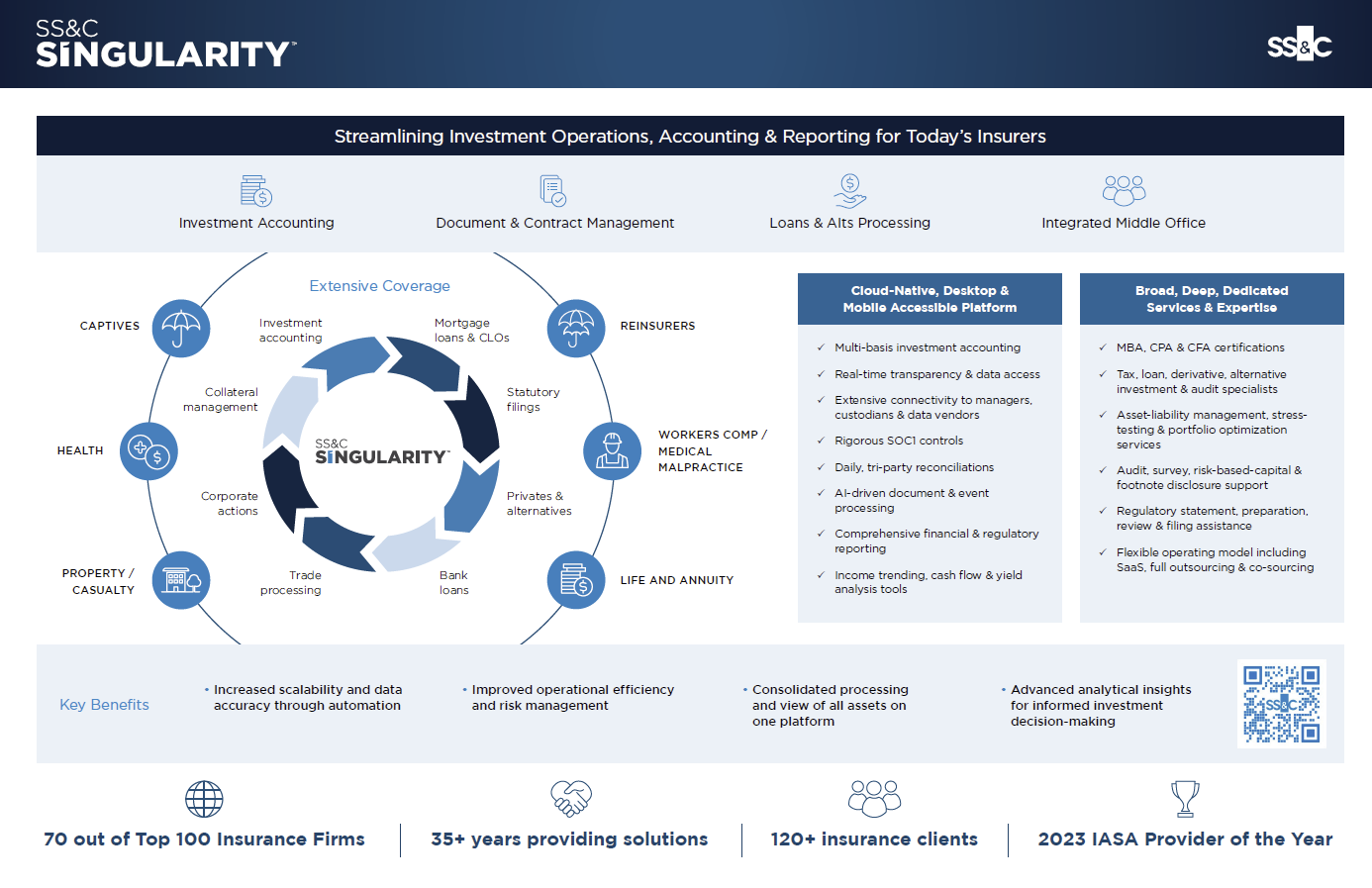

SS&C Insurance Solutions Presents, Singularity™, for market-leading, AI-powered insurance investment accounting, operations, analytics and reporting. With 35 years of industry experience, a deep bench of tenured experts and a modern, cloud-based mobile friendly platform SS&C thrives on complexity — processing both public and private investments while delivering unparalleled levels of operational efficiency, full transparency, post trade compliance and regulatory reporting, accounting flexibility and actionable insight through your choice of operating models (SaaS, Outsourced or co-sourced).

The Sometimes Unintended Consequences of Banking Regulation

As regulators consider their response to the recent banking turmoil triggered by the collapses of Silicon Valley Bank (SVB) and Signature Bank, they would be wise to consider the full impact of their actions.

Beware Concentration Risk: Lessons in Avoiding Financial Risk Pitfalls

In just the last few years, there have been various events where the word “unprecedented” has been increasingly used in risk management circles. We have seen Brexit, COVID-19, the Russia-Ukraine war, surging inflation, rising interest rates and slowing global growth in the aftermath.

Sobering Lessons from SVB: Manage Financial Risk Beyond Compliance

The Silicon Valley Bank collapse may be an isolated event… but it’s a cautionary tale.

Insurers Get Real about Real Estate: 5 Reasons to Expand Your Portfolio in 2023

In 2023, real estate and real assets continue to be valuable and attractive investment opportunities for insurance investment portfolios, despite some recent volatility in the sector. This eBook explores some of the favorable environmental, economic and regulatory drivers supporting these types of investments, and how insurers can best capitalize on them.

5 Reasons Insurers Should Consider Real Estate and Real Assets

We’ve compiled the five most compelling reasons why real estate investment presents a significant opportunity for insurers.

10 Considerations for Choosing a Hybrid Credit Fund Platform

As hybrid funds become more common, we continue to see the lines blur between hedge funds and private equity funds as typical closed-end private equity structures venture more into liquid assets.

Episode 118: 2023 Insurance Asset Management Technology and Investment Outlook with SS&C’s Scott Kurland

Scott Kurland is the Managing Director of SS&C Technologies’ Insurance Solutions Group.

Success Tips for Annual Statutory Statement Filing in 2023

SS&C’s statutory preparation and filing service experts have outlined four tips to help you reduce errors and inquiries related to your 2022 NAIC annual filing, and ensure a smoother audit process come June.

Short-Term Investment Pools: Ripe for Optimization

In this blog, we look at the role technology plays in addressing common pain points to expand the potential of an insurer’s short-term investment pools.

2023 Lenders Guide for Private Market Investing: 10 Things to Know

Private lending portfolios are complex. Managing them doesn’t have to be if you leverage modern technology and external domain expertise.

2023 Insurance Private Markets Asset Allocation Report

The trend among insurers toward private market investments may have started as an effort to counter the effect of low interest rates but has gained a solid, growing foothold in insurance investment portfolios across North America.

Mastering the Operational Challenges of Short Term Pools

Many large insurers rely on short-term investment pools to aggregate idle cash and put it to productive use. As these pools grow in complexity, they put a strain on operations that raises costs and risks. Insurers may be missing an opportunity to optimize the value of their short-term pool programs through increased efficiency and scalability. Today’s advanced technologies can help insurers make the most of this important cash management tool.

5 Things Every Insurer Should Expect From an Investment Accounting Provider

Insurance investment accounting is a complex science. Multi-basis accounting and regulatory expertise backed by modern technology is critical for success. Placing your trust in a service provider can be a great strategy as long as they bring a reliable team of experts who can consistently deliver accurate, timely service through flexible scalable technology. Is your current provider living up to the challenge?

An Insurer's Guide to ESG Investing

Private investments in ESG-related ventures can represent an opportunity for insurers to strengthen ESG participation and to generate alpha. However, with a low tolerance for risk and rigorous accounting and reporting requirements, insurers like you can face a unique set of challenges as you drive further into this type of allocation. In this short e-book we’ll show you how to build a well-planned approach to private market ESG investing. It outlines insurance-specific challenges and considerations to address when developing a private market ESG strategy. Then to help you gauge your firm’s strengths and opportunities, we included a Private Market ESG Investment Readiness Checklist.

Four Investment Strategies for Insurers to Consider as Interest Rates Rise

Maintaining yield in current geopolitical, economic and social conditions means staying on top of unexpected trends. Garnered from line-of-sight across more than 500 insurers for which SS&C provides investment accounting services and technology, this whitepaper explores four potential investment strategies that may provide opportunities to generate higher yield with lower risk, in the wake of rising interest rates.

The Convergence of Insurance, Alternatives and Private Equity

In the quest for higher yields and increased portfolio diversification, deal making between insurers, private equity firms and alternative managers is hotter than ever, with more than 14,000 private market transactions completed in 2021 alone. With the right domain expertise and technology infrastructure, operating margins can be further improved and risk can be reduced. Read this e-book for insights into the key trends fueling the convergence of insurance, PE and alternatives, as well as six levers that can help shore up your private market investment strategies.

PODCAST

PODCAST